Expiring provisions in the 2017 Tax Cut and Jobs Act (TCJA) are poised to be the dominant fiscal issue in 2025. As we approach the November 5 election, both US presidential candidates have outlined broad objectives that would extend some or all TCJA provisions, partially offset by a mixture of new taxes and tariffs. In part three of our series, we review major policy plans and budget deficit challenges.

Former President Donald Trump favors extending all expiring provisions in the TCJA, which overhauled US corporate and individual tax rates, and raising tariffs. Vice President Kamala Harris endorses much of President Joe Biden’s budget proposal, while promising to limit tax increases to those making over $400,000.

Even in a unified government, legislative challenges and a thin majority can prevent campaign promises from becoming law. From the standpoint of the deficit, fiscal policy could be tighter in a divided Congress, which could limit spending increases and tax cuts that would pass under either Democratic or Republican control. But gridlock is no panacea, with the current divided Congress producing historically high deficits at over 6% of GDP.

As the campaign season has progressed, candidates have offered a longer list of tax breaks—from eliminating tax on social security and tip income to removing the cap on state and local income tax (SALT). Estimating the net budgetary impact is a moving target that is trending more deeply into the red. In early October, the Committee for a Responsible Budget had midpoint estimates for the 10-year net cost of Harris’s and Trump’s proposals at $3.5 trillion and $7.5 trillion, respectively.1 Unfortunately for our long-term fiscal health, neither candidate’s proposals appear to pay for themselves—let alone cure the structural drivers of the deficit. Serious reform likely requires higher revenues than proposed taxes and tariffs produce.

Presidential proposals: Tax breaks anyone?

TCJA was passed using the budget reconciliation process—a popular legislative tool that allows Congress to pass a bill with a simple majority, bypassing the 60-vote filibuster requirement. The American Rescue Plan Act (ARPA) of 2021 and the Inflation Reduction Act (IRA) of 2022 were also passed in budget reconciliation. However, provisions are subject to the “Byrd Rule,” which disqualifies changes that would increase the deficit beyond the budget window of 10 years.

As a result, most individual tax rate reductions in the TCJA are set to expire after 2025. The top marginal tax rate would revert to 39.6% from 37%, and the standard deduction would decline by nearly a half. Offsetting limits on itemized deductions—including the $10,000 cap on deductions for state and local taxes (SALT)—would also return to pre-TCJA rules.

