The managed account industry has seen tremendous growth and client adoption, with assets increasing by 28% over the last year and 50% over the past two years.1 Leading the way have been rules-based, customized and tax-efficient solutions like direct indexing and bond ladders.

As client demand for personalized investment strategies continues to increase, direct indexing has become the fastest growing segment within the managed account space. Since 3Q 2022, direct indexing assets have increased from $383 billion to over $811 billion today.

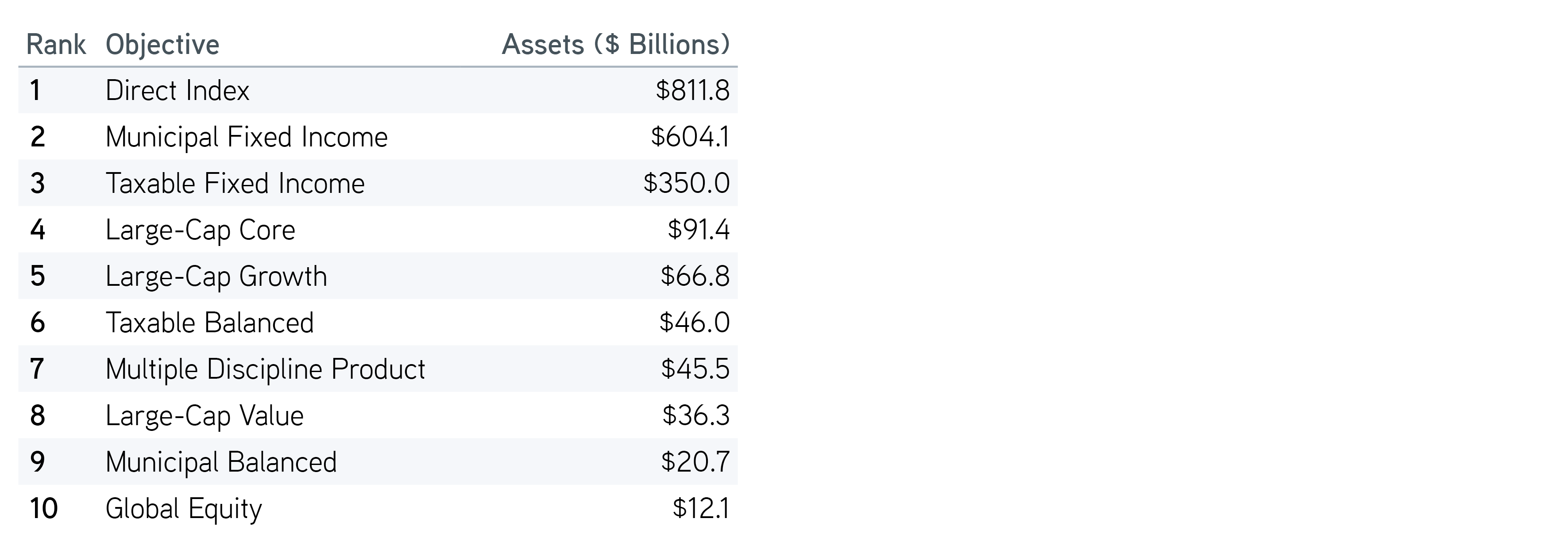

Top 10 manager-traded SMAs as of 3Q 2024

Source: MMI-Cerulli Advisory Solutions Quarterly, data as of 9/30/2024. For illustrative purposes only. Past performance is not an indicator of future results.

Among the top manager-traded categories, the municipal and taxable fixed income segments—with $604 billion and $350 billion, respectively—stand right behind direct indexing. Providers of those solutions offer both actively managed strategies and more systematic, rules-based strategies like bond ladders.

Parametric has been a pioneering leader in both direct indexing and bond ladder solutions. We wondered if comparisons could be made between these strategies. Could a bond ladder be considered the direct indexing of the fixed income space?

