Customization is an integral part of direct indexing. The technology behind it can make or break the experience for clients and advisors alike. We dive into the features and functions that make the best tools.

Direct indexing needs powerful technology to deliver optimal outcomes. With so many investment tools out there, how do you choose one? Let’s discuss ways to take account management to the next level.

Many people don’t realize how important technology is to Parametric. Technology plays a role in every facet of what we do at Parametric. Technology powers the scale and customization that is core to our business, it enables our researchers to continue to enhance and grow our customized investment solutions and it provides the investment tools and reporting to help clients make informed decisions and understand their portfolios. We believe our combined focus on technology along with over three decades of experience is what sets us apart. This means we also know what to look for when choosing a direct indexing platform.

How do advisors manage direct indexing accounts through a platform?

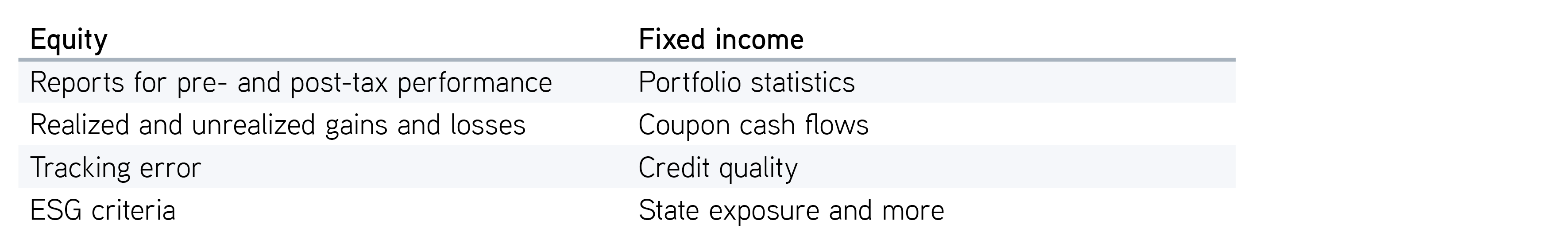

With the right reporting and investment tools at your disposal, you can easily build and evaluate personalized portfolios for each investor’s unique needs. One feature you should look for is client-ready reporting for customized equity or fixed income separately managed accounts (SMAs). Some examples are:

These kinds of reports are built to make advisor-client communication clearer and more efficient. One of the key advantages of direct indexing is customization, which breeds deeper conversations with clients on what they do and don’t want out of their portfolios. Being able to look at an individual account and capture its performance, realized gains and losses, country exposures, sector weights, portfolio characteristics and more will have you quickly prepared for any meeting. Account reports should be easy for your clients to understand, so you can spend less time discussing transactions and more time discussing how their plans are progressing. And when you have questions, knowing you have experts available to help can be crucial to your success. This is one way direct indexing can bring advisors and clients closer together.

What does a full-service direct indexing platform look like?

The best platforms will offer more than routine account management functions. Advisors should have access to advanced tools on top of reporting to help build and evaluate portfolios. Here are a few offerings to look for:

Transition analysis

Clients can be wary of transitions that might trigger a large tax bill, even if they’re disappointed with their current portfolio performance. Use a transition analysis to show potential scenarios with different tax and tracking error outcomes. Each client may have different investment goals and the transition analysis should offer choices and allow the client to choose what is the best fit for them.

Estimated tax benefit and customized exposure

Tax-loss harvesting is a great tool in any advisor’s belt. A simulator can compare potential pre- and after-tax returns when you actively harvest losses and defer gains. It can also show your clients the potential after-tax performance in different market environments as volatility and returns vary. Not sure how a particular client customization will compare to a benchmark? Check if your provider offers ways to compare benchmarks and see if it’s right for the client’s needs.

Environmental, social and governance (ESG)

It can be difficult for clients to visualize how applying screens changes their portfolio and how their portfolios are living up to their chosen responsible investing ideals. Having a way to show clients metrics on how their choices are impacting their portfolio in a straightforward and clear way is important to help them make an informed choice. If your client changes their mind about including an ESG screen in their portfolio, they’ll want to know how the change might impact their exposure. Find tools that help you analyze the impact of those decisions before making them.

Consider the potential benefits of active tax management

The bottom line

Direct indexing does take work for advisors, but a strong platform makes that work easier. Investors and markets are always evolving, and our team keep working to advance our technology with it. With Parametric’s more than thirty years of experience and focus on technology, our tools offer everything we’ve discussed and more. We’ll help you while you make this powerful investing approach work to its full potential. Reach out and explore the ability to make it simpler to see, measure and share insights on personalized investments.

The views expressed in these posts are those of the authors and are current only through the date stated. These views are subject to change at any time based upon market or other conditions, and Parametric and its affiliates disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions for Parametric are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Parametric strategy. The discussion herein is general in nature and is provided for informational purposes only. There is no guarantee as to its accuracy or completeness. Past performance is no guarantee of future results. All investments are subject to the risk of loss. Prospective investors should consult with a tax or legal advisor before making any investment decision. Please refer to the Disclosure page on our website for important information about investments and risks.

03.14.26 | RO 4070122