Defensive Equity

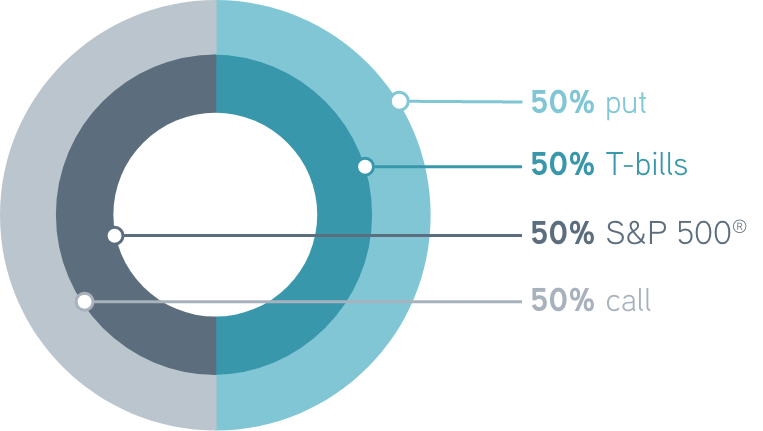

Parametric’s Defensive Equity (DE) strategy seeks to provide equity-like returns with reduced volatility over a full market cycle. Investors access the volatility risk premium (VRP) through collateralized put underwriting and covered call overwriting.

![]()

![]()

For institutions particularly sensitive to volatility, reducing equity market risk in favor of pursuing the VRP smooths out returns over the long term, providing an alternative to hedge-fund strategies at a lower cost and with greater liquidity and transparency.

Investing in an options strategy involves risk. All investments are subject to loss. Learn more.

Explore more VRP solutions

A smoother ride

DE’s model-driven approach is designed to remove emotions and guesswork from the investment decision-making process.

We construct a lower-volatility portfolio by reducing equity market beta and systematically selling fully collateralized equity index options to enhance returns. Compared with a fully invested equity portfolio, DE’s combination of reduced equity exposure and the VRP is expected to realize a lower magnitude in drawdowns and a quicker recovery from stress events.

The strategy is expected to deliver the best relative performance in moderately down and sideways markets while trailing in strong rallies. DE is best suited to investors with a heightened sensitivity to equity risk seeking an alternative source of yield.

Portfolio construction

Model beta: 0.5

Intended benefits of Defensive Equity

Systematic process

Learn more >>

DE offers a disciplined and rules-based investment process designed to deliver more predictable, repeatable results without the use of market forecasts or behavioral biases.

Faster recovery

Learn more >>

The defensively structured base portfolio is designed to reduce drawdowns during stress events. Consistent exposure to the VRP aims to deliver faster recovery to prior peak valuation compared with a long-only equity portfolio.

Portfolio diversification

Learn more >>

DE gives investors an alternative return source while potentially delivering favorable risk-adjusted returns without sacrificing liquidity. It may be used as a complement or replacement for hedge funds or low-volatility equity allocations.

How it works

Strategy overview

Want to know more about Parametric Defensive Equity?

Download our strategy overview.

Why choose Parametric?

More to explore

Midyear Commodity Outlook: Better for Commodities than Consumers

by Greg Liebl, Director, Investment Strategy; Adam Swinney, Investment Strategist

July 7, 2025

Rising tariffs may lead to higher inflation and slower economic growth—an environment that has historically favored commodities.

Municipal Bond Premiums: Separating Fact from Fiction

by Jonathan Rocafort, Managing Director, Head of Fixed Income Solutions; Evan Rourke, Director, Portfolio Management

June 24, 2025

This paper helps dispel common misconceptions about premium municipal bonds that can lead to poor decision-making. Once investors learn the difference between fact and fiction regarding municipal bond premium prices, they can make decisions that lead to better investment outcomes.