Reflecting ongoing uncertainty around inflation and the trajectory of monetary policy, yield volatility posed challenges in 2024. Yet it also highlighted the importance of tax-efficient strategies like loss harvesting in fixed income portfolios.

The Bloomberg US Aggregate Index returned 1.25% in 2024, with sharp ups and downs in month-to-month performance. Over the course of the year, index returns ranged from sharply negative (-2.53% in April) to strongly positive (+2.34% in July). In our view, these market swings can provide promising opportunities for harvesting tax assets.

Once again, as in previous years, waiting for December to realize losses wouldn’t have been ideal. Instead, we found that a systematic approach to harvesting losses year-round turned out to be a better way to manage tax efficiency in client portfolios. Third-party research has shown that tax management can add 1%–2% in after-tax excess returns for equity and 0.3% for fixed income.1 This is known as tax alpha.

In 2024, Parametric sold over $14 billion in market value across fixed income portfolios to realize $386 million in losses.2 As a result, many of our clients have benefited from locking in potential tax savings, while still maintaining their exposure to the market as intended.

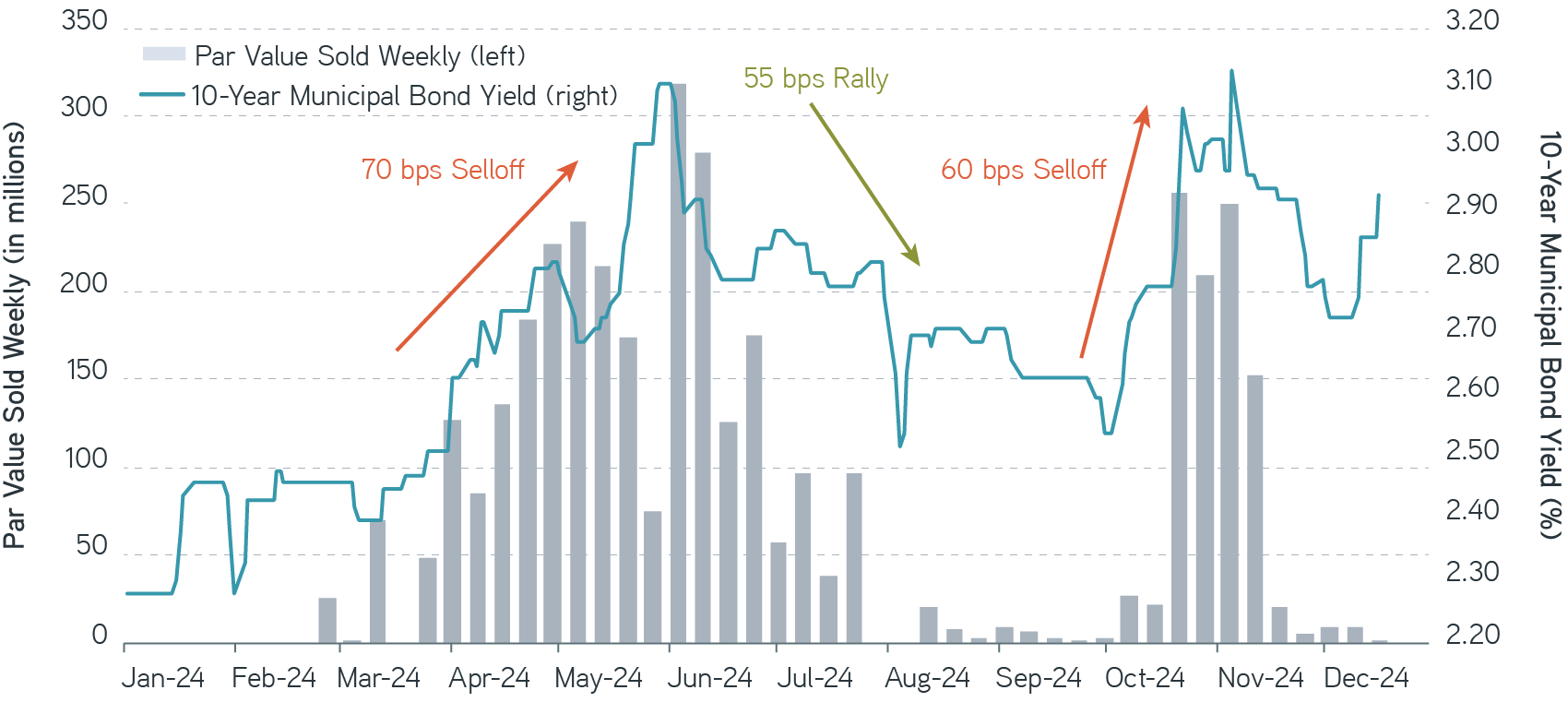

When we compare the 10-year municipal index yield to Parametric’s tax loss harvesting activity within municipal portfolios, we can see that as market yields increased, so did our weekly harvesting activity.

Weekly loss harvesting activity in 2024

Source: Thomson Reuters, Parametric as of 12/31/2024. Weekly par volume shown above includes only municipal strategies that incorporate ongoing discretionary loss harvesting by Parametric. It is not possible to invest directly in an index. Indexes are unmanaged and do not reflect the deduction of fees or expenses. All investments are subject to risk, including risk of loss.

Looking ahead, we don’t expect tax loss harvesting opportunities to fade in 2025. Along with uncertainty around the new administration’s fiscal discipline and the policies they implement, the path of monetary policy will continue to create pockets of short-term adjustments in yields. By systematically and proactively implementing an active approach in fixed income investing, clients may be able to weather volatility better, while also enhancing after-tax value in their portfolios—a critical consideration for today’s tax-sensitive investors.

Boost bond potential with active tax management

The bottom line