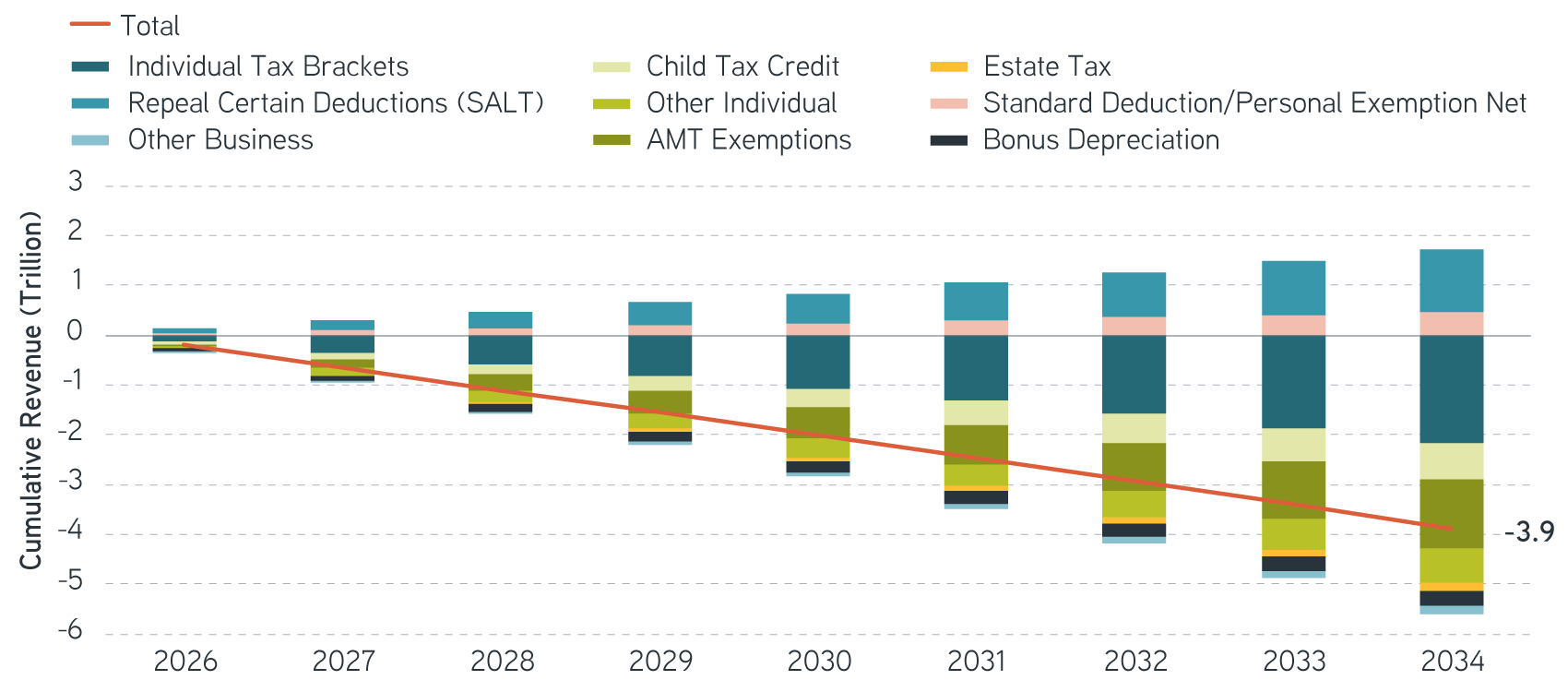

According to scoring by the Congressional Budget Office (CBO), Trump’s proposal to extend all expiring provisions would add $3.9 trillion to the deficit over 10 years, excluding additional interest. While the cuts could raise economic growth relative to the baseline, the net effect would increase borrowing by 1.3% of GDP annually, on top of a deficit projected to exceed 6% of GDP over the next 10 years.

Extending expiring Tax Cut and Jobs Act provisions – 10-year cumulative cost

Source: Congressional Budget Office, Budgetary Outcomes Under Alternative Assumptions About Spending and Revenues, updated May 21, 2024.

Harris favors extending TCJA tax rates for earners making less than $400,000 while expanding tax credits to support families and new homebuyers. After increasing the ARPA’s Child Tax Credit (CTC) and Earned Income Tax Credit (EITC),along with adding a $6000 newborn credit and a $25,000 first-time homebuyer tax credit, the cost to taxpayers could exceed $2 trillion over 10 years, according to the Penn Wharton Budget Model. Combined with the $1.4 trillion cost of extending TCJA rates for eligible households, the combined budgetary impact would be similar to extending TCJA in its entirety.

Pay-fors: Tariffs and taxes

To pay for these budget-busting ideas, candidates have proposed a mix of tariffs and tax increases. As with any budget, it’s uncertain which portions of the proposal make it into the legislative agenda and potentially become policy. Recall that during President Trump’s first term, severe cuts to social spending in his annual budget proposals got little traction in Congress.

