Recent challenges from higher rates and banking turmoil are well known to investors in preferred securities, but the performance of this asset class relative to other alternatives in fixed income may not be. Here’s why we think preferreds continue to offer attractive total return potential and a tax-advantaged income stream.

Understanding preferred securities

Preferreds are fixed income securities with characteristics of both debt and equity. Like debt, they carry a credit rating and have a set face value and a predetermined coupon. As with equities, issuers can defer or suspend payments, and the instruments typically carry perpetual or long-dated maturities. They do come with additional risk from subordination and sector concentration, which the regional banking stress in early 2023 made clear.

Despite their subordination, preferreds are primarily investment grade (IG) rated. Ratings agencies tend to notch the rating for preferreds lower than the issuer’s senior bond, based on their methodology. Whether senior, subordinated or preferred, these credit instruments are rated on the same ratings scale. Default rates for preferreds have averaged less than 1% annually, as is the case for similarly rated corporate bonds.

For these features, preferreds have historically paid among the highest yields in the IG fixed income universe.

Outperforming other fixed income investments in Q1

Rising inflation data and surprising gains in monthly employment shifted market expectations for interest rate cuts from the Federal Reserve, sending the 10-year US Treasury yield 33 basis points higher in the first quarter. While higher rates generally limited fixed income performance, preferreds posted a 4.52% return. Their attractive starting valuations led to outperformance versus high yield and IG corporates.

