The municipal bond tax exemption is back in focus. We believe the threat to infrastructure investment outweighs the modest revenue benefits, which could keep the risk of elimination or significant curtailment low.

As the 2017 Tax Cuts and Jobs Act (TCJA) approaches its scheduled sunset at the end of 2025, policymakers are debating ways to extend key provisions while limiting increases to the federal debt and deficit. Once again, Congress appears to be looking toward tax-exempt municipal bonds in their search for revenue.

Quantifying the tax exemption of municipal bonds

For decades, tax-exempt municipal bonds have been a cornerstone of public finance, allowing state and local governments to fund critical infrastructure projects—such as roads, schools, hospitals and affordable housing—at low cost. Yet discussion and debate around the elimination or limitation of the muni tax exemption to pay for various other tax measures is not a new development.

For example, TCJA eliminated the ability for issuers to refinance or “advance refund” outstanding municipal bonds with new tax-exempt debt. That was expected to generate approximately $17 billion in federal tax revenue over a 10-year period. Early drafts of the TCJA also included a proposal to eliminate the tax exemption on Private Activity Bonds (PAB)—which are issued by private hospitals, private colleges and others for public benefit—for an estimated increase of $38 billion in federal tax revenue over the same period, although that was not part of the final bill

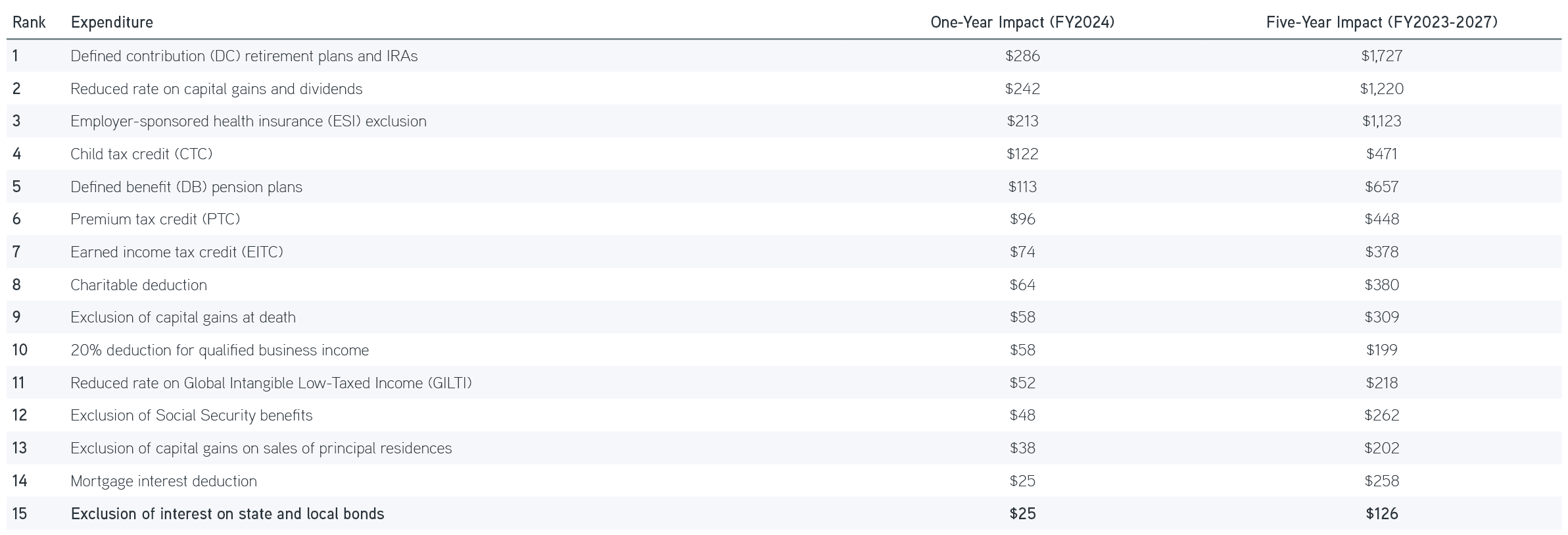

With the cost of extending TCJA estimated to exceed $4.8 trillion over the next decade,1 we see evidence that lawmakers are already considering similar tweaks to the tax exemption. Excluding interest on municipal bonds is expected to cost the federal government only $25 billion in lost revenue annually, or $250 billion over a 10-year period—ranking the exclusion 15th on the list of top federal tax expenditures.2 Yet with total tax expenditures at $1.9 trillion, the tax exemption for interest on these bonds only represents 1.32% of the total federal tax expenditures for fiscal year 2025.

Top 15 Tax Expenditures, by Revenue Impact ($ billions)

Source: Bipartisan Policy Center, “Tax Expenditures and the Budget, Explained” by Andrew Lautz, 9/17/2024.

