Persistent inflation combined with a strong labor market has caused the market to reprice the probability of substantial Fed cuts—a massive pivot from the six rate cuts that were expected for this year at the end of 2023. As rates have drifted higher, we see a potential opportunity to lock in attractive yields here.

On April 10, the 10-year US Treasury experienced the largest single day gain in yield since 2022. Yields surged past 4.5% following a spike in inflation readings. With March inflation data beating expectations, there were increasing concerns that the Federal Reserve may not be able to justify substantial cuts in their target rate this year.

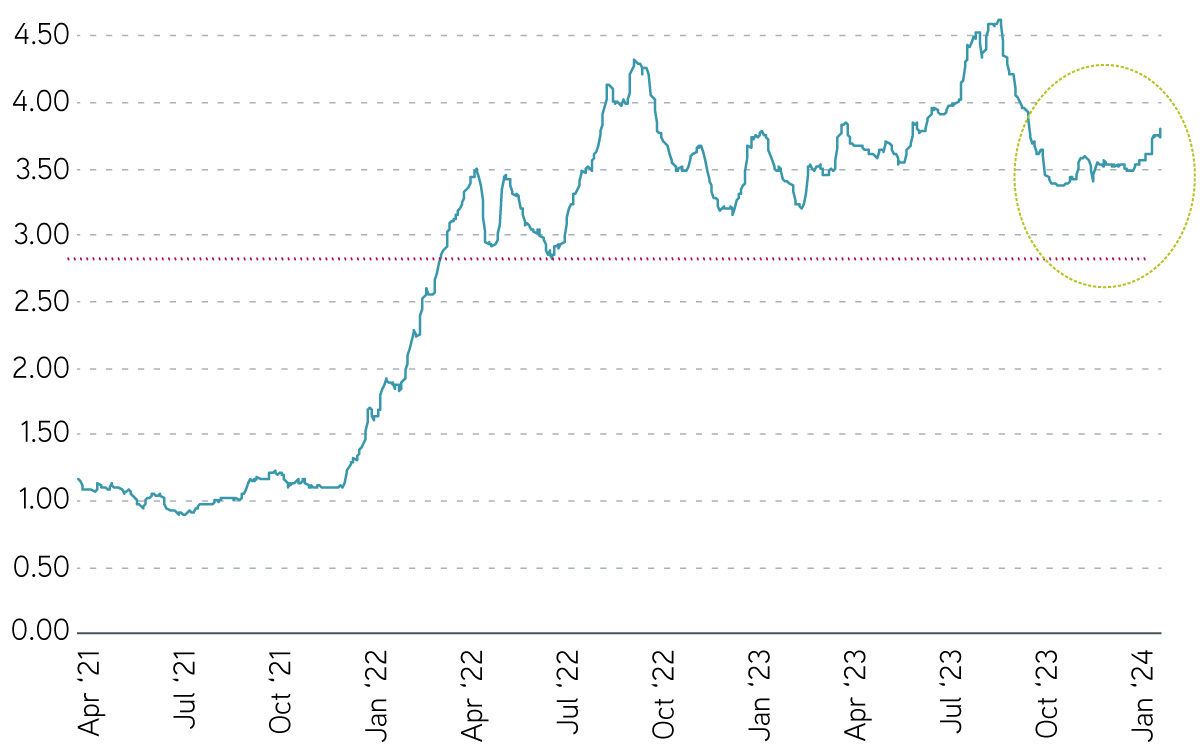

Is rate volatility back?

After this dramatic shift in expectations, investors have been forced to embrace rate volatility once again. With volatility comes opportunity, however. Looking at municipal bonds specifically, increases in yield of roughly 60 to 70 basis points (bps) along the curve have brought yields to year-to-date highs. In fact, this is the highest current level since November 2023, creating another attractive entry point for investors in high tax brackets.

For example, the AA rated municipal bond benchmark now sits at 2.84%, 2.89%, 3.46% and 3.94%, respectively, for the five-year, 10-year, 15-year and 20-year maturities. For investors in the highest federal tax bracket of 40.8%, those yields can translate to 5% to 6% of taxable equivalent yield. And if an investor lives in a high tax state, those taxable equivalent yields can be even higher.

Municipal bond yields rising

Source: Bank of America Merrill Lynch Municipal Master Index. Data as of April 10, 2024. The index performance is provided for illustrative purposes only and is not meant to depict the performance of a specific investment. Past performance is no guarantee of future results.

We offer tax-advantaged core bond market exposure

Time to lock in higher yields?

The ability to lock in yields like these may provide a timely opportunity for diversification against risk-on assets, along with the potential benefits of adding duration. Historically, fixed income—and specifically intermediate to long duration solutions—have tended to perform well once the Fed begins to cut.

While the timing of the Fed’s next cuts is uncertain, we would make the case that current market yields may provide a great source of income today, with the potential for upside appreciation once the Fed acts. If short-term rate volatility ensues, investors would be somewhat cushioned against further increases in yields, thanks to today’s higher absolute yields.

Increasing muni demand to meet supply

Higher absolute yields may also provide an opportunity for more inflows into the municipal market. That higher demand might come at a time when reinvestment flows tend to be strong: June 1 and July 1 historically see some of the largest flows due to maturities and coupon payments.

In our view, municipal issuers may be well positioned to handle a broad array of economic outcomes. Credit remains sound, with most issuers displaying strong financials. According to a Moody’s Municipal Bond Default study published last summer, the average five year cumulative default rate since 2013 for the investment grade municipal sector is just 0.08%.

The bottom line

Multiple fixed income solutions may allow investors to take advantage of today’s opportunistic yields. Actively managed strategies help to leverage yield curve positioning and relative value trading, while tax-optimized strategies can focus on investment grade bonds across the taxable and tax-exempt space, based on the highest after-tax yield. Whatever the approach, we believe a new attractive buying opportunity has surfaced for fixed income investors.

Parametric and Morgan Stanley do not provide legal, tax or accounting advice or services. Clients should consult with their own tax or legal advisor prior to entering into any transaction or strategy.