After multiple years of heightened volatility, tax awareness has become an essential component of fixed income investing. Tax loss harvesting remains a reliable strategy for adding value in any market environment. By adopting an “all weather” approach, investors can seek to uncover opportunities to help optimize their after-tax returns, regardless of market conditions. After all, taxes can be one of the easiest “fees” that investment managers can help reduce, and systematic tax management seeks to do just that.

1 Shomesh E. Chaudhuri, Terence C. Burnham, and Andrew W. Lo. 2020. “An Empirical Evaluation of Tax-Loss-Harvesting Alpha.” Financial Analysts Journal 76:3, 99–108, and Andrew Kalotay. 2016. “Tax-Efficient Trading of Municipal Bonds.” Financial Analysts Journal 72:1, 48–57. These studies did not involve Parametric or its clients. There is no guarantee that a tax-management strategy will result in increased after-tax returns. Results will differ based on an individual investor’s circumstances.

2 Source: Parametric, 12/31/2024. The information is provided for illustrative purposes only. Values are aggregated across all municipal laddered strategies, managed municipal strategies and municipal total return strategies. Only client positions with unverified cost basis were excluded from calculations. Loss calculation is based on the amortized book price minus the sell price, represents historical information and should not be construed as future results. Loss information illustrates the effect to a portfolio and is not representative of, and should not be construed as, performance. There is no assurance that tax loss harvesting will continue in the future. There is no guarantee that any specific account may engage in tax loss harvesting.

Parametric and Morgan Stanley do not provide legal, tax, or accounting advice or services. Clients should consult with their own tax or legal advisor prior to entering into any transaction or strategy described herein.

The views expressed in these posts are those of the authors and are current only through the date stated. These views are subject to change at any time based upon market or other conditions, and Parametric and its affiliates disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions for Parametric are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Parametric strategy. The discussion herein is general in nature and is provided for informational purposes only. There is no guarantee as to its accuracy or completeness. Past performance is no guarantee of future results. All investments are subject to the risk of loss. Prospective investors should consult with a tax or legal advisor before making any investment decision. Please refer to the Disclosure page on our website for important information about investments and risks.

01.14.2026 | RO 4136195