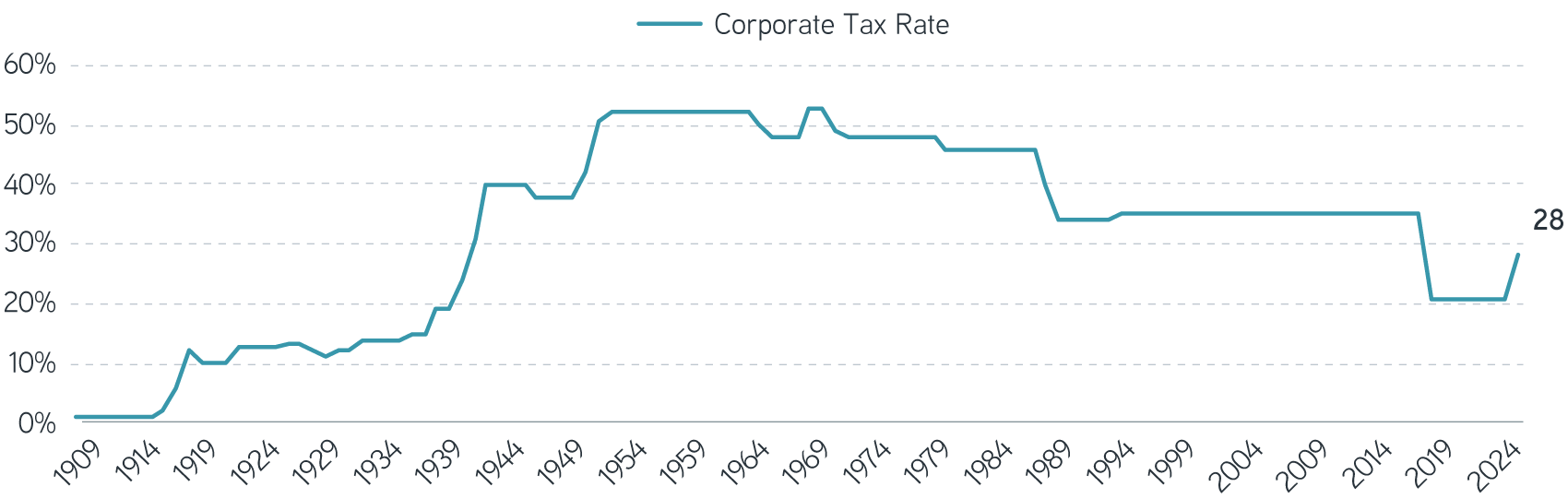

According to the Office for Management of the Budget (OMB), the Harris plan to increase the corporate tax rate from 21% to 28% would raise over $1.3 trillion, while adding a minimum corporate tax, taxing stock buybacks and limiting employee expense deductions would raise more than $500 billion over 10 years. On the individual side, increasing the Net Investment Income Tax (NIIT)—the so-called Medicare Surtax—from 3.8% to 5% and extending it to passthrough entities would raise nearly $800 billion. A proposed unrealized capital gains tax on households with a net worth greater than $100 million could raise $500 billion over 10 years.

Historical corporate tax rate since 1909

Sources: 1909–2001: World Tax Database, Office of Tax Policy Research. 2002–2024: Internal Revenue Service, Instructions for Form 1120, January 2024. Notes: Data refer to the top marginal tax rate on corporations. Unless otherwise mentioned, this is the tax rate applicable at the federal level on domestic companies. Different rates apply on non-resident/foreign-owned companies. Provincial and local governments may levy additional taxes. In addition, the effective corporate tax rate may be higher due to the imposition of corporate level taxes on dividend or other distributions.