Similarities of equity direct indexing and bond ladders

Direct indexing has historically been considered an equity investing strategy. With equity direct indexing, an investor purchases some or all of the stocks in an index to obtain its market beta. Owning individual stocks instead of an index or ETF creates certain opportunities. Investors can use tax-loss harvesting to generate tax alpha, potentially leading to higher after-tax returns. Investors can also introduce levels of customization not otherwise available.

Like equity direct indexing, municipal, corporate or Treasury ladders also follow a highly customizable, rules-based approach to investing. Investors and their advisors work together to build equal-weighted laddered portfolios that can be customized for credit quality, duration, maturity range and other characteristics. Each laddered portfolio will likely be constructed with different securities than other portfolios, but they can be built with similar maturity, quality, risk, return and other traits—resulting in portfolios that capture the market beta of a fixed income asset class across the targeted maturity range.

Boost bond potential with active tax management

Bond ladders may deliver many of the same benefits as equity direct indexing strategies—possibly even improving upon them in some ways.

Taxes are a crucial element in direct indexing, and tax-loss harvesting may have added benefits in a fixed income portfolio compared to an equity portfolio. With an equity portfolio, unless new cash is added, tax-loss harvesting opportunities may run out as the cost basis on individual securities is continually reset lower. Contrast that with a fixed income portfolio, where proceeds from maturing bonds, calls and coupons offer ongoing opportunities for reinvestment and resetting of the cost basis.

A bond ladder can also be constructed with the investor’s own tax rate in mind—along with careful consideration of the tax treatment of different bond sectors like US Treasurys, corporates and in-state versus out-of-state municipals. For example, a traditional municipal bond buyer in a mid-tier tax bracket may benefit from a more tactical but still rules-based approach—one that aims to optimize the allocation between tax-exempt and taxable bonds based on their tax rate and the relative value between sectors, always buying the bond with the highest after-tax yield.

Bond ladders may also offer returns that are easier to predict. With no market timing of interest rates, yield curve or credit, laddered bond portfolios lend themselves to more dependable return outcomes relative to active portfolios. Returns and potential tax savings from loss harvesting can be estimated using a Laddered Interest Rate Scenario Tool.

Responsible investing factors are another element of customization within the equity direct indexing space. Both corporate and municipal bond ladder solutions also offer investors the ability to align their fixed income exposures with their values. In the corporate space, investors can choose from a variety of environmental and social screens based on business involvement, reporting transparency or analyst ratings. In the municipal space, investors can filter on the bond’s use of proceeds to invest in projects that have positive social or environmental impacts.

The bottom line

A bond ladder can be an attractive vehicle for implementing a direct indexing-like approach in fixed income. While tracking a specific index may be less of a focus than in equity direct indexing, the two approaches share similar potential benefits around personalization, flexibility and tax advantages.

The systematic, rules-based and evenly weighted structure of ladders can support stability in duration and may make performance more predictable in changing interest rate environments. SMA laddering also opens the door to multiple tax optimization strategies through tax-loss harvesting and tactical allocation between taxable and tax-exempt fixed income sectors.

1 MMI-Cerulli Advisory Solutions Quarterly by Cerulli Associates & Money Management Institute, 3Q 2024

Parametric and Morgan Stanley do not provide legal, tax, or accounting advice or services. Clients should consult with their own tax or legal advisor prior to entering into any transaction or strategy described herein.

The views expressed in these posts are those of the authors and are current only through the date stated. These views are subject to change at any time based upon market or other conditions, and Parametric and its affiliates disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions for Parametric are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Parametric strategy. The discussion herein is general in nature and is provided for informational purposes only. There is no guarantee as to its accuracy or completeness. Past performance is no guarantee of future results. All investments are subject to the risk of loss. Prospective investors should consult with a tax or legal advisor before making any investment decision. Please refer to the Disclosure page on our website for important information about investments and risks.

02.21.2026 | RO 4259018