For taxable investors with sizable gains in their brokerage accounts, the decision when to realize that capital gain is intensely personal—depending of course on individual circumstances, while also factoring in market return expectations and the prevailing tax structure.

Let’s look at the context for capital gain realization in 2025, informed by historical experience and potential future paths of tax policy.

Could 2025 be another year of strong market returns?

After two consecutive years of 20%-plus market returns—the first time that’s happened since the late 1990’s dot-com bubble—many investors face the prospect of capital gains. Even if we look further back to include the 2022 loss of 18.11% in the S&P 500® Index, the annualized five-year average return of 14.53% has been historically robust.

We can point to fundamental reasons why the stock market may be unable to sustain such a torrid pace—and could even take a step back, given the volatility we’ve witnessed so far in the first quarter. Yet many market watchers are still decidedly bullish on 2025. Early this year, analysts at several prominent banks called for the S&P 500® to end the year at 7000. If their predictions turn out to be accurate, the appreciation would represent another 15% gain.

What do historical patterns of capital gain realization tell us?

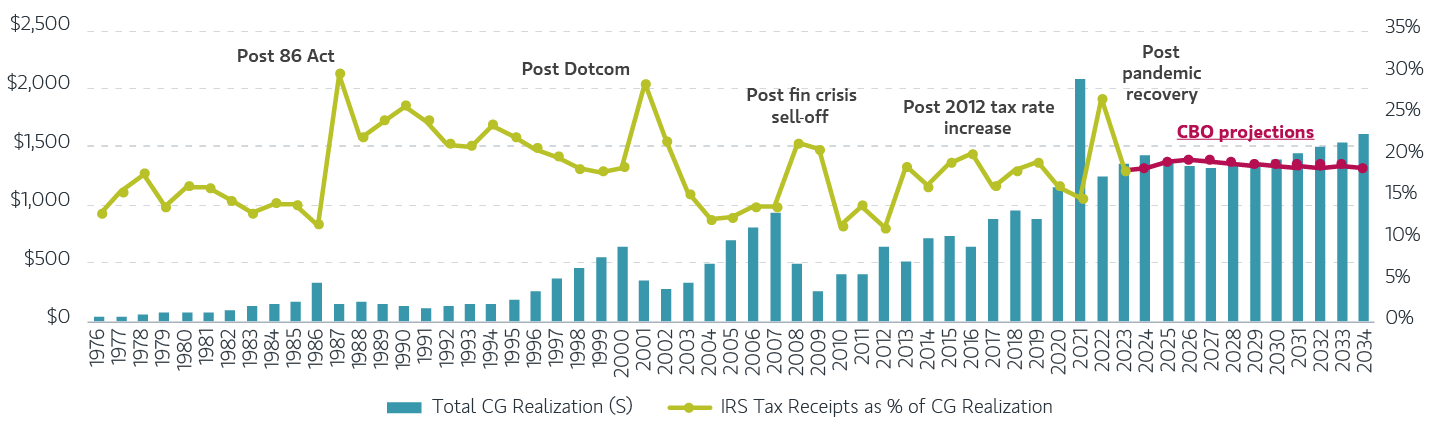

When making choices whether to realize gains, investors might be just as concerned about the taxes they would have to pay on those gains. Considering the historical data may be quite instructive, and for that we turn to the Congressional Budget Office (CBO), which has been assiduously keeping track of such statistics for many decades. The CBO even makes projections of the likely tax collections from various income sources, which serves as an input into budgetary decisions on government spending and therefore tax policy.

Display 1 shows that over the last 50 years or so, the dollar value of capital gain realization has risen along with the stock market’s appreciation, while also experiencing ebbs and flows. A record $2.07 trillion dollars in capital gains was realized in 2021, representing an 80.5% jump from 2020, which was then followed by a 40% reduction in realization in 2022.

Display 1: Capital gain (CG) realization and S&P 500® growth

Source: S&P Dow Jones Indexes LLC, CBO actual data through 2023, CBO estimated data in 2024. For illustrative purposes only. Not a recommendation to buy or sell any security. Past performance is not indicative of future results. It is not possible to invest directly in an index. Indexes are unmanaged and do not reflect the deduction of fees or expenses.

What accounts for this dynamic? The S&P 500’s 28.7% appreciation in 2021 is clearly one factor. But more broadly, from the pandemic bottom in March 2020 through year end 2024, the S&P 500 has gone up by approximately 183%. That drove investors to realize much of their gains. Once realized, fewer gains remained for the following year, and another build up cycle began.

