Parametric’s tax optimized ladders (TOL) solution may help to enhance after-tax yield by seeking to optimize the allocation between tax-exempt and taxable bonds, based on an investor’s own tax rate and the relative value between sectors.

Personalized separately managed accounts (SMA) have evolved into an effective customized solution that seeks to meet a client’s unique financial objectives. Until now, advisors looking for such custom fixed income solutions have needed to factor in key considerations—income requirements, liquidity preferences, investment horizon, credit tolerances and personal values. At Parametric, we believe the focus shouldn’t just be on what you earn, but also on what you keep.

How can you keep more of what you earn?

Taxes are a crucial element of customization, and when it comes to fixed income investing, every basis point counts. One strategy to potentially enhance after-tax yield and performance involves capitalizing on opportunities across multiple fixed income sectors. With this approach, investors can let their individual tax considerations and relative value in the market help them select a better after-tax option.

A traditional municipal bond buyer is often an investor in an upper tax bracket, who steers toward tax-exempt municipal bonds as a common fixed income allocation. Why? Because tax-exempt munis are more likely to provide the highest level of after-tax return most of the time. This may not hold true all the time, however. Within a rules-based portfolio, that traditional muni-only buyer in a mid-tier tax bracket may benefit from a more tactical investing approach.

How do tax optimized ladders work?

A bond ladder seeks to minimize the impact of interest rate risk by reinvesting maturing bond proceeds at higher interest rates. What if that ladder could be constructed with the investor’s tax rate in mind? A TOL solution aims to optimize the allocation between tax-exempt and taxable bonds based on that tax rate and the relative value between sectors. In short, this method of investing allows an investor to buy the bond with the highest after-tax yield.

Want more information about this strategy? Download our Tax Optimized Ladder strategy overview.

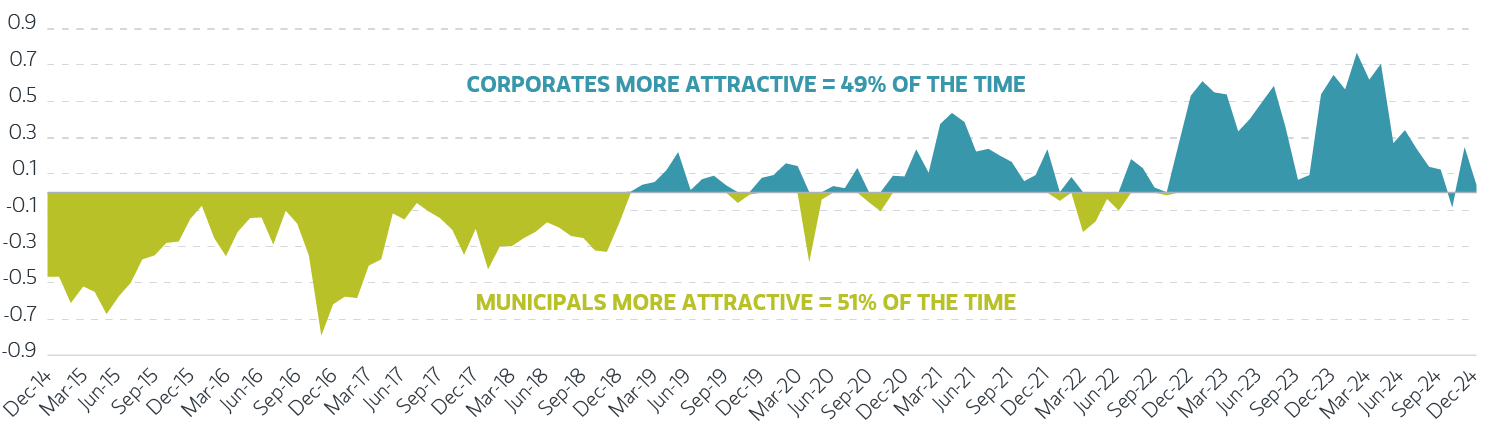

We can compare 10-year A+/A/A-rated corporate bond yields after tax (adjusted for the marginal tax rate of 32%) with 10-year A+/A/A- rated municipal bond yields going back to 2014. When the value is positive (shaded blue), corporates provide a higher after-tax yield. When the yield differential falls into negative territory (shaded green), tax-exempt munis are more attractive.

10-year corporate yield (after tax in 32% bracket) minus 10-year municipal yield

Source: Bloomberg, as of 12/31/2024. Municipal yield is the 10-Year GO BVAL A+/A/A- curve. Corporate yield is the 10-year US Corp A+/A/A- BVAL curve, after tax in the 32% bracket. Difference is computed monthly from December 2014 to December 2024. For illustrative purposes only. Not a recommendation to buy or sell any security.

