Liability-Driven Investing

Parametric’s Liability-Driven Investing (LDI) strategies are designed to help pension plans manage assets in concert with their liabilities. LDI is an exercise in investing assets to fund future liabilities while balancing the resulting risk exposures on a total plan basis.

![]()

Parametric LDI focuses on the total portfolio, enabling plan sponsors to better observe the total risk profile of assets versus liabilities and to create a more efficient liability hedge.

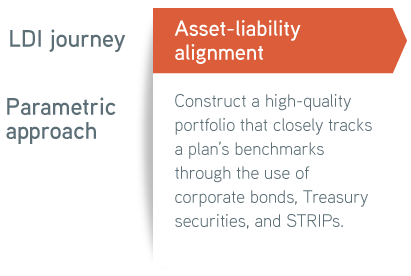

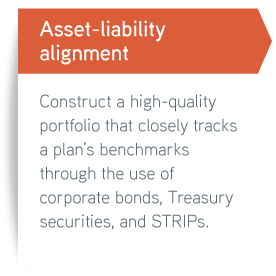

Parametric LDI is a suite of comprehensive, systematic, risk-managed solutions for all stages of the LDI process. Recognizing that each investor’s LDI journey is unique, Parametric offers a broad range of solutions that can be customized to support the goal of funding future liabilities while balancing risk exposures on a total plan basis.

Investing involves risk. There is no guarantee that the strategy will be successful. All investments are subject to loss.

Explore more institutional solutions

Why choose Parametric?

How it works

Parametric LDI is tailored to meet the individual plan’s needs. Through our pension and analysis program, we analyze plan liabilities and assets to understand key pension risks. We thoughtfully assess liability cash flows, yield curve suitability, and liability characteristics to design an effective hedging program that can incorporate cash, bonds, a completion overlay, and glide path management.

Parametric offers many options that help meet the evolving needs of a sponsor’s LDI strategy.

Intended benefits of Liability-Driven Investing

Innovative solutions

Learn more >>

A focus on risk

Learn more >>

Experience and scale

Learn more >>

Parametric has more than 30 years’ experience managing systematic, rules-based strategies. Our size, scale, and proprietary technology enable us to deliver customized, cost-effective LDI solutions for clients of all sizes, at all stages of the LDI journey.

More to explore

Extensive Capabilities of an Overlay Program: More than Meets the Eye

by Richard Fong, Managing Director, Overlay Solutions; Heather Wolf, Portfolio Manager

August 4, 2025

Read why we believe consultation, customization and flexibility are three key elements of a successful and holistic overlay program.

Midyear Liability-Driven Investing Outlook: What’s Next for Corporate Pensions?

by David Phillips, Director, Liability-Driven Investment Strategies

July 14, 2025

From funding ratios and plan allocations to buyouts and surplus assets, here’s our midyear review of LDI trends.

2025 Liability-Driven Investing Outlook: Plan Reopening, Buyout Litigation and Risk Transfer Trends

by David Phillips, Director, Liability-Driven Investment Strategies

January 21, 2025

With pension plans in relatively good shape compared to the past, what trends do we see continuing into the future?