As investors continue to step out of cash and potentially rebalance out of equities following their strong performance, we expect bonds to play a larger role in diversified portfolios next year.

Shaped by a balance between potentially opposing monetary and fiscal forces, our fixed income outlook recognizes the Federal Reserve’s ongoing commitment to easing toward a more neutral stance. At the same time, we see the new administration pursuing policies that could lead to higher growth, resurging inflation and increased debt and deficits. While these crosscurrents are likely to create volatility at times, overall we believe that 2025 could be favorable for fixed income investors.

Yields and equities surge following the first rate cut

The Fed cut rates in September for the first time in four years—lowering the target rate from a 23-year high, first set 14 months prior in July 2023. Yields have surged since then on signs of a resilient US economy and indications that the disinflationary trend has slowed. Real GDP rose at a 2.8% annual rate in Q3, an uptick compared to the start of 2024, while the three-month annualized increase in core CPI was 3.1% in November, the highest since May.1

The 10-year US Treasury yield has increased more in the first three months of this rate cutting cycle than in any cycle since 1989. Also factoring in the potential impact of the new administration’s policies, the market and Fed are now pricing in only two 25 basis point (bp) cuts over the next 12 months—roughly a quarter of the easing expected for that period back in September. The projected terminal rate when the cutting cycle ends has moved closer to 4%—up from 3% around the September Fed meeting.

The good news is that yields are higher on the year and back above historical averages. Tax-free municipal bond yields of 3.00% to 3.50%—equating to taxable equivalent yields over 5% to 7% (assuming a 40.3% tax rate in the highest brackets)—and investment grade (IG) corporate yields over 5% represent value in our opinion. Assuming a macro backdrop of modest growth and slowing inflation similar to what we witnessed in 2024, any meaningful push above those levels would likely be met with strong support. The recent outperformance of equities reinforces that view, so we think bonds are looking increasingly more attractive than stocks.

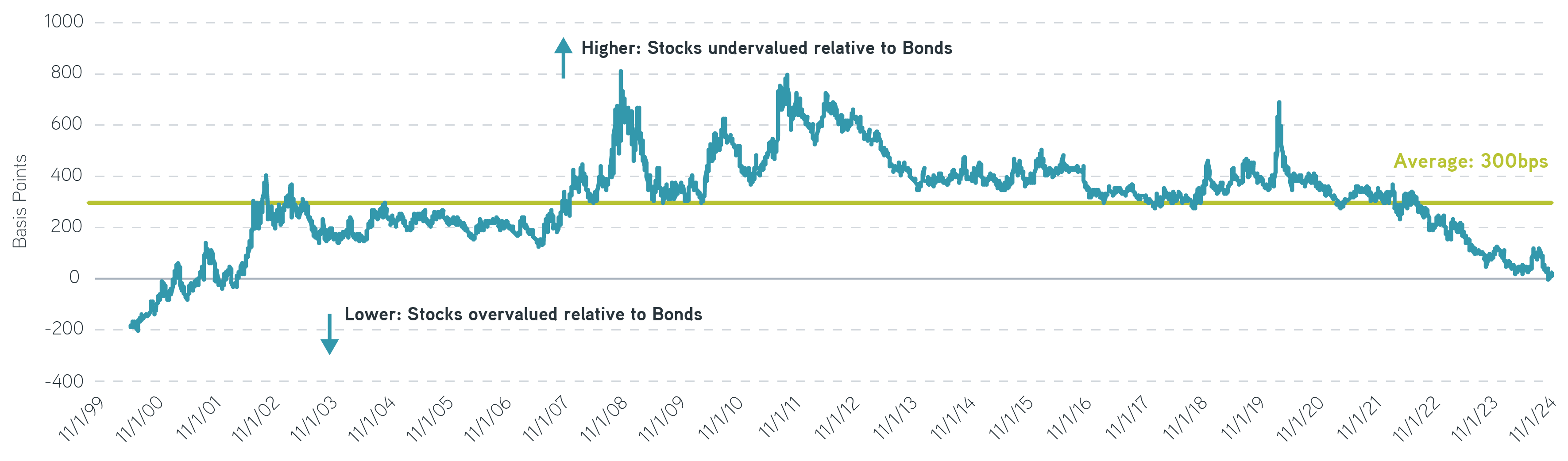

A good measure to determine the relative value between stocks and bonds is the equity risk premium. When expressed as the difference between the S&P 500® earnings yield—reflecting the expected return on stocks—and the 10-year Treasury yield, that spread currently stands at 6 bps, versus a long-term average of 300 bps.2 By that measure, bonds are the most undervalued relative to stocks they have been in last 20 years.

Investors may consider a rebalance toward fixed income in 2025

Source: Bloomberg data from 11/29/1999 to 12/18/2024. Equity Risk Premium = Difference between S&P 500 earnings yield and 10-year Treasury yield.

Bonds would benefit if investors diversified away from an elevated stock market. With the equity risk premium suggesting bonds are the cheapest relative to equities in over 20 years, yields near a decade high and the potential for a reversion to the mean, we think this may be the right time to rebalance.

