Another period of heightened volatility in the markets reminds us why tax management can be such an essential part of fixed income investing.

At the start of 2025, bond yields rose sharply in response to stronger than expected economic data and persistent inflation. Over the two-week timeframe through January 14, we saw the 10-year US Treasury yield rise roughly 30 basis points (bps). Soon thereafter, however, yields retreated as geopolitical risks, aggressive tariff policies and weaker economic indicators reintroduced uncertainty.

Municipal bonds in particular faced headwinds, with stronger issuance—up 23% year over year through April 8—and weaker demand leading to underperformance. Despite Treasury yields declining later in the quarter, muni bond yields generally moved higher. For the quarter ended March 31, the Bloomberg Municipal Bond Index was down -0.22%, underperforming the Bloomberg US Treasury and US Corporate Indexes, which were up 3.19% and 2.56%, respectively—the widest margin for a three-month period since 2020.

Muni bond underperformance continued as US Treasurys gained from a tariff-driven rally over the beginning of April. Read Parametric’s insights about the tax-exempt divergence and current opportunity in municipals.

How can investors take advantage of losses?

While negative returns aren’t ideal for investors, they do present a valuable opportunity to harvest tax losses—especially when they occur early in the year. The ability to realize losses and replace positions in the market during periods of elevated supply have already allowed us to deliver a tax benefit.

In the first quarter of 2025, Parametric sold more than $5.3 billion in market value to realize $88 million in net losses—delivering a potential tax benefit over $30 million for Parametric Fixed Income SMA investors.1

