Global Low Beta VRP

Parametric’s Global Low Beta Volatility Risk Premium (VRP) strategy seeks consistent incremental returns by selling fully collateralized equity index options against a conservatively structured base of US Treasuries and global equity.

![]()

![]()

This strategy is suited to investors seeking an alternative to hedge funds; it is designed to deliver more predictable returns, better liquidity, greater transparency, and lower fees.

Investing in an options strategy involves risk. All investments are subject to loss. Learn more.

Explore more VRP solutions

A strategy that

adapts to the market

Global Low Beta VRP employs a rules-based, systematic approach that avoids forecasts and market timing but remains responsive to changing market conditions through the use of dynamic strike prices. Implied volatility drives the determination of strike price, and strike prices move further out of the money in higher-volatility environments. Frequent expirations mitigate risk and allow for the capture of mean reversion in volatility.

Due to economic, behavioral, and structural factors, options buyers are willing to pay a premium to sellers to hedge against the risk of drawdowns and volatility. Global Low Beta VRP capitalizes on this tendency for index options to trade at higher implied volatilities than realized volatility.

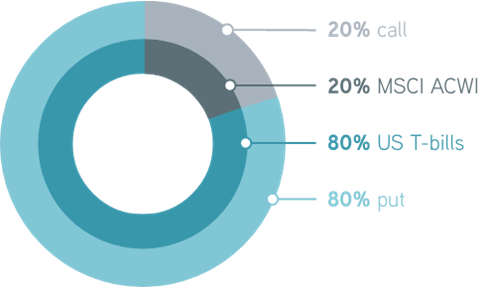

Portfolio construction

Model beta: 0.3

Intended benefits of Global Low Beta VRP

Absolute returns

Learn more >>

Global Low Beta VRP aims to produce total returns above those of US Treasury bills.

Consistency

Learn more >>

Investors gain access to the volatility risk premium, offering the potential for long-term diversification benefits compared to traditional risk premiums.

Systematic

Learn more >>

A stringent rules-based process eliminates behavioral biases and market timing.

Hedge fund alternative

Learn more >>

Global Low Beta VRP is designed to deliver better liquidity, greater transparency, and lower fees than hedge funds.

Want to know more about Parametric Global Low Beta VRP?

Download our strategy overview.

Why choose Parametric?

More to explore

As Tariffs Cloud Outlook, Municipal Bonds May Offer Opportunity

by Jonathan Rocafort, Managing Director, Head of Fixed Income Solutions

April 8, 2025

With growth concerns emerging following tariff announcements, here’s why we see potential opportunity in stepping out of cash, adding some duration and locking in yields near a decade high.

2025 Equity and Volatility Outlook: Is the US Equity Investor at a Crossroad?

by Thomas Lee, Co-President and Chief Investment Officer

January 27, 2025

Now may be the time to start preparing for more challenging markets in the future. Parametric is here to help.

Why a Talented Trading Desk Matters for Fixed Income SMA Investors

by Brian Barney, Managing Director, Institutional Portfolio Management and Trading

July 5, 2023

Across the fixed income asset class, trading efficiency matters more than many investors realize. See how our technology makes it happen.