Direct Indexing

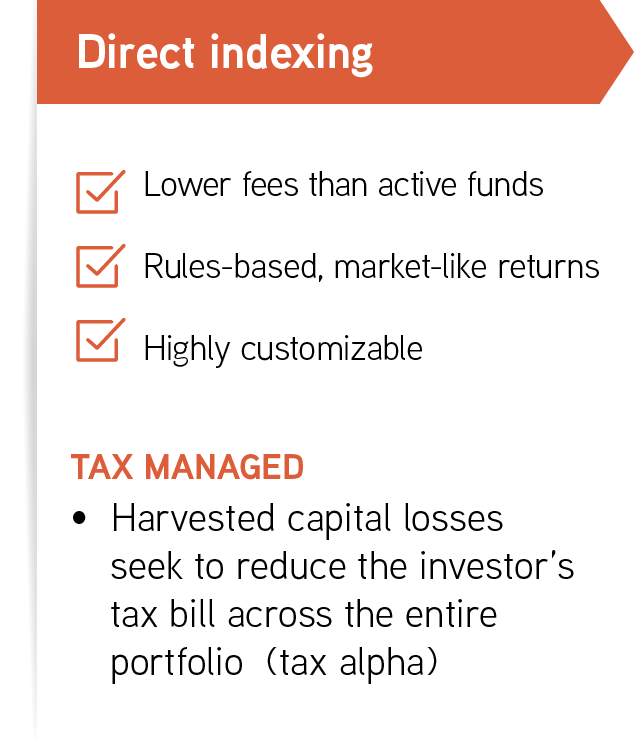

Direct indexing is a form of passive investing that enables direct ownership of the individual securities that compose a benchmark. Unlike an ETF or other commingled fund, it gives an investor greater control, allowing for tax-loss harvesting at the security level, customization around ESG preferences, and other advantages.

What makes direct indexing so compelling?

Flexibility

Investors can use direct indexing to escape concentrated positions, optimize charitable giving, and more.

Customization

Clients can choose from equities or fixed income, blending benchmarks to get the precise exposure they seek.

ESG

From screens to proxy voting and more, investors can align a portfolio with their environmental and social values.

CERULLI ASSOCIATES REPORT

The Case for Direct Indexing: Differentiation in a Competitive Marketplace

Researchers at Cerulli Associates got the global investment industry talking in 2021 with a bold prediction: that growth in direct indexing, pioneered by Parametric, would outpace both ETFs and mutual funds. This year they’re back with deeper insights into this new investing frontier, featuring case studies from advisors putting direct indexing to work for their clients. You’ll find out:

Where firms are finding opportunities to scale up and stand out with direct indexing

Why tax management is at the core of direct indexing solutions

How advisory firms use direct indexing to address a wide range of client needs

Learn more from Cerulli Associates in their 2021 report Improving Client Experience: Customizing with Direct Indexing.