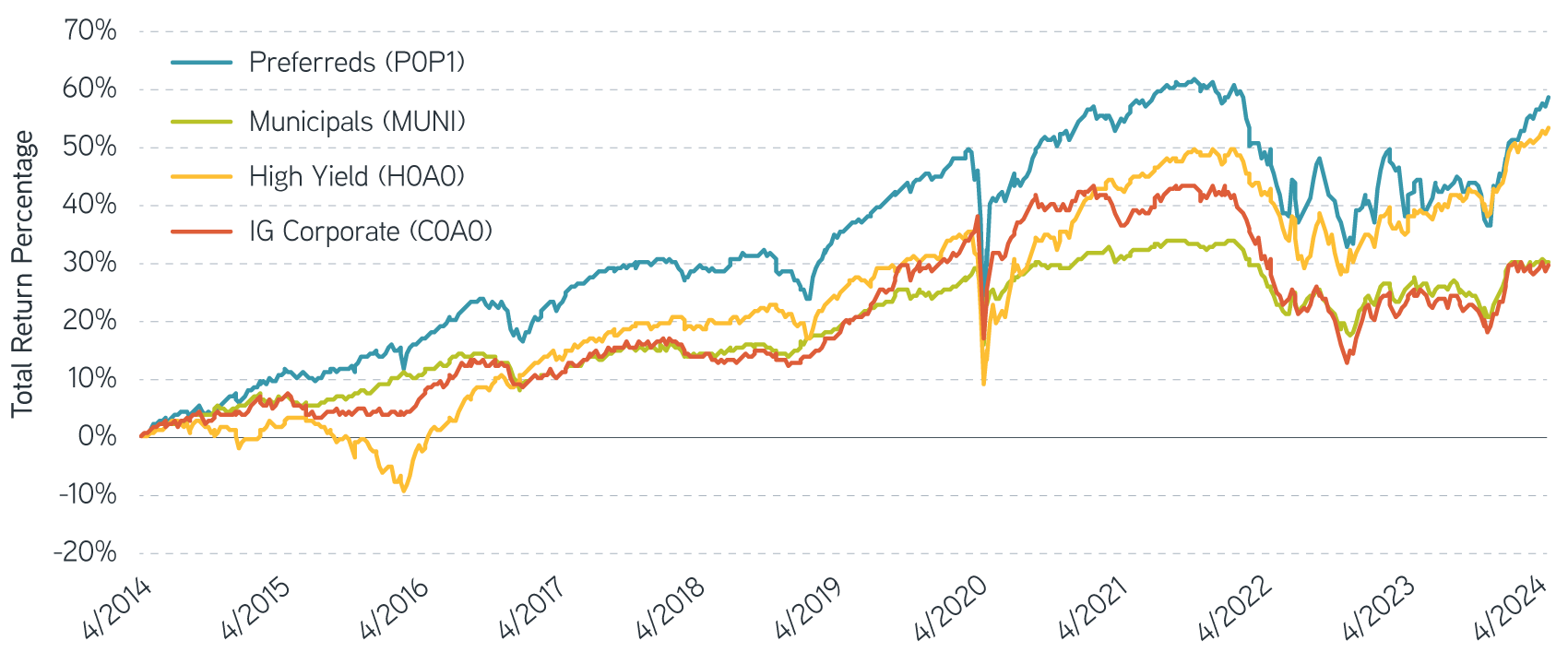

Viewed from a longer historical perspective, preferreds have performed well versus alternatives in fixed income. Over the past 10 years, returns for the asset class have exceeded lower rated high yield, as well as municipals and IG corporates.

10 year returns: Preferreds have exceeded corporate, municipal and high yield indexes

Source: Bloomberg, weekly data as of 3/28/2024. P0P1 = ICE BofA Fixed Rate Preferred Securities Index, MUNI = ICE US Broad Municipal Index, H0A0 = ICE BofA US High Yield Index, C0A0 = ICE BofA US Corporate Index. For illustrative purposes only. Not a recommendation to buy or sell any security. Past performance is not indicative of future results. All investments are subject to risk, including risk of loss. It is not possible to invest directly in an index. Indexes are unmanaged and do not reflect the deduction of fees or expenses.

Preferred securities may offer after-tax income and portfolio diversification for investors

