Tax-exempt cash flows and a protective premium coupon structure could make long-duration munis a good choice for bond investors.

One of the challenges for investors in today’s municipal bond market is the level of yields. The Municipal Market Data AAA Scale doesn’t offer a 1% handle until 2034. Even though relative value remains attractive, with AAA municipals yielding over 100% of Treasuries all along the yield curve, absolute yields are uninspiring.

What’s an investor to do? It’s a good idea to start by looking at real rate of return: the return on an investment net of inflation. Absolute yields catch the eye, but earnings net of inflation should be what matters. At the end of Q1 2008, the 10-year Treasury yield was 3.41%, which seems terribly attractive relative to today’s yields. At the same time, however, the Personal Consumption Expenditure Deflator (PCE Deflator), which is the Fed’s preferred measure of inflation, stood at 3.20%. That means the real rate of return on 10-year Treasuries was actually 0.21%.

The PCE Deflator has averaged 1.4% since 2015. However, the economy took a sharp disinflationary turn this year due to COVID-19. At the end of May 2020, the PCE Deflator was 0.5%. With 10-year Treasuries yielding 0.65% at that time, the real rate of return was 0.15%.

Municipal bonds yielding more than 0.50% are providing a real rate of return—but that’s not the only factor investors should consider. The absolute yield becomes even more enticing when we take into account the tax-exempt nature of their cash flows. Taxable equivalent yields (TEY) on municipals should be compelling for upper-bracket payers, even at current rates. For example, the TEY on a 1% return is 2.18% for a top-bracket payer in California and 2.15% for a top-bracket payer in New York City—not too bad when the dividend yield on the much riskier S&P 500® is 1.85%.

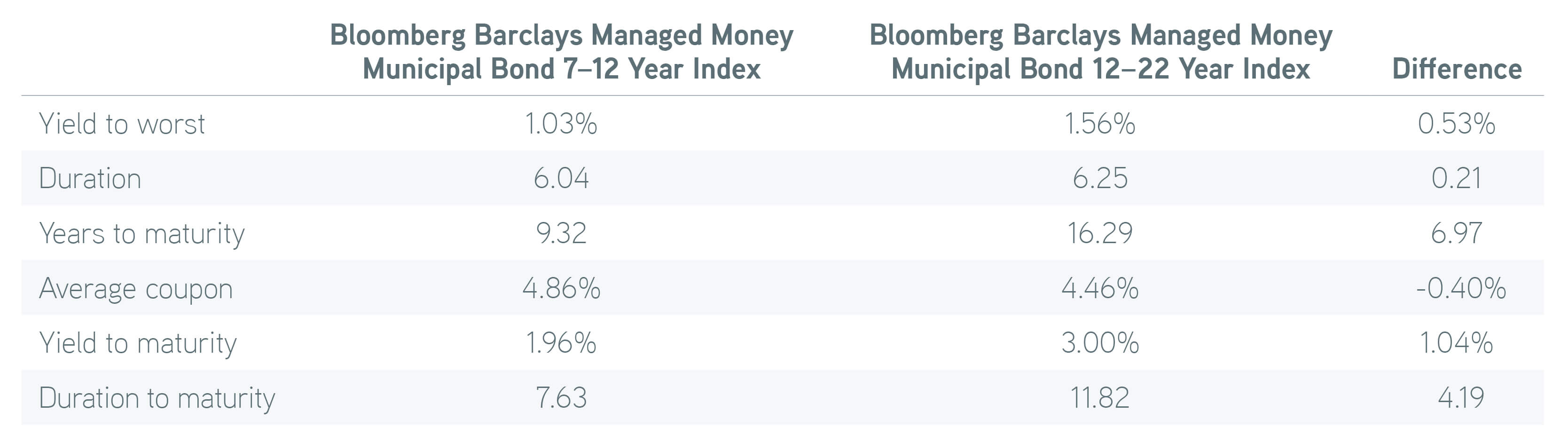

For investors balking at tax-exempt yields below 1%, it might be worth moving out the yield curve. While this may seem counterintuitive at a time of record-low yields, municipal bonds are ideally structured for this sort of move. The vast majority of municipal bonds are issued as premium bonds, and the vast majority of bonds maturing longer than 10 years have embedded calls. These factors mitigate the risk of going out the curve. The table below illustrates the yield pickup available from moving longer by comparing the June 30 statistics for the Bloomberg Barclays Managed Money Municipal Bond (Barclays MM) 7–12 Year Index and the Barclays MM 12–22 Year Index.