New administration has big plans, but elevated debt may limit their ability to deliver

We believe an environment of moderate growth, declining inflation and continued Fed easing will support fixed income performance in 2025. The US economy has been on a solid footing, and policymakers seem intent on keeping it there. How much further they can lower interest rates will still depend, at some point, on how they see the interaction of tax cuts, tariffs and immigration policies affecting the economy. Our initial view is that their impacts may be more muted than expected—or least delayed until 2026 and beyond.

Tariffs and immigration

Increased cost of living stemming from a historic bout with inflation was one of the primary issues that mobilized voters to seek change in the 2024 election. We think the new administration is unlikely to blindly pursue policies that could potentially drive a resurgence of inflation and result in economic and market instability—just for the sake of keeping campaign promises and scoring political points. Rather, we believe that a measured and gradual approach to tariffs and immigration is likely. Compared to the more extreme versions of those proposals, this would help to keep a lid on inflation and allow the Fed to continue along its path.

Tax cuts and the deficit

The administration’s top economic priority, extending the 2017 Tax Cut and Jobs Act (TCJA), may also face some hurdles. According to the CBO, the US is expected to run deficits of 6% of GDP for the next decade. Estimated debt held by the public is expected to climb from $28 trillion to $50 trillion—roughly 120% of GDP by 2034.3 Debt servicing costs are also surging in today’s higher rate environment. The Treasury will spend over $1 trillion to service debt in 2025, exceeding defense spending for the first time and reaching the highest level relative to GDP in 28 years.

Along with higher total debt, debt service costs may complicate efforts to extend the TCJA, which is estimated to cost $4 trillion over 10 years. Finding the pay-for offsets and getting a deal done in the complex budget reconciliation process, with thin majorities in the House and Senate, will be no easy task.

Solutions for today’s complex interest rate environments

The bottom line

We think that the new administration and lawmakers will want to prevent a meaningful resurgence in inflation—or worse, possible deflation from the demand destruction caused by mass deportations. Renewing the TCJA may be a lot more challenging this time around, given the country’s current debt and deficit challenges—much less enacting new tax cuts.

Therefore, we believe that we could have an environment of modest growth around 2% and modest inflation between 2% and 3%. Even if the neutral rate is determined to be higher than it was before the pandemic, further interest rate cuts are likely. In 2025, under those conditions, we see yields unchanged to slightly lower, a steeper curve and credit spreads trending sideways.

Here’s our outlook for munis, corporates and preferreds in the second half of 2025

Municipals

• The muni market goes into 2025 with yields near decade highs and above long-term averages,4 up 30 to 60 bps compared with the start of last year.

• Tax exempt yields in the 3% to 4% range should keep buyers engaged. For investors in higher tax brackets (who have faced tax rates up to 40.3%), this could equate to tax adjusted yields of 6% to 7%. Investors may increasingly see value in these tax adjusted yields as an attractive alternative to equity exposure.

• We believe the muni market could see total returns of 3% to 6% depending on yield curve positioning—with the long end potentially outperforming the short end.

• Muni fund inflows totaled $42 billion in 2024, with 23 consecutive weeks of inflows heading into year-end.5 We expect this solid momentum to continue into 2025. Rate cutting cycles have typically been favorable environments for fund inflows, with muni funds experiencing net positive inflows in the last six easing cycles.

• After the pandemic, municipal issuance stagnated, likely due to generous federal aid, while other fixed income sectors saw significant growth. As revived economic growth creates new infrastructure needs, munis may see some catch up. Total new issue volume was elevated in 2024 with $490 billion coming to market, up 36% compared to 2023.6 At times, elevated issuance caused munis to underperform and ratios to increase, which presented more attractive entry points. We expect 2025 to be another record issuance year, potentially offering similar opportunities for favorable entry points when net supply turns positive.

• Municipal credit has remained on a solid footing. State tax revenue increased over 2024, and rainy day funds remain near an all-time high. Upgrades outpaced downgrades by 2.5 to 1.7 We expect muni credit spreads to remain unchanged or tighten slightly given the current solid economic backdrop.

• As lawmakers look for ways to pay for the extension of the TCJA, we expect noise and headlines around the potential adjustment to muni taxation. While certain sectors and bond types may be impacted going forward, we don’t expect any broad change or limitation to tax exemption in general. We would view any weakness and underperformance related to this risk as a buying opportunity in 2025.

Corporates

• Investment grade corporate bonds are on pace to deliver a nearly 4% to 5% return for 2024, as the sector’s high starting yield and spread compression more than compensated for the 30 bp rise in US Treasury rates through December.

• Despite spreads narrowing to their tightest level in 26 years, we expect corporate bonds to continue generating attractive near-term and long-term returns.

Near-term considerations – High starting yield could generate attractive income and provide a loss buffer

• Corporate bond yields remain above 5%,8 higher than their peak yield during the 2020 pandemic recession and one of the highest levels since the global financial crisis.

