Commodity

For institutional investors

A well-diversified portfolio goes beyond equities and fixed income. An allocation to commodities helps to diversify your institution’s portfolio while also providing some inflation protection.

Parametric’s Commodity Strategy uses a unique portfolio construction process that provides greater diversification than traditional commodity benchmarks. Through intelligent design and rules-based methodologies, the strategy seeks to outperform the Bloomberg Commodity Index over three to five years, while experiencing 90% to 95% of the index’s volatility.

There is no guarantee that the investment objective will be achieved. The targeted return is aspirational in nature and is not based on criteria and assumptions. All investments are subject to the risk of loss. See disclosures for additional information.

Investing in a commodity strategy involves risk. All investments are subject to loss. Learn more.

Explore more systematic solutions

Why choose Parametric?

How it works

Diversification, intelligently designed

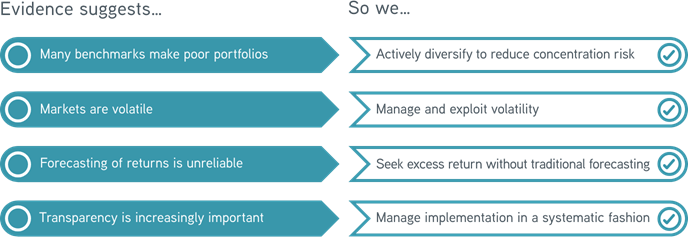

Unlike traditional asset classes, commodities don’t have a “market cap” equivalent. As a result, each commodity index provider constructs benchmarks according to its own unique example. While no benchmark is superior to another, they often exhibit sector concentrations, particularly when it comes to crude oil and agriculture.

Parametric avoids these concentrations by broadly diversifying across commodity types and sectors, including significant allocations to non-index commodities. That gives investors access to underrepresented commodities and increases overall portfolio diversification.

We reweight the portfolio to reduce concentration risk and dynamically rebalance through time to reinforce diversification. Our rebalancing techniques seek to enhance potential returns while minimizing implementation friction.

Sources: Bloomberg, Parametric as of 12/31/2024. It is not possible to invest directly in an index.

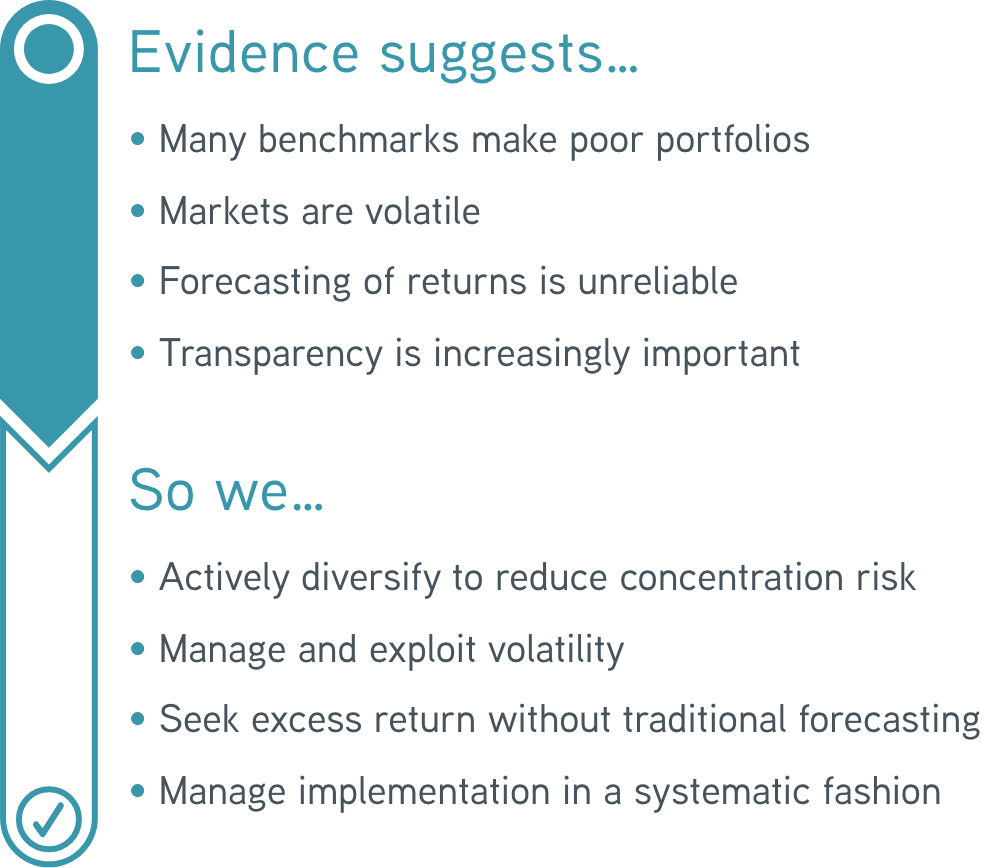

Intended benefits of Commodity Strategy

Inflation protection

Learn more >>

Commodity prices are correlated with inflation. An allocation to commodities acts as an inflation hedge.

Exposure

Learn more >>

Our long-only strategy lets investors fully capture the characteristics of the commodity asset class.

Transparency

Learn more >>

Our Commodity Strategy uses an easy-to-understand rules-based methodology to avoid human bias.

Diversification

Learn more >>

Our investment process maintains diversification across commodity types and sectors and gives you exposure to commodities not traditionally included in most indexes.

More to explore

Midyear Commodity Outlook: Better for Commodities than Consumers

by Greg Liebl, Director, Investment Strategy; Adam Swinney, Investment Strategist

July 7, 2025

Rising tariffs may lead to higher inflation and slower economic growth—an environment that has historically favored commodities.

Expect the Unexpected: The Role of Commodities During Periods of Unexpected Inflation

by Greg Liebl, Director, Investment Strategy; Adam Swinney, Investment Strategist

March 17, 2025

We believe that including commodities in a portfolio not only offers potential opportunities for increased diversification but can also help mitigate the worst inflationary outcomes.

2025 Commodity Outlook: Three Areas to Watch

by Greg Liebl, Director, Investment Strategy; Adam Swinney, Investment Strategist

February 13, 2025

For commodity investors, three areas to watch are inflation, the US dollar and supply conditions across physical markets.