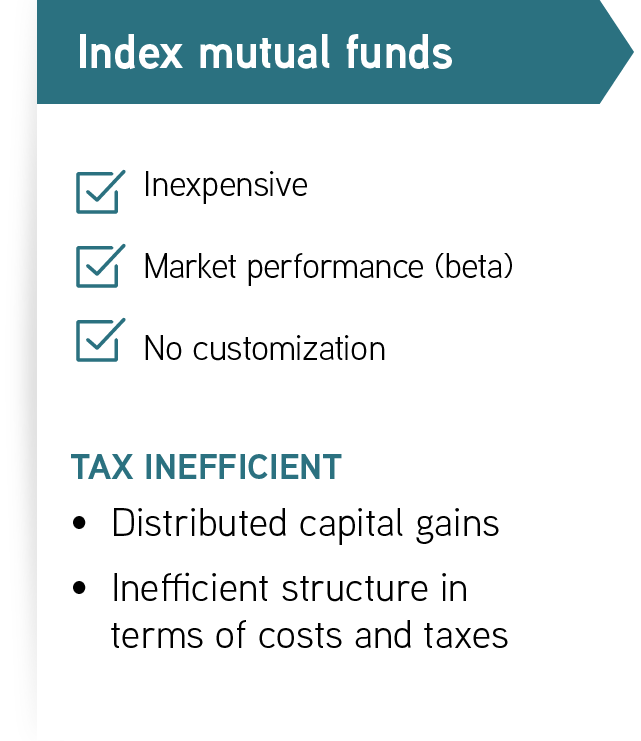

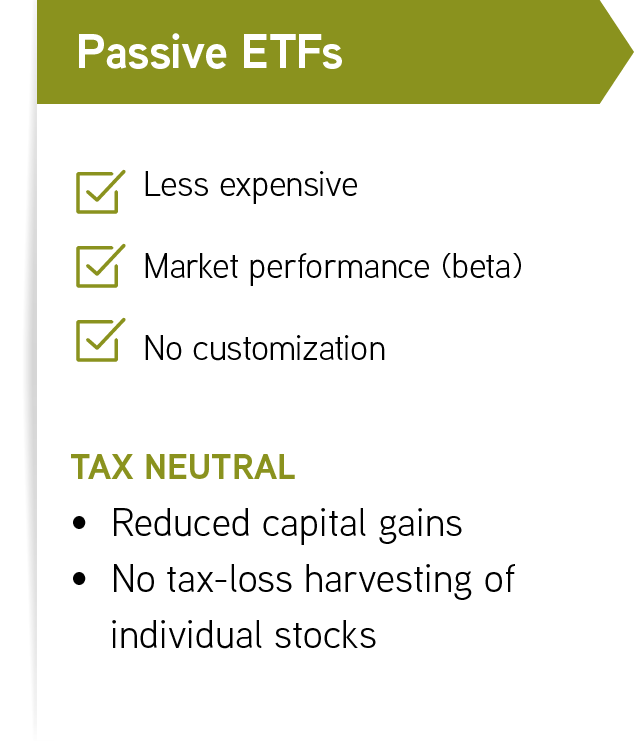

Evolution of passive investing: from “bulk beta” to personalization

Customize with confidence

Risk management is embedded in the rules-based models that form the foundation of our decision-making and portfolio construction processes.

We measure risks through tracking error, which we aim to control in three key ways:

Keeping exposures similar to investors’ chosen benchmarks

Trading only when the value add justifies the cost

Staying mindful of IRS wash-sale rules

Which types of investors benefit most from direct indexing?

Direct indexing offers a number of advantages, but it may not be ideal for all investors.

If you’re weighing whether the strategy is right for your clients, consider those with an interest in one or more of the following:

Transitioning assets

Learn more >>

Transitioning assets

Unlike an ETF, you can fund a direct indexing portfolio with cash or existing securities—potentially lessening the tax impact of transition.

Tax management

Learn more >>

Tax management

Direct indexing systematically harvests losses at the security level, so your clients can offset gains elsewhere in their holdings.ESG

Learn more >>

ESG

Direct indexing allows for robust screening, so you can align a client’s passive portfolio with their environmental or social values.

Charitable giving

Learn more >>

Charitable giving

Unlike an ETF, direct indexing allows your clients to gift individual securities, potentially lessening the tax impact of appreciated holdings.

By owning the underlying securities of a passive allocation, investors can tailor their portfolios to reflect their environmental and social principles.

Learn more about responsible investing at Parametric >>

of affluent investors preferred to invest in companies that have a "positive social or environmental impact."

Source: Cerulli Associates

Direct indexing at Parametric:

Custom Core®

Equities or fixed income? One benchmark or a combination of benchmarks? ESG screens, single-stock exclusions, or both? With Parametric Custom Core, your clients get to make passive investing personal, and you get to enhance your value by tailoring a tax-managed portfolio around their precise needs.

An idea that’s 30 years new

Parametric pioneered custom passive portfolios close to 30 years ago. Today we remain the leading provider of direct indexing, and we continue to demonstrate its value to advisors and their clients.

Get in touch to learn more about how Parametric can help you grow your practice.

More to explore

How to Fit Direct Indexing into a Client’s Current Portfolio

by Jeremy Milleson, Director, Investment Strategy

March 31, 2025

Direct indexing is designed to fit your clients’ allocations just the way they are. See how it works for core-satellite portfolios.

How to Put the Power of Direct Indexing at Your Fingertips

by Jeremy Milleson, Director, Investment Strategy

March 17, 2025

What features, functions and favored outcomes should you look for in a direct indexing provider? Read to find out.

How to Manage Taxes in Direct Indexing Portfolios

by Jeremy Milleson, Director, Investment Strategy

December 16, 2024

What does it mean to “manage” taxes? We explain the basics of tax-loss harvesting and other sources of potential tax savings.