Volatility Risk Premium

For institutional investors

The volatility risk premium (VRP) is the compensation earned by investors for providing protection against unexpected market volatility. Parametric’s VRP solutions are a suite of strategies that seek to capture this unique and diversifying risk premium through the systematic sale of call and put options.

![]()

The VRP can be a persistent source of return over time that may allow investors to access attractive risk-adjusted returns and increase overall portfolio diversification.

Investing in an options strategy involves risk. All investments are subject to loss. Learn more.

Explore more VRP solutions

Capturing the VRP effectively and consistently

Equity index options may be thought of as financial insurance contracts, and investors pay a premium for insurance-like protection against unfavorable outcomes. The size of the VRP is driven by a range of behavioral, structural, and economic factors that may lead to an imbalance between buyers and sellers of index options.

A defensively structured portfolio can capture the VRP by selling fully collateralized options without introducing leverage. Our rules-based solutions favor diversification, accessibility, and transparency.

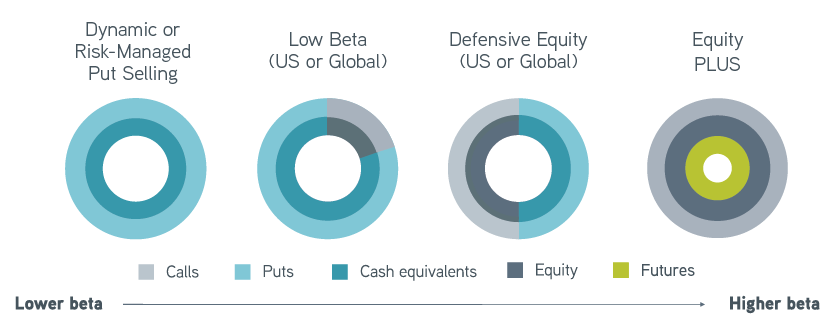

Using different combinations of collateralized equity index put and call option positions, your institution can access VRP strategies across a range of equity market betas.

Which VRP solution is right for you?

Why choose Parametric?

More to explore

Midyear Outlook: Exceptional Uncertainty, Unexpected Market Resiliency

by Thomas Lee, Co-President and Chief Investment Officer

July 17, 2025

Welcome to the 2025 Midyear Outlooks from Parametric. Where does the time go?

Midyear Liability-Driven Investing Outlook: What’s Next for Corporate Pensions?

by David Phillips, Director, Liability-Driven Investment Strategies

July 14, 2025

From funding ratios and plan allocations to buyouts and surplus assets, here’s our midyear review of LDI trends.

Midyear Commodity Outlook: Better for Commodities than Consumers

by Greg Liebl, Director, Investment Strategy; Adam Swinney, Investment Strategist

July 7, 2025

Rising tariffs may lead to higher inflation and slower economic growth—an environment that has historically favored commodities.