In dramatic fashion, the so-called magnificent seven stocks declined in 2022 and then rebounded strongly in 2023. Given that active tax management could lead to underperformance in this environment, how can we manage risk in a market driven by a handful of highly volatile mega-cap stocks?

Tax loss harvesting may be a powerful tool for enhancing after-tax returns, but it can come at a cost if you’re not careful. Active tax management introduces the potential for pre-tax performance differences, which can be magnified in volatile market environments. That’s why Parametric’s approach to risk management considers the volatility of an individual stock when determining its benchmark-relative weight in the portfolio.

What is single-stock risk?

By design, a tax managed account tends to look a bit different than the benchmark it tracks. These differences give the manager the flexibility to potentially improve after-tax returns, largely by harvesting losses and deferring gains. The catch is that the more an account varies from its benchmark, the greater the risk that its performance will deviate from the benchmark on a pre-tax basis.

To limit pre-tax performance differences, we manage risk by limiting how much an account can differ from its benchmark. One risk management practice is to control systematic risk factors such as short-term reversal. However, not all risk is captured by systematic factors such as industry membership or equity style. Single-stock risk can affect benchmark-relative pre-tax performance in ways that can’t be explained by systematic factors.

Here’s an example of how active tax management can introduce single-stock risk into a direct indexing account. A large decline in a single stock makes it a good candidate to sell for loss harvesting, which could make the account underweight that stock relative to the benchmark. If the stock subsequently outperforms the benchmark, then the account’s pre-tax returns would suffer.

Much of the time single-stock underweights and overweights tend to cancel each other out. But in periods when the underweight stock’s outperformance is exceptional, it could create a meaningful drag on pre-tax return.

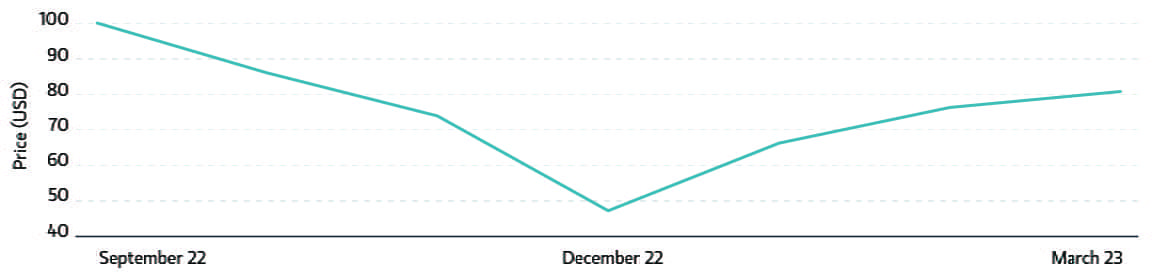

Consider Company XYZ, which experienced a sharp drawdown of more than 50% in Q4 of 2022 and a strong recovery of about 70% in Q1 of 2023. Throughout this period, a typical tax-managed direct indexing account might have loss harvested XYZ during Q4 and then been underweight XYZ when it rebounded in Q1.

Company XYZ price, October 2022 to March 2023

Sources: Parametric, Morningstar Direct, 12/31/2023. For illustrative purposes only. Past performance is not indicative of future results. Not a recommendation to buy or sell any security.

This period was particularly notable, not only because the S&P 500® Index gained about 7.5% in both quarters, but also because a handful of other large index constituents had similar return profiles around the same time. So, any active tax manager would have faced a similar dilemma when trying to manage risk in a market driven by a handful of highly volatile mega-cap stocks.

Manage taxes efficiently all year

How could we manage single-stock risk?

In short, an active tax manager wouldn’t have to treat all securities the same. To manage single-stock risk, an active tax manager could differentiate stocks based on riskiness. With that goal in mind, whenever we consider a stock with a high level of risk, we generally require deeper losses before we loss harvest, and we try to reduce preexisting underweights. When we follow this risk management approach, we expect smaller underweights to higher risk stocks and therefore potentially less risk of missing single-stock reversals.

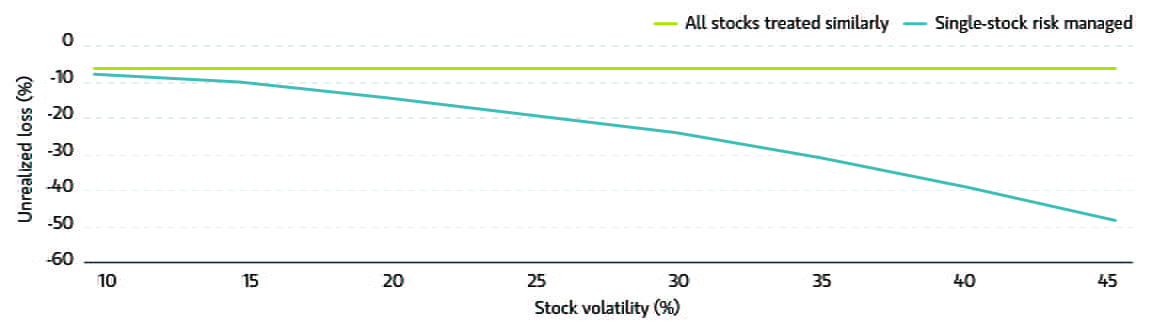

To explore what that looks like in practice, let’s look at an approach where all stocks are treated similarly, regardless of riskiness, versus an approach that considers single-stock risk. The figure below illustrates the potential effect of each approach on loss harvesting results, with the maximum underweight indicating the lower bound of a single stock’s weight relative to its weight in the benchmark.

Reaching the single-stock maximum underweight

Source: Parametric, September 2023. Stock volatility (%) in units of standard deviation. For illustrative purposes only. Does not reflect the experience of any client. All investments are subject to risk, including risk of loss.

Without a single-stock risk managed approach, the depth of loss required for a low-volatility stock and a high-volatility stock to reach its maximum underweight is the same (shown by the horizontal line across the volatility spectrum). If this is company XYZ discussed above, then the realized loss might not be worth the impact on pre-tax performance, given its subsequent outperformance.

With a single-stock risk managed approach, the loss required for a high-volatility stock to reach its maximum underweight is much greater (shown by the downward sloping line). At a volatility of 45%, as shown above, this tax managed approach would require an almost 50% unrealized loss to sell company XYZ down to the maximum underweight—a depth of loss multiple times that required with the approach that treats all stocks the same.

What about the tax losses?

We would argue that the single-stock risk managed approach is better from a risk management perspective, but does reducing the underweights also reduce the tax losses? In our experience it could, unless it’s done thoughtfully. We have fine-tuned our approach through many market environments, so that it aims to deliver the most efficient tradeoff of realized losses per unit of single-stock risk—with the potential to materially reduce single-stock risk in the most volatile stocks, while only marginally impacting losses.

The bottom line

Active tax management might seem like a commodity, with one approach interchangeable with any other. But the devil is in the details. Not all tax losses are created equal in terms of risk, and in some cases the cost might outweigh the benefit. Parametric spends a lot of time thinking about this tradeoff, looking for ways to make sure losses don’t come at the expense of pre-tax returns. If you can’t have one of those without the other, we think it’s better to take the single-stock risk managed approach.

Parametric and Morgan Stanley do not provide legal, tax or accounting advice or services. Clients should consult with their own tax or legal advisor prior to entering into any transaction or strategy.