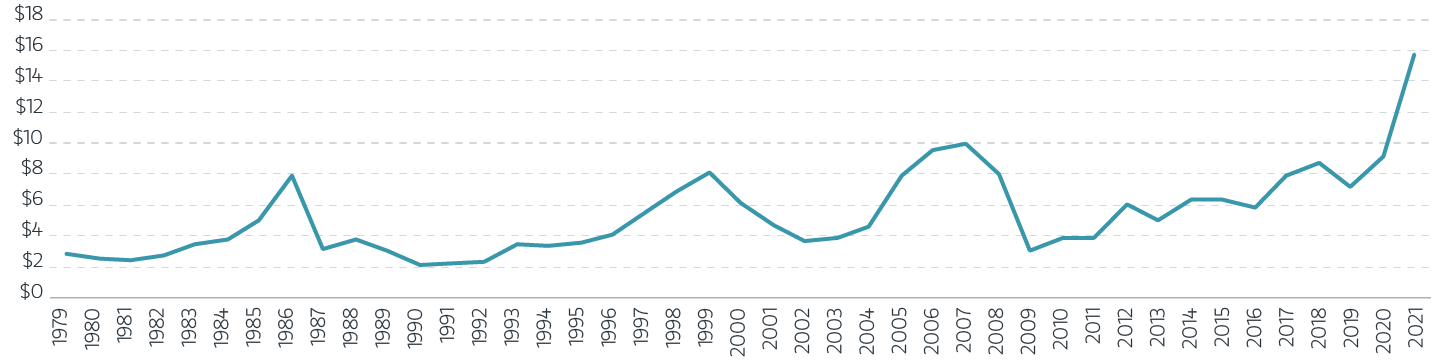

Over the past decade, in the years running up to the 2020–2022 realization pattern, average household income from capital gains has also been on the rise. Display 2 highlights that the average income from realized capital gains reached an all-time high of $15,700 in 2021—about 60% higher than its previous peak in 2007. According to CBO estimates, 32 million households realized capital gains in 2021. Among those households, the average income from capital gains was $64,200. In 2020, by comparison, 28 million households realized capital gains, averaging $40,200 per household.

Display 2: Growth of average household income (in thousands) from realized capital gains

Source: CBO data from 1979 to 2022.

The CBO highlights another explanation for the large capital gain realization in 2021. As the economy continued to recover from the pandemic-induced downturn, all forms of income increased except social insurance benefits, reflecting the decrease in regular unemployment insurance. The largest increases in income came from realized capital gains, rather than business or labor income.

Explore how active tax management may help advisors provide added value to their clients.

How much IRS tax revenue comes from capital gain realization?

Based on the CBO data, we think the evidence is clear that capital gain realization tends to be highly cyclical. That cyclicality is dependent on investor responses to catalyst events, such as changes in tax laws (in 1986 and 2012, for example) or market cycles with significant increases or decreases in asset prices (in 2001, 2007 and 2021). Historical data also points to Internal Revenue Service (IRS) tax receipts from capital gain realization experiencing large jumps in the year following such a catalyst event.

As investors process the implication of a new tax law or anticipate market movements, they tend to react by realizing a capital gain prior to the effects of the change. In fact, the CBO plans and projects budgets based on their assessment of how investors will react to such catalysts. Display 3 details these jumps in tax collection in the years following the capital gain realization, when taxes must be paid. Currently the CBO is projecting an increasing capital gain realization trajectory over the next 10 years and a stable level of tax receipts. Yet reality is often full of surprises, and tax receipts from capital gain realizations have never been that stable.

Display 3: IRS tax receipts from capital gain realization after catalyst events

Source: US Treasury, CBO publication 60039, “An Update to The Budget and Economic Outlook: 2024 to 2034,” June 2024. Capital gains realizations are the sum of net capital gains from tax returns reporting a net gain. Data for realizations after 2021 and data for tax receipts in all years are estimated or projected by CBO. Data on realizations before 2022 are estimated by the US Treasury.

What tax regime will investors face?

Under a different administration in the White House, the structure of the tax regime when investors file their 2025 returns remains unclear. Before the election last November, we viewed tax policy proposals through an investor’s lens. Based on policy discussions so far, the tax rates in the 2017 Tax Cut and Jobs Act (TCJA) could be made permanent. History suggests that many details are still open to negotiation. Some important aspects of the TCJA may change as government officials struggle to balance the tax cuts with the need for tax revenue to pay for other policy initiatives.

Investors and their advisors will have to wait and see while the final law takes shape over the next few months.

The bottom line

After two years of stellar market returns and with signs of changing tax laws, investors may be trying to read the tea leaves on 2025 markets and assessing their options on the path forward for realizing capital gains.

For taxable investors, it’s prudent to plan several years in advance for liquidity or life-changing events—such as the sale of a business or other capital assets. Similarly, it could also help to plan for capital gain realization moments in response to anticipated market cycles or tax law changes. After all, the cyclical nature of realizing capital gains is akin to liquidity events, where a buildup over several years can prompt a large repositioning of assets or strategically taking risk off the table.

At Parametric, we believe that including a tax loss harvesting strategy as part of the mix in the overall portfolio may allow investors to better prepare for these moments. Learn more about Parametric’s approach to tax loss harvesting.

Parametric and Morgan Stanley Investment Management do not provide legal, tax or accounting advice or services. Investors should consult with their own tax or legal advisors prior to entering into any transaction or strategy.

The views expressed in these posts are those of the authors and are current only through the date stated. These views are subject to change at any time based upon market or other conditions, and Morgan Stanley Investment Management and its affiliates disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions are based on many factors, may not be relied upon as an indication of trading intent on behalf of any strategy. The discussion herein is general in nature and is provided for informational purposes only. There is no guarantee as to its accuracy or completeness. All investments are subject to the risk of loss. Please refer to the Disclosure page on our website for important information about investments and risks.

03.26.2026 | RO 4342850