Moving out the curve offers potentially higher taxable equivalent yields

Source: Bloomberg, 6/30/2020. Index data is provided for illustrative purposes. It is not possible to invest directly in an index. Indexes are unmanaged and do not reflect the deduction of fees or expenses. Not a recommendation to buy or sell any security.

We offer tax-advantaged core bond market exposure

The 12–22 Year Index is significantly longer in terms of the maturity range, with an average maturity of 16.21 years versus 9.26 years for the 7–12 Year Index and yields of 1.54% versus 1.02%. However, because of the embedded calls, the duration of the longer index is 6.15 versus 5.99. The 12-22 Year Index has 51% more yield with only 3% more duration. We think this is an attractive proposition in the current market environment.

How is it that investors can add so much yield without taking on more credit risk or duration? The answer is simple: They’re substituting extension risk for duration. Extension risk is the risk of investors having their principal committed for longer than expected. When municipal yields are below the coupon rate of a callable bond, we assume the bond will be called. The effective duration of the bond will be to the call date. If yields were to rise above the coupon rate, the assumption shifts to the bonds remaining outstanding until maturity, and the duration is calculated to maturity.

The table also shows the duration to maturity, which is the maximum duration that the portfolios would have if all bonds were priced to maturity. In addition to the extra yield for assuming extension risk, investors do get some compensation for being extended. Because the bonds will be outstanding longer, they’ll provide more cash flow to the investor, which means yields are higher than they would be if the bonds were called.

Since the risk of extension is tied to the coupon rate, municipal bonds could be an ideal investment for investors seeking to take on extension risk. The premium coupon structure that dominates issuance offers investors significant protection. For example, the 12–22 Year Index has an average coupon of 4.46% and a yield of 1.54%. Rates could rise over 250 basis points and investors would still not be fully extended.

Given the current disinflationary environment, we think there’s a compelling case for picking up yield and going long. We like the trade-off that comes with adding yield while taking on extension risk in a portfolio with a premium coupon structure. For some investors, longing for yield might be the perfect answer.

The Bloomberg Barclays Managed Money Municipal Bond Index (7–12 years) is an unmanaged custom benchmark that measures intermediate-range bond securities issued by state and local municipalities whose interest is exempt from federal income tax and the federal alternative minimum tax. The index is composed of high-quality municipal bonds (only rated AA- or higher) with maturity ranges between seven and 12 years and excludes calls shorter than five years. The Bloomberg Barclays Managed Money Municipal Bond Index (12–22 years) is an unmanaged custom benchmark that measures longer-term bond securities issued by state and local municipalities whose interest is exempt from federal income tax and the federal alternative minimum tax. The index is composed of high-quality municipal bonds (only rated AA- or higher) with maturity ranges between 12 and 22 years. “Bloomberg” is a trademark and service mark of Bloomberg Finance L.P. (“Bloomberg”). “Barclays” is a trademark and service mark of Barclays Bank Plc, used under license. Bloomberg Finance LP and its affiliates (collectively, “Bloomberg”) or Bloomberg’s licensors own all proprietary rights in the “Bloomberg Barclays Indexes.” Neither Bloomberg nor Barclays Bank Plc or its affiliates (collectively, "Barclays") guarantees the timeliness, accuracy, or completeness of any data or information related to the Bloomberg Barclays Indexes. This strategy is not sponsored or endorsed by Bloomberg or Barclays and each makes no representations regarding the content of this material.