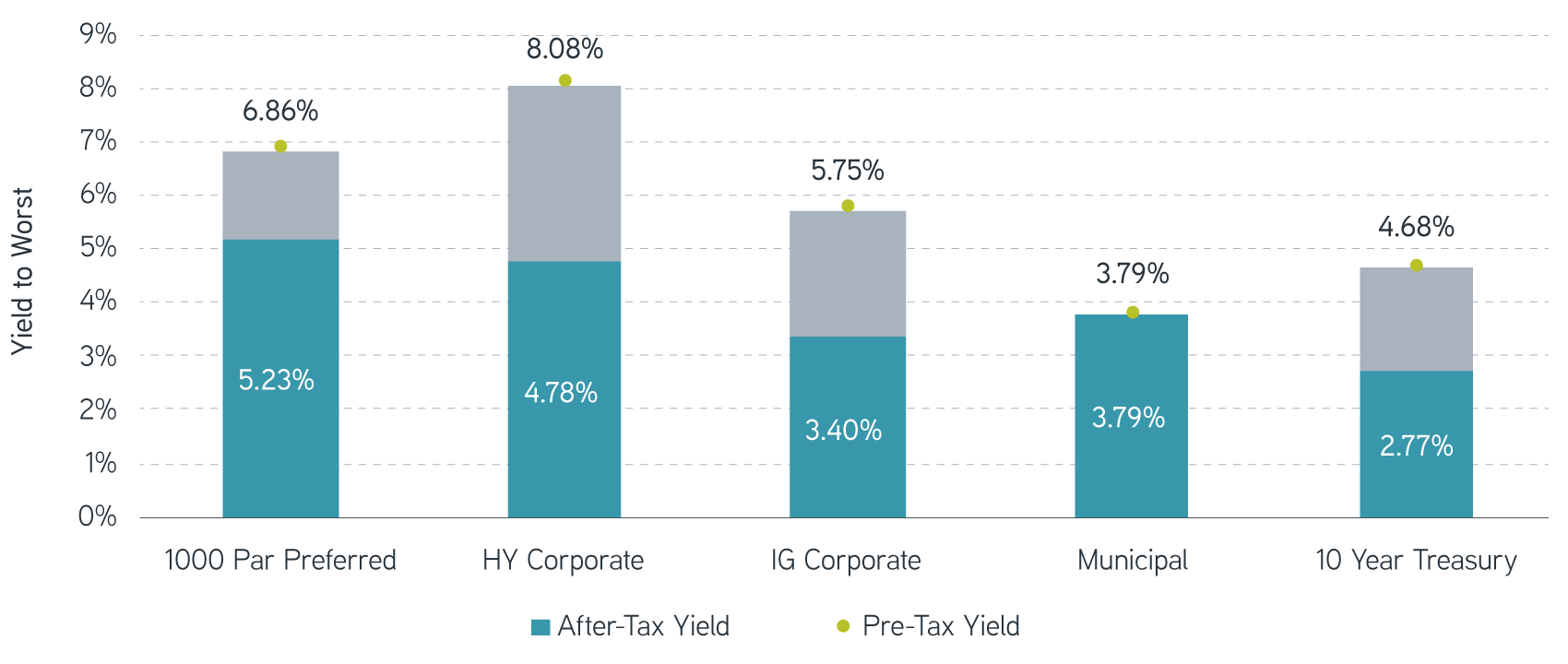

For investors seeking a higher yield than corporate and municipal bonds can provide, the potentially tax-advantaged income from preferreds may offer a compelling addition to fixed income portfolios. Enhancing high yields in preferreds is the qualified dividend income (QDI), which is taxed at the long-term capital gains rate for US taxpayers.

For individuals in the highest tax bracket, this translates to a federal tax rate of 20% plus the 3.8% Medicare surcharge, compared with a 40.8% combined ordinary income rate paid on corporate bond coupons. For corporations, the dividend received deduction (DRD) can lower the effective tax rate on income from qualifying securities to 10.5%.

With yield to worst for preferreds now approaching 7%, few alternatives in the IG fixed income universe can match the potential after-tax yields of preferred securities.

After tax yield: Potential benefit of preferreds with QDI

Source: ICE BofA Fixed Rate Preferred Securities Index, ICE BofA US High Yield Index, ICE BofA US Corporate Index, ICE US Broad Municipal Index and 10-year US Treasury yields as of 4/30/2024. After-tax yields based on 40.8% tax rate (37% Federal plus 3.8 Medicare surcharge) for high yield, investment grade and Treasury yields or 23.8% rate (20% capital gains plus 3.8% Medicare) for preferreds. For illustrative purposes only. Not a recommendation to buy or sell any security. Past performance is not indicative of future results. All investments are subject to risk, including risk of loss. It is not possible to invest directly in an index. Indexes are unmanaged and do not reflect the deduction of fees or expenses.

The bottom line

We believe preferreds have the potential to perform well, given reasonable valuations and historically high yields. So far this year, the financial sector has outperformed in corporate credit while remaining inexpensive relative to non-financials on a historical basis. Sustained economic growth and strong fund flows from income-seeking investors can support credit spreads. Commercial real estate is still a risk for the banking sector, but larger institutions tend to be better positioned and profitability has remained strong. Combined with the tax advantage of qualified dividend income, preferreds may continue to offer a compelling opportunity for fixed income investors.

Parametric and Morgan Stanley do not provide legal, tax or accounting advice or services. Clients should consult with their own tax or legal advisor prior to entering into any transaction or strategy.

The views expressed in these posts are those of the authors and are current only through the date stated. These views are subject to change at any time based upon market or other conditions, and Parametric and its affiliates disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions for Parametric are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Parametric strategy. The discussion herein is general in nature and is provided for informational purposes only. There is no guarantee as to its accuracy or completeness. Past performance is no guarantee of future results. All investments are subject to the risk of loss. Prospective investors should consult with a tax or legal advisor before making any investment decision. Please refer to the Disclosure page on our website for important information about investments and risks.