Investors face new challenges as their wealth grows. So it’s a good thing that direct indexing is designed to fit their allocations just the way they are. See how it works for one popular portfolio model.

One of the first steps in a financial advisor’s relationship with a new client is to decide on their asset allocation: the best mix of asset classes, including equities, fixed income and alternatives, that suit their financial goals. If the client’s investments perform well, they may not be eager to make big changes to that allocation. But with higher wealth comes new challenges, most notably the investor’s likelihood of having to pay higher taxes on their appreciated positions. This investor is an ideal candidate for direct indexing, which can add new dimensions of flexibility and tax management to their tried-and-tested portfolio.

Direct indexing is nothing new to Parametric. We’ve been a leader in the space since building our first personalized separately managed account (SMA) in 1992. But it’s a fairly recent addition to the larger investment conversation. Advisors are still building their own knowledge, which means their clients have even more to learn. An especially important lesson is that direct indexing isn’t a whole new asset class—it’s an investment technique designed to fit comfortably with an investor’s existing allocation. Here’s how it works with one popular portfolio model known as core-satellite investing.

How can investors use direct indexing for their core equity allocation?

Core equities are perhaps the most straightforward and certainly most common asset class for direct indexing. The core equity allocation is the more static long-term portion of the allocation, often consisting of well-known, large, domestic companies across a range of sectors. Many investors look to these stocks as their main source of return, viewing them as more reliable and less volatile. An index-based vehicle like a mutual fund or ETF allows investors to “set it and forget it,” worrying less that their portfolio will perform very differently from the market itself.

This is an easy way to invest in equities, but it may not be the best way, particularly for investors in higher tax brackets. By holding units of a commingled product like an ETF, investors can only buy and sell in units, which limits their ability to harvest losses that can offset gains elsewhere in the portfolio. Even when the index goes up, not all stocks or sectors go up, and ETFs aren’t able to pass on these potential losses to shareholders. Commingled vehicles also offer limited exposure choices without the ability to customize. Investors worried about concentration risk in popular large-cap indexes, or seeking to alter sector or individual security weights, are limited to available exposures in commingled vehicles.

Direct indexing aims to solve these problems by giving investors individual ownership of each stock in their chosen equity benchmark. In addition to enabling active tax-loss harvesting, direct indexing allows investors to customize their exposures, which may reduce concentration risk. It also creates room for investors to remove sectors and securities that they’d prefer not to own. It’s the job of an SMA provider to balance client preferences with their performance targets, ensuring that each investor’s returns come by each investor’s rules.

How can investors use direct indexing for their core fixed income allocation?

Trying to replicate a fixed income index is a huge task. The largest broad-market US equity index holds only about 3,400 stocks, but popular bond indexes hold tens of thousands of issues at any given moment. Maturing issues exit and new issues enter the indexes frequently, much more often than equity index providers change their constituents. Bond indexes weight issuers by the value of their outstanding debt without accounting for why the debt exists, which could expose investors to companies that struggle to fulfill their obligations. All these challenges are especially tough for SMA providers, whose goal is to minimize tracking error from the investor’s benchmark.

One potential solution is a benchmark structure that accounts for fragmentation in the bond market and works dynamically with it. This structure is a bond ladder, which equally weights bonds by maturity along a defined segment of the yield curve. Instead of letting a maturing bond exit the benchmark altogether, the ladder structure reinvests the proceeds into longer-dated bonds. Continuous reinvestment gives the laddered portfolio a similar maturity and duration profile to a bond index. The goal is to adjust to changes in the interest rate environment, potentially helping investors meet their yield requirements, and provide predictable income over the investor’s time horizon.

Structure of a laddered bond portfolio

Source: Parametric. For illustrative purposes only. Not a recommendation to buy or sell any security.

A ladder structure lends itself especially well to a direct-indexed fixed income SMA, which helps investors customize their asset class exposure. One example is duration, or the sensitivity of an investment to the interest rate environment. One investor may prefer to lock in rates in the longer portion of the yield curve by investing in longer-dated bonds. Another investor may prefer to hedge against rate risk by investing in shorter-dated bonds. A laddered portfolio allows both to select the exact maturity range and duration for their targeted risk-reward profile.