Conversely, a Public Finance network report from the Government Finance Officers Association (GFOA) estimates that eliminating the tax exemption would increase borrowing costs by more than $824 billion over the same period.3 Raising borrowing costs for state and local governments by 35% to 40% would make funding critical infrastructure projects more costly—impacting quality of life, public services and economic growth. Eliminating or curtailing the municipal bond tax exemption would lead to higher borrowing costs and reduced financial flexibility for public entities—a cost that we believe could outweigh the benefit.

Financing critical infrastructure

Tax-exempt bonds are a crucial infrastructure financing tool for states, local governments and public entities. According to the National League of Cities (NLC), tax-exempt bonds have financed more than three quarters of our nation’s infrastructure. If allowed to continue, tax exempts are expected to finance another $3 trillion in new infrastructure investments by 2031—investments that are sorely needed. The American Society of Civil Engineers has given US infrastructure a score of a C- overall, citing a $3.7 trillion funding gap over the next 10 years.4 Elimination or curtailment of this lower cost of financing would likely impair the existing infrastructure gap.

Public finance advocates and issuers are beginning to mobilize to educate lawmakers on the importance of tax-exempt financing to fund infrastructure and support economic development. The NLC and the GFOA have launched the #BuiltByBonds campaign to demonstrate the importance of this source of lower cost financing.5 The Public Finance Network report recently sent to lawmakers seeks to quantify the impact of elimination or limitation, reminding them that strong infrastructure has long been a national priority. Raising the borrowing cost of the very entities tasked with funding that infrastructure development seems illogical to us.

While we’ve seen policymakers eyeing the tax exemption in the past, the risk appears to be a bit more heightened this time around for a few reasons:

- The large task to offset the costs of tax cuts amid the challenging US fiscal situation. The current challenges related to debt and deficits are something we have written about in our Gradually, then Suddenly blog series. Based on a 51-page list of targeted programs floated by the House Ways and Means Committee,6 lawmakers appear to be taking an “everything’s on the table” approach. Potential revenue raisers like the elimination of muni tax exemption are being considered as offsets to policies that would cost the federal government revenue, such as increasing the state and local tax deduction (SALT) above $10,000—a balancing act to keep the US federal deficit and debt in check.

- The notable shift toward change and disruption within the political landscape. Newly elected lawmakers may be more willing to alter a long-standing federal subsidy like tax exemption as they seek to execute on their mandate to challenge the status quo.

Boost bond potential with active tax management

The bottom line

The risk to the municipal bond tax exemption in 2025 does appear to be elevated compared to years past. In our view, however, the likelihood that the tax exemption gets eliminated entirely is low. Instead, as we witnessed with the TCJA’s drafting in 2017, the exemption may be curtailed. For example, the tax treatment of certain types of bonds like PAB could be altered. Should that occur, we believe that existing bonds in affected sectors would be grandfathered. That may still result in market volatility, however, and Parametric’s Laddered Interest Rate Scenario Tool can show how potential volatility may impact our muni, corporate, treasury, and tax optimized ladder solutions.

In the end, we expect that lawmakers may be likely to preserve the lower cost of financing that state and local government rely upon heavily to fund the nation’s infrastructure development—especially if they can be influenced by ramped-up public finance advocacy efforts. We think the cost outweighs the benefit of eliminating or significantly curtailing a vital subsidy that represents only 1.7% of total tax expenditures.

1 Committee for a Responsible Federal Budget, “Trump Tax Priorities Total $5 to $11 Trillion,” 2/6/2025.

2 Bipartisan Policy Center, “Tax Expenditures and the Budget, Explained” by Andrew Lautz, 9/17/2024.

3 Government Finance Officers Association, “Understanding Financing Options Used for Public Infrastructure: A Primer,” accessed 2/24/2025.

4 American Society of Civil Engineers, “America’s Infrastructure Scores a C-,“ 2021 report

5 National League of Cities, “#BuiltByBonds: Demonstrating Why Tax-Exempt Municipal Bonds Are Essential for Cities” by Dante Moreno, 10/14/2024.

6 The Bond Buyer, “GOP policy cuts go beyond tax-exemption, to infrastructure, hospitals” by Caitlin Devitt, 1/21/2025.

Parametric and Morgan Stanley do not provide legal, tax or accounting advice or services. Clients should consult with their own tax or legal advisor prior to entering into any transaction or strategy.

The views expressed in these posts are those of the authors and are current only through the date stated. These views are subject to change at any time based upon market or other conditions, and Parametric and its affiliates disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions for Parametric are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Parametric strategy. The discussion herein is general in nature and is provided for informational purposes only. There is no guarantee as to its accuracy or completeness. Past performance is no guarantee of future results. All investments are subject to the risk of loss. Prospective investors should consult with a tax or legal advisor before making any investment decision. Please refer to the Disclosure page on our website for important information about investments and risks.

03.03.2026 | RO 4275245