• We think this attractive carry provides a material cushion against rising rates and wider spreads. Based on Parametric’s Interest Rate Scenario Tool, a 1–10 year corporate ladder could potentially withstand a 150 bp rise in yields before its projected 1-year return turned negative.

• Spreads are in their lowest 0% to 10% decile, while yields are in the 50% to 60% percentile. When this combination occurred six times in the past, the subsequent 1-year, 3-year and 5-year annualized returns averaged 1.7%, 2.8% and 5.4%, respectively, and returns were positive for each period in all 6 occurrences.

• Corporate spreads could continue to offer adequate compensation, given the positive credit rating momentum, with 2.4 companies upgraded for each one downgraded in 2024.

• The economy continues to avoid a recession and appears to be reaccelerating, which would tend to support tighter spreads.

• Tight spreads reflect the underlying fundamental strength of corporate balance sheets. While interest coverage has declined as companies refinance debt at higher interest rates, this credit metric has remained above pre-pandemic levels.

• Demand could continue to outpace supply, as we expect net new issuance to decline with a rise in maturities, while the high historic yields could continue to bolster demand.

• However, even a 5% starting yield may not be able to mitigate against loss if monetary and fiscal policy result in rate volatility. Historically, we have found that 70% of the time, corporate bond returns for a year were within a range 5% above or below their starting yields.

Long-term considerations – Corporate bonds have delivered enhanced US Treasury returns

• Since December 1996, corporate bonds have generated an average annualized return of 5.1%,9 outperforming similar duration US Treasury securities by 96 bps per year, despite spreads widening 26 bps over the period.

• Since our blog Can Tight Spreads Still Deliver Excess Returns? posted in May 2024, corporate bonds have outperformed like-duration US Treasury notes by 95 bp.

• Even at current spread levels, we believe corporate bonds continue to offer significant protection from credit losses. Moody’s estimates the average default and recovery rates at 0.2% and 43%, respectively, resulting in an annual default loss of just 12 bps.

• Intermediate spreads have remained below 100 bps for extended periods, including from 2004 to 2007 and 43% of the time over the past 10 years.

Preferreds

• In our view, high yields in preferred securities should continue to attract investor demand after the asset class outperformed other fixed income alternatives in 2024. Valuations have fully recovered, but credit spreads could remain at the tight end of the range next year if economic growth and technical support persist.

• Financials sector outperformance was a tailwind throughout 2024. We continue to like banking sector fundamentals, but we anticipate that total return going forward should be closer to the starting yield around 6%. In a coupon-clipping year, investors can potentially keep more of their income with the tax benefit of qualified dividend income (QDI) preferreds.

• Banks ended Q3 with the highest capital levels since the global financial crisis, allowing some firms to call preferred securities without replacement throughout 2024. We expect earnings to benefit from robust capital markets activity and lower deposit costs for regional lenders. Potential regulatory changes could be delayed following the election. Commercial real estate (CRE) and consumer lending are likely to remain a focus in the financial sector, but ongoing economic growth would support credit quality, and provisioning is already high.

• Utilities issued a record amount of hybrid securities in the US market in 2024. We anticipate that hybrid supply could remain elevated as firms invest in generation capacity to meet demand from AI, and recent changes to ratings agency methodology may spur refinancing activity.

• Historical periods with high rates and steady economic growth, such as the mid-1990s and 2000s, are associated with tight credit spreads but also positive returns driven primarily by coupon income. We believe valuations appropriately reflect strong fundamentals and a positive economic outlook.

1 Real GDP EHGDUS index (Bloomberg). Core CPI MoM CPUPXCHG index (Bloomberg).

2 Morgan Stanley Equity Risk Premium (S&P 500) Index. MSRPSPX index (Bloomberg).

3 Congressional Budget Office, The Budget and Economic Outlook: 2024 to 2034 (CBO publication 59710), February 7, 2024.

4 Bloomberg Municipal Bond Index.

5 Municipal Fund Flow – LSEG Lipper Global Fund Flows.

6 Municipal Supply – Bloomberg.

7 Moody’s Ratings.

8 Bloomberg 10 year BBB Corp Yield (IGUUBC10).

9 ICE BofA 1-10 Year US Corporate Index.

Past performance is no guarantee of future results. The returns referred to in the blog are those of representative indexes and are not meant to depict the performance of a specific investment.

Parametric and Morgan Stanley do not provide legal, tax, or accounting advice or services. Clients should consult with their own tax or legal advisor prior to entering into any transaction or strategy described herein.

The views expressed in these posts are those of the authors and are current only through the date stated. These views are subject to change at any time based upon market or other conditions, and Parametric and its affiliates disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions for Parametric are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Parametric strategy. The discussion herein is general in nature and is provided for informational purposes only. There is no guarantee as to its accuracy or completeness. All investments are subject to the risk of loss. Prospective investors should consult with a tax or legal advisor before making any investment decision. Please refer to the Disclosure page on our website for important information about investments and risks.

12.18.2025 | RO 4090105