Factors

For wealth managers

Parametric provides cost-efficient, risk-controlled access to a suite of 14 different factor strategies across US and developed international equities.

![]()

Securities displaying certain characteristics, or factors, tend to exhibit higher return potential over time. Your clients can customize a factor-based portfolio to express unique investment views. You can apply these strategies to customized portfolios, which allow for additional customization options such as responsible investing and active tax management.

Explore more Custom Core solutions

How factor investing works

Advisors and clients prioritize their preferred factors.

Three ways to invest

Single factors

Parametric identifies stocks that exhibit these individual characteristics.

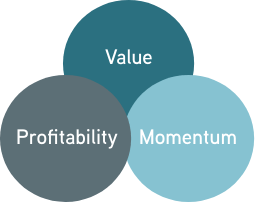

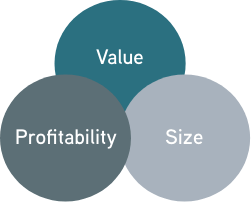

Multifactor combinations

Choose from premade combinations of popular factors.

Custom factor strategies

Build your own customized exposures through a blend of strategies based on

your client’s needs or by combining factor strategies with a cap-weighted index.

Why choose Parametric?

Intended benefits of factors

Efficient exposure

Learn more >>

Our thoughtful approach to factor design and research-based portfolio construction doesn’t compromise other aspects of investment management.

After-tax return

Learn more >>

We use a systematic tax management approach to capture tax alpha opportunities.

Consultative approach

Learn more >>

We work with clients to understand their current portfolios and how to more efficiently replicate existing risk factors while promoting opportunities for higher after-tax returns.

Get in touch

Want to know more about our Factors solutions? Complete our contact form, and a representative will respond shortly.

More to explore

Three Ways that Direct Indexing Can Help Diversify Beyond the S&P 500

by Izabella Goldenberg, Senior Investment Strategist; Jeremy Milleson, Director, Investment Strategy

August 1, 2025

Here’s why we think an investor might choose an index other than the S&P 500 to diversify in a tax efficient way.

More Is More: Combining Corporates and Munis in Laddered Bond Strategies

by Nisha Patel, Managing Director; Bernie Scozzafava, Director, Quantitative Research and Portfolio Management ; +1

July 31, 2025

Take advantage of municipal and corporate bonds’ combined strength. Read how one blended portfolio strategy can provide the best of both worlds.