As expected, tax-exempt munis were more attractive 51% of the time. Interestingly, corporates (after tax) were more attractive 49% of the time, even for an investor in a 32% bracket. In this case, the muni buyer may have benefited by optimizing the allocation of tax-exempt munis and taxable corporates based on relative value.

Transform fixed income opportunities into optimization

Municipal bonds are commonly perceived as the default option given their tax exemption. Investors may assume that these investments are the best for them, but they may fail to consider tax rate changes that can occur over a portfolio’s life cycle. Many portfolios remain static with those municipal holdings, rather than adjusting future investments with an eye to maximizing after-tax income potential.

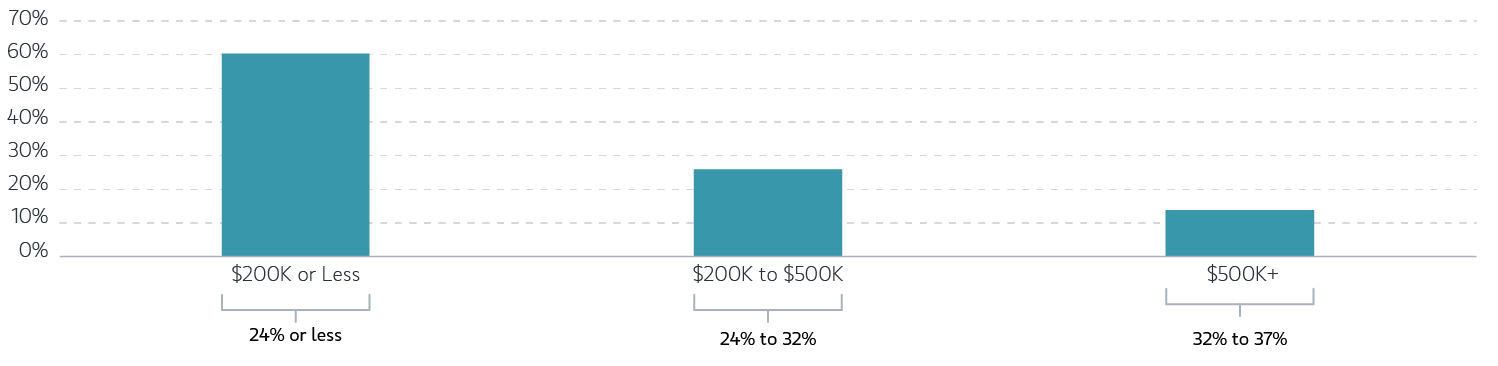

Looking at 2023 IRS individual tax filing data, with tax-exempt interest categorized by various tax ranges of adjusted gross income (AGI), we can see an interesting trend. A staggering 60% of those returns came from a tax bracket of 24% or lower!

Percentage of US filers with tax-exempt income by AGI range

Source: IRS.gov, SOI Tax Stats – Individual income tax returns complete report (Publication 1304) – Basic tables part 1, data as of 2/3/2025, based on filing year 2023. In total, 6.12 million of taxable tax returns filed contained tax-exempt interest.

This finding suggests that a significant portion of municipal bond investors in lower brackets might benefit from a taxable bond allocation. A better outcome could be a tactical investment solution that takes individual tax rates into consideration, while allowing for dynamic allocation between tax-exempt and taxable asset classes.

Returns, income and potential tax savings can be estimated using Parametric’s Laddered Interest Rate Scenario Tool. This calculator helps explore the performance of municipal, corporate, and Treasury bond portfolios in changing rate environments.

The bottom line

For clients in the highest tax bracket, tax-exempt municipal bonds have the potential to provide the highest level of after-tax return most of the time, but not all the time. Moving to investors in lower tax brackets, we find that selectively allocating to taxable sectors may become more beneficial. A client’s fixed income allocation can potentially be enhanced to maximize the after-tax income by carefully considering that investor’s tax rate and relative value between sectors.

Parametric and Morgan Stanley do not provide legal, tax or accounting advice or services. Clients should consult with their own tax or legal advisor prior to entering into any transaction or strategy.

The views expressed in these posts are those of the authors and are current only through the date stated. These views are subject to change at any time based upon market or other conditions, and Parametric and its affiliates disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions for Parametric are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Parametric strategy. The discussion herein is general in nature and is provided for informational purposes only. There is no guarantee as to its accuracy or completeness. Past performance is no guarantee of future results. All investments are subject to the risk of loss. Prospective investors should consult with a tax or legal advisor before making any investment decision. Please refer to the Disclosure page on our website for important information about investments and risks.

03.10.2026 | RO 4298191