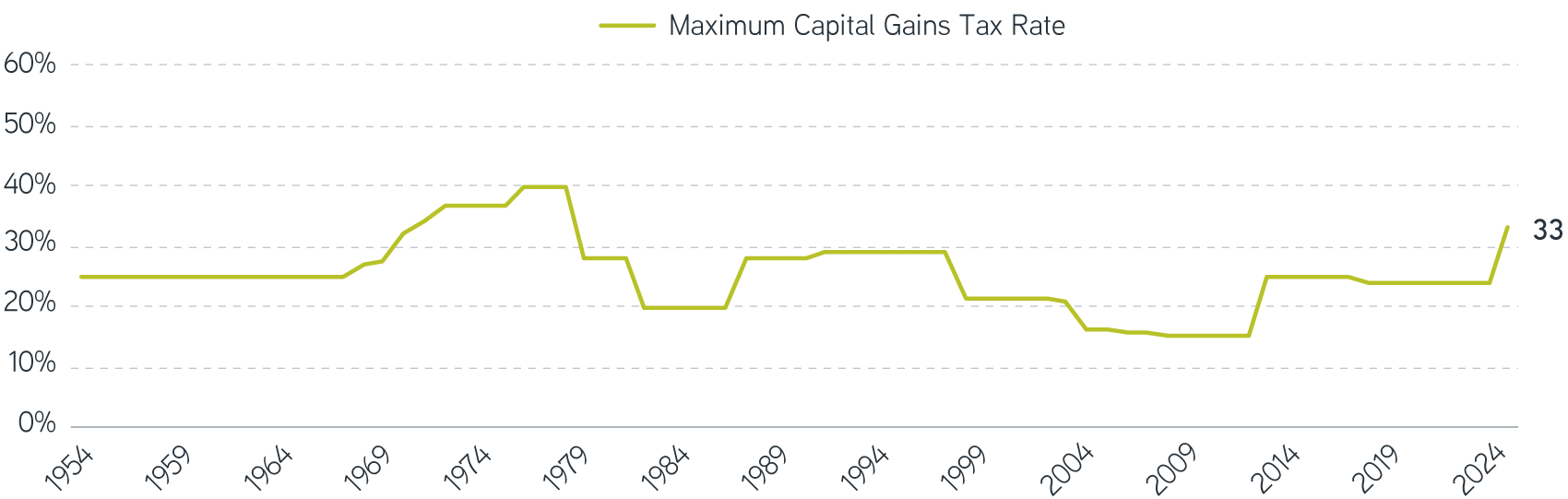

For capital gains, Harris favors increasing the rate from the current 20%—or 23.8% including NIIT—to 28%, resulting in an effective rate of 33% inclusive of the NIIT for high earners. But if we exclude budget proposals such as the “billionaire tax,” the candidate’s proposed revenues don’t offset spending increases and tax cuts.

Maximum capital gains tax rate since 1954

Source: US Department of Treasury, Office of Tax Analysis, “Taxes Paid on Capital Gains for Returns with Positive Net Capital Gains, 1954-2014."