Depending on their income tax bracket, investors might see dissimilar results from tax-exempt versus taxable bonds. A ladder structure gives investors the flexibility to tactically adjust between these product types. Opportunities to harvest tax losses in fixed income exist in all interest rate environments, but they can be more pronounced when rates are more volatile. Managers can use the following techniques to unlock tax savings for investors:

- Amortizing premiums (bonds trading above face value) to reduce taxes on coupon payments

- Deferring discounts (bonds trading below face value) until they mature and are recognized as ordinary income

- Using short-term losses to offset short-term gains elsewhere in the total portfolio

For all their differences, a laddered bond strategy can offer the same central advantage as a direct-indexed equity portfolio: rules-based construction paired with flexible customization.

Take control of your passive investments

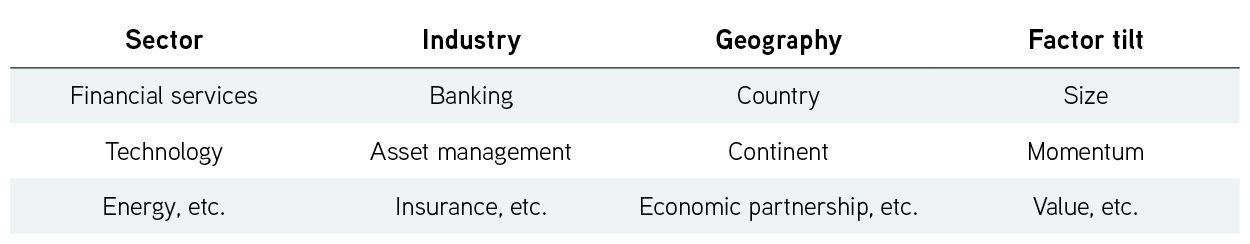

How can investors use direct indexing for their satellite allocation?

Core-satellite investors typically save the satellite portion of their portfolio for smaller and more niche holdings. This structure allows investors to chase additional outperformance, often using a relatively low amount of capital, which keeps the portfolio’s overall risk-return profile in check. For example, an investor who believes one industry will outperform in the future might buy more shares of companies in that industry, even when their diversified core holdings already include those companies. If the investor’s expectations come true, they may get some extra return. If not, they can unwind their overweighted position with a lower threat to the health of their total portfolio.

To be comfortable with satellites, investors need both a high tolerance for concentration risk and high conviction in one of the following areas:

As with their core holdings, investors can build their satellite positions using ETFs based on corresponding indexes, or they can rely on active managers to choose suitable securities. But here’s another type of risk to consider: By using satellite holdings to pursue new alpha, investors may find themselves in a flurry of portfolio activity, earning capital gains here and trading or rebalancing there, more than they’d see in their more static core allocation. All these can add to tax bills—an effect that investors and advisors can and do overlook.

This makes direct indexing a strong third choice for investors with significant satellite holdings. Using one or a blend of narrow-market indexes as a benchmark, SMA providers can deliver the investor’s desired satellite exposures with a rules-based approach to tax management. Providers can also manage these satellite holdings alongside the more passive equity allocation. The potential result is a more broadly tax-efficient portfolio that still gives investors the chance to find out if their convictions are right.

The bottom line

Investors’ needs evolve with time and growth, and their portfolios should evolve with them. Advisors should be prepared to help adjust the journey while staying focused on the destination. A customized and tax-managed SMA may be the right vehicle to help investors get more out of what they already own and trust. A complimentary transition analysis will show your clients what “more” can mean when they move into direct indexing.

The views expressed in these posts are those of the authors and are current only through the date stated. These views are subject to change at any time based upon market or other conditions, and Parametric and its affiliates disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions for Parametric are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Parametric strategy. The discussion herein is general in nature and is provided for informational purposes only. There is no guarantee as to its accuracy or completeness. Past performance is no guarantee of future results. All investments are subject to the risk of loss. Prospective investors should consult with a tax or legal advisor before making any investment decision. Please refer to the Disclosure page on our website for important information about investments and risks.

03.31.2026 | RO 4239802