Laddered Fixed Income

For wealth managers

Our laddered strategies provide a systematic and customizable approach for income-oriented investors.

Make time for market updates. Read what happened in fixed income for the week.

![]()

Parametric’s Laddered Fixed Income strategies give investors the opportunity to adjust to rising interest rates and improve yields. These strategies aim to deliver predictable income and preserve investor capital, with the option to harvest tax losses on an ongoing basis.

Municipal Ladders

Our municipal laddered strategies allow for rules-based, equal-weighted allocation across the yield curve, customized for state or national exposure.

Corporate Ladders

Our corporate laddered strategies allow for rules-based, equal-weighted allocation across the yield curve, customized for credit quality.

![]()

Parametric Tax Optimized Ladders

Looking across corporate bonds, municipal bonds, and U.S. Treasury bonds we aim to purchase the highest-yielding securities based on the investor’s tax situation to create a laddered portfolio that best fits their needs.

Treasury Ladders

We seek to deliver predictable cash flow and capital preservation from high-quality US Treasuries.

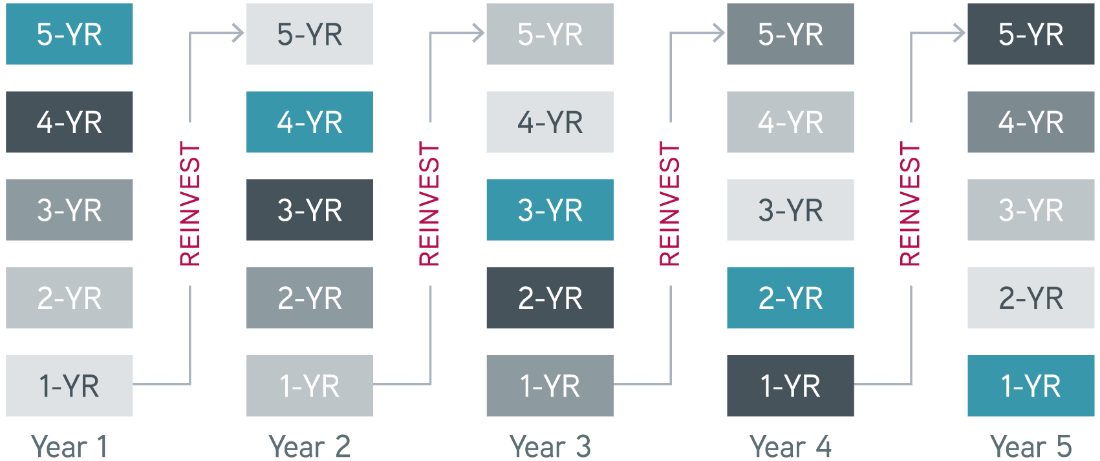

How it works

Bond funds expose investors to interest rate risk and fluctuating returns, while individual bonds can lock investors into maturities. Bond laddering is a dynamic strategy that provides predictable income and benefits from rising interest rates.

To build a laddered portfolio of corporates or municipals, we equally weight investment-grade bonds by maturities along a defined segment of the yield curve. As bonds mature, their proceeds are reinvested into longer maturities, which typically have higher yields. Through continuous reinvestment in longer-dated bonds, the overall portfolio benefits from higher income during periods of rising rates.

Intended benefits of laddered bond portfolios

Access

Learn more >>

Execution

Learn more >>

Using proprietary technology, our size and scale allows us to buy and sell bonds at attractive prices. We aggregate client transactions to execute efficient and cost-effective trades.

Oversight

Learn more >>

Our in-house analysts and strategists perform extensive research to select securities and monitor for credit risks.

Tax efficiency

Learn more >>

Investors can embrace year-round tax-loss harvesting, allowing us to aim for enhanced after-tax returns.

VIDEO

Why would a client want to use a laddered portfolio?

We combine flexibility, a rules-based approach and tax optimization into laddered portfolios for a solution The based on each investor’s individual tax rate. Explore how customization can help meet your client’s needs and objectives.

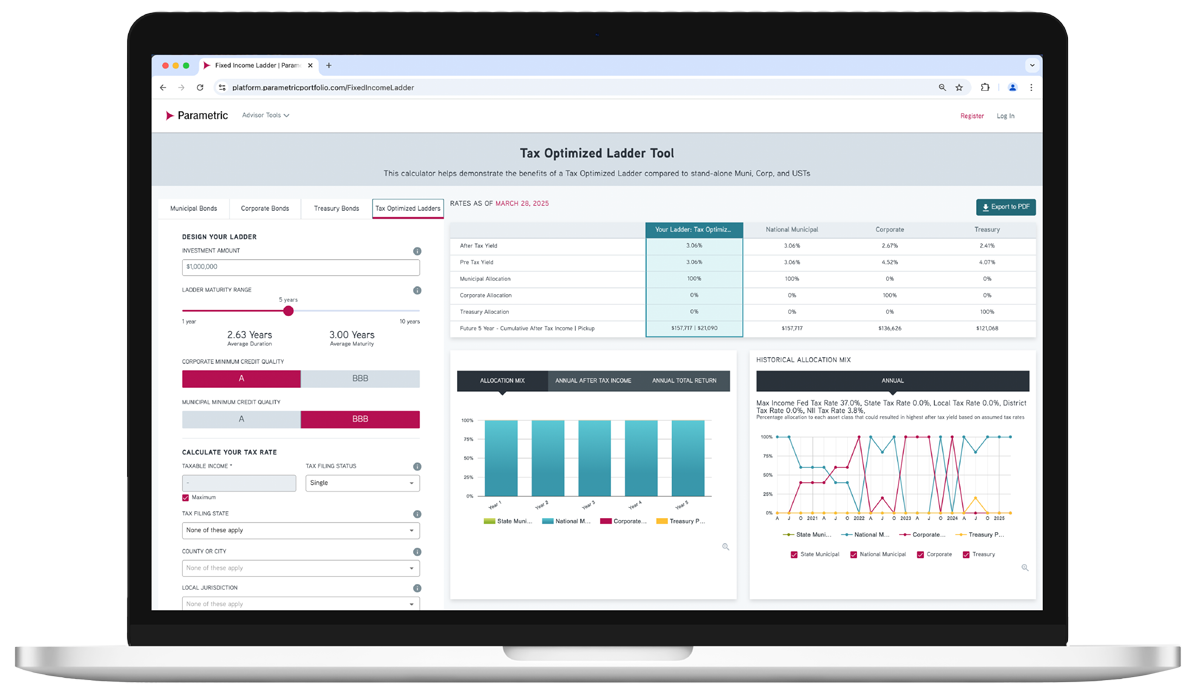

ADVISOR TOOL

Laddered Interest Rate Scenario Tool

Which fixed income asset class is just right for each investor? Explore possible ways to achieve optimal after-tax yield.

Use our online tool to showcase potential benefits of tax-managed and customized laddered bond portfolios.

Explore more fixed income solutions

Tax efficiency through advanced technology

Even sophisticated fixed income investors can miss opportunities to boost tax efficiency. Learn how Parametric's advanced technology can help investors navigate complex rate environments and enhance potential after-tax returns.

Why choose Parametric?

Get in touch

Want to know more about our Laddered Fixed Income solutions? Complete our contact form, and a representative will respond shortly.

More to explore