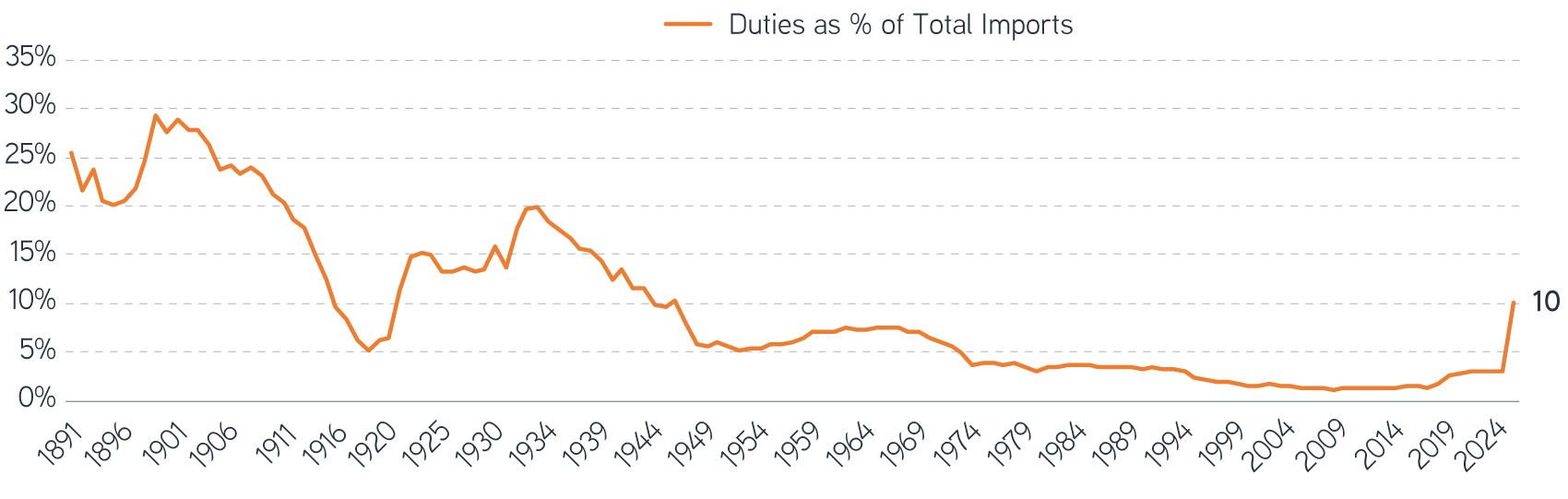

For the Trump team, tariffs are not only a favored revenue source but also a potential path toward a new geopolitical approach. Unlike tax increases that must make it through Congress, the first Trump administration demonstrated the president has broad authority to craft trade policy without Congressional approval. But tariff increases don’t happen in a vacuum—substitution, retaliation and inflation can limit the revenue impact.

After new tariffs were imposed in 2018, the average rate on imported goods rose from 1.5% to 3%. Trump has proposed a 10% tariff on all goods and a 60% rate on Chinese imports. Against the $3.1 trillion in imported goods in 2023, these tariffs could generate significant revenue. But 2018 also saw the price of washing machines increase 12% and soybean exports to China decline 75%, triggering new subsidies for farmers.

When the US imposes a tariff, the businesses importing the good are responsible for paying it—either by accepting lower margins or passing along a portion of the cost to consumers. If tariffs resulted in $200 billion in additional revenue, and were fully passed on to consumers, that would raise prices approximately 1%, reducing real incomes. The non-partisan Tax Policy Center estimates a 10 year effect for the proposed tariffs of $3.7 trillion gross, or $2.7 trillion net when including the inflationary impact.

Given these limitations, it seems unlikely new revenues would offset the impact of tax cuts and increased spending under either candidate’s proposals, let alone address structural drivers of the deficit.

Duties as a percentage of total imports since 1891

Source: US International Trade Commission, US Imports for consumption, duties collected, and ratio of duties collected to value, 1891–2021, May 2022.

Solutions for today’s complex interest rate environment

The deficit: Can we fix this thing?

As we pointed out in part one, over 90% of the expected growth in federal spending over the next 10 years comes from Social Security, health care and interest. The major drivers are aging demographics and high health care costs. Keeping those costs in check will likely be a key factor determining our long-term fiscal fate.

The Government Accountability Office estimates over $200 billion in wasteful government spending annually. A proposed government efficiency commission could reduce that value over time. But with the scale of annual budget deficits nearing $2 trillion, those efficiency gains would only help at the margin.

Policy could address costs more directly, as in the Simpson-Bowles proposals that extended the Social Security retirement age and adjusted annual increases to chain-linked CPI. Issues can only be ignored by politicians for so long—barring congressional action, Social Security is due for across the board cuts of over 20% starting in 2033.

The bottom line

Without significant spending changes, higher revenues will be needed to balance the equation. Individuals could lose popular exemptions, such as the mortgage interest deduction, or begin paying tax on employer-provided health care. As we argued with the proposals from the candidates, the revenues in the current tax code are insufficient to pay for promises already made.

1 Committee for a Responsible Budget, US Budget Watch 2024, “The Fiscal Impact of the Harris and Trump Campaign Plans,” October 7, 2024.

Parametric and Morgan Stanley do not provide legal, tax or accounting advice or services. Clients should consult with their own tax or legal advisor prior to entering into any transaction or strategy.

The views expressed in these posts are those of the authors and are current only through the date stated. These views are subject to change at any time based upon market or other conditions, and Parametric and its affiliates disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions for Parametric are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Parametric strategy. The discussion herein is general in nature and is provided for informational purposes only. There is no guarantee as to its accuracy or completeness. Past performance is no guarantee of future results. All investments are subject to the risk of loss. Prospective investors should consult with a tax or legal advisor before making any investment decision. Please refer to the Disclosure page on our website for important information about investments and risks.

10.23.2025 | RO 3946040