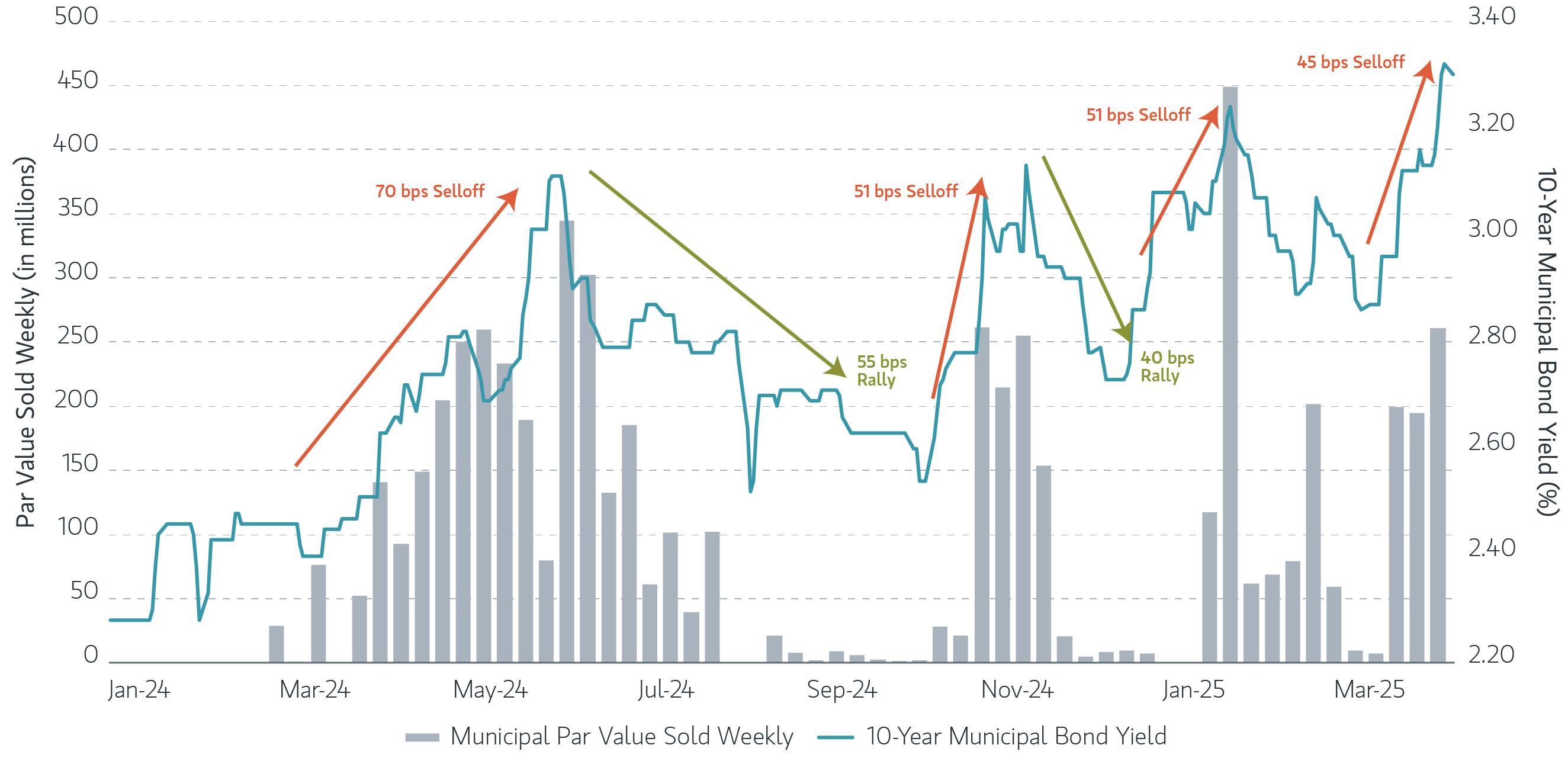

When we compare the 10-year municipal index yield to Parametric’s tax loss harvesting activity within municipal portfolios, we can see that as market yields increased, so did our weekly harvesting activity.

Weekly municipal loss harvesting activity from January 2024 to March 2025

Source: Thomson Reuters, Parametric as of 03/31/2025. Weekly par volume shown above includes only municipal strategies that incorporate ongoing discretionary loss harvesting by Parametric. It is not possible to invest directly in an index. Indexes are unmanaged and do not reflect the deduction of fees or expenses. All investments are subject to risk, including risk of loss.

Why harvest fixed income tax losses throughout the year?

A proactive, systematic tax loss harvesting (TLH) strategy can generate realized losses—creating a tax asset that may be able to enhance after-tax returns.

Third-party research has shown that tax management can add 1% to 2% in after-tax excess returns for equity and 0.3% for fixed income.2 This is known as tax alpha.

These losses can be used to offset gains in the current year or carried forward indefinitely. TLH can be especially beneficial to separately managed accounts (SMAs) that can hold securities directly. Taxes are a crucial element in equity direct indexing. TLH may have added benefits in a fixed income portfolio, where proceeds from maturing bonds, calls and coupons offer ongoing opportunities for reinvestment at current rates, resetting the cost basis and book yields higher.

Advisors typically review their portfolios for TLH trades later in the year, with some waiting until December. But in our experience, harvesting losses systematically throughout the year can be much more effective. For fixed income portfolios, this is particularly true, since the changes in interest rates and yearly rate peaks that mostly drive TLH opportunities have historically been distributed throughout the calendar year.

An analysis of Bloomberg monthly yields data from 2001 to 2024 found that municipal bond and investment grade (IG) corporate bond yields have rarely peaked in December—representing only 8% and 4%, respectively, out of the past 23 years.3 We believe that systematically monitoring price declines helps to ensure that maximum losses are realized, no matter when they occur. Spreading the trades across the calendar also avoids the full brunt of poor liquidity conditions that we tend to see late in the year.

Boost bond potential with active tax management

The bottom line

- It’s no wonder that tax awareness has become a critical component of fixed income investing, when TLH has been a reliable strategy for adding value across market environments.

- Investors who adopt an “all weather” approach can seek to uncover opportunities to enhance tax alpha in any market climate.

- Systematic tax management can help to reduce the “fee” of taxes throughout the year.

1 Source: Parametric, 03/31/2025. The information is provided for illustrative purposes only. Values are aggregated across all municipal laddered strategies, managed municipal strategies and municipal total return strategies. Only client positions with unverified cost basis were excluded from calculations. Loss calculation is based on the amortized book price minus the sell price, represents historical information and should not be construed as future results. Loss information illustrates the effect to a portfolio and is not representative of, and should not be construed as, performance. There is no assurance that tax loss harvesting will continue in the future. There is no guarantee that any specific account may engage in tax loss harvesting.

2 Shomesh E. Chaudhuri, Terence C. Burnham, and Andrew W. Lo. 2020. “An Empirical Evaluation of Tax-Loss-Harvesting Alpha.” Financial Analysts Journal 76:3, 99–108, and Andrew Kalotay. 2016. “Tax-Efficient Trading of Municipal Bonds.” Financial Analysts Journal 72:1, 48–57. These studies did not involve Parametric or its clients. There is no guarantee that a tax management strategy will result in increased after-tax returns. Results will differ based on an individual investor’s circumstances.

3 Parametric, Boost Bond Potential with Active Management, January 14, 2025.

Parametric and Morgan Stanley do not provide legal, tax, or accounting advice or services. Clients should consult with their own tax or legal advisor prior to entering into any transaction or strategy described herein.

The views expressed in these posts are those of the authors and are current only through the date stated. These views are subject to change at any time based upon market or other conditions, and Parametric and its affiliates disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions for Parametric are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Parametric strategy. The discussion herein is general in nature and is provided for informational purposes only. There is no guarantee as to its accuracy or completeness. Past performance is no guarantee of future results. All investments are subject to the risk of loss. Prospective investors should consult with a tax or legal advisor before making any investment decision. Please refer to the Disclosure page on our website for important information about investments and risks.

04.10.2026 | RO 4391581