Investors in US equities don’t want to give back the hard-earned gains they realized over the last two years, so what are their options? Let’s dig into that question.

Investors may be at a crossroad in early 2025. US equities have recovered from the 2022 bear market with two exceptional years of +25% returns. Yet a handful of growth-oriented firms drove most of the market gains, while the average stock experienced a much more modest outcome. This has left investors pondering alternative views of the future.

Will the good times continue under a new administration? If so, market gains may remain narrow, concentrated in just a handful of names.

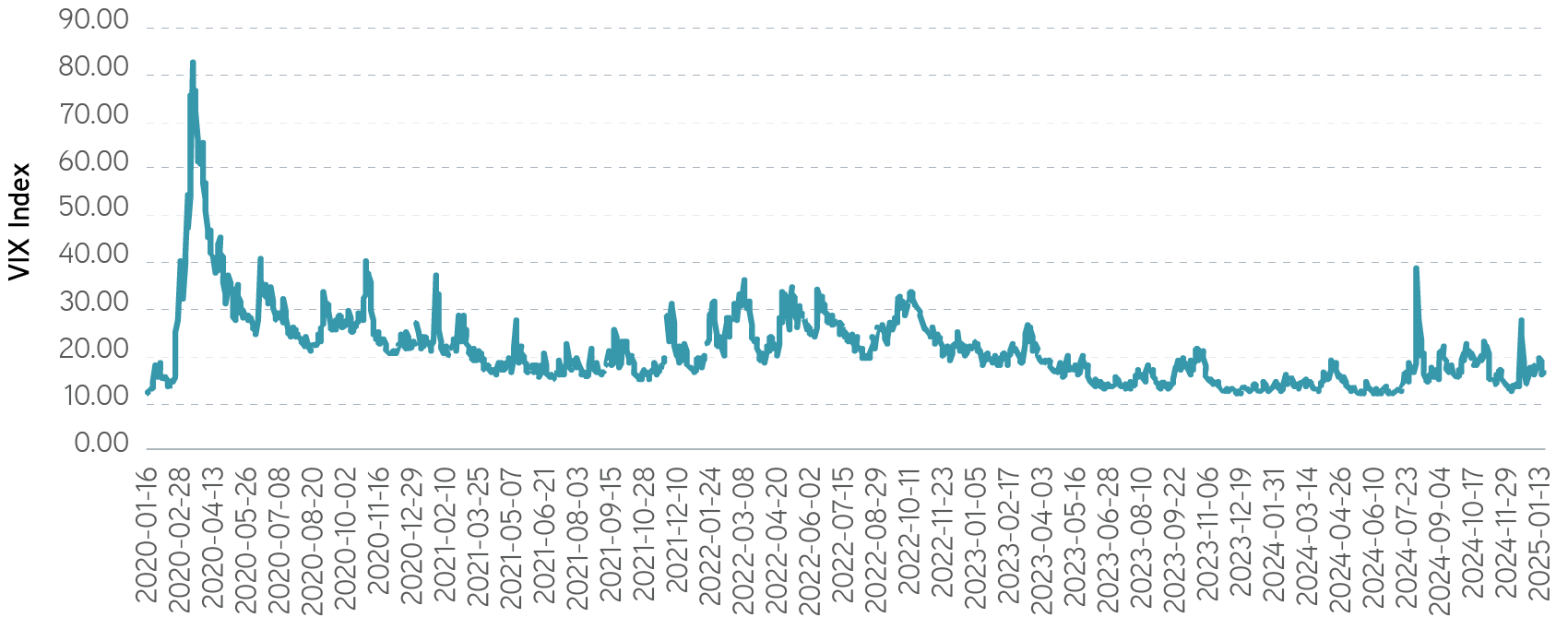

If not, an alternative view is grounded in heightened macroeconomic risk, fiscal policy uncertainty, higher long-term interest rates and bigger earnings disappointments relative to lofty expectations—an environment that would be more challenging for equities, leading to muted performance and increased market volatility. For a brief snapshot of that view, consider the December swoon in equities, coupled with the steepening yield curve and the associated rise in the VIX.1

US equity’s day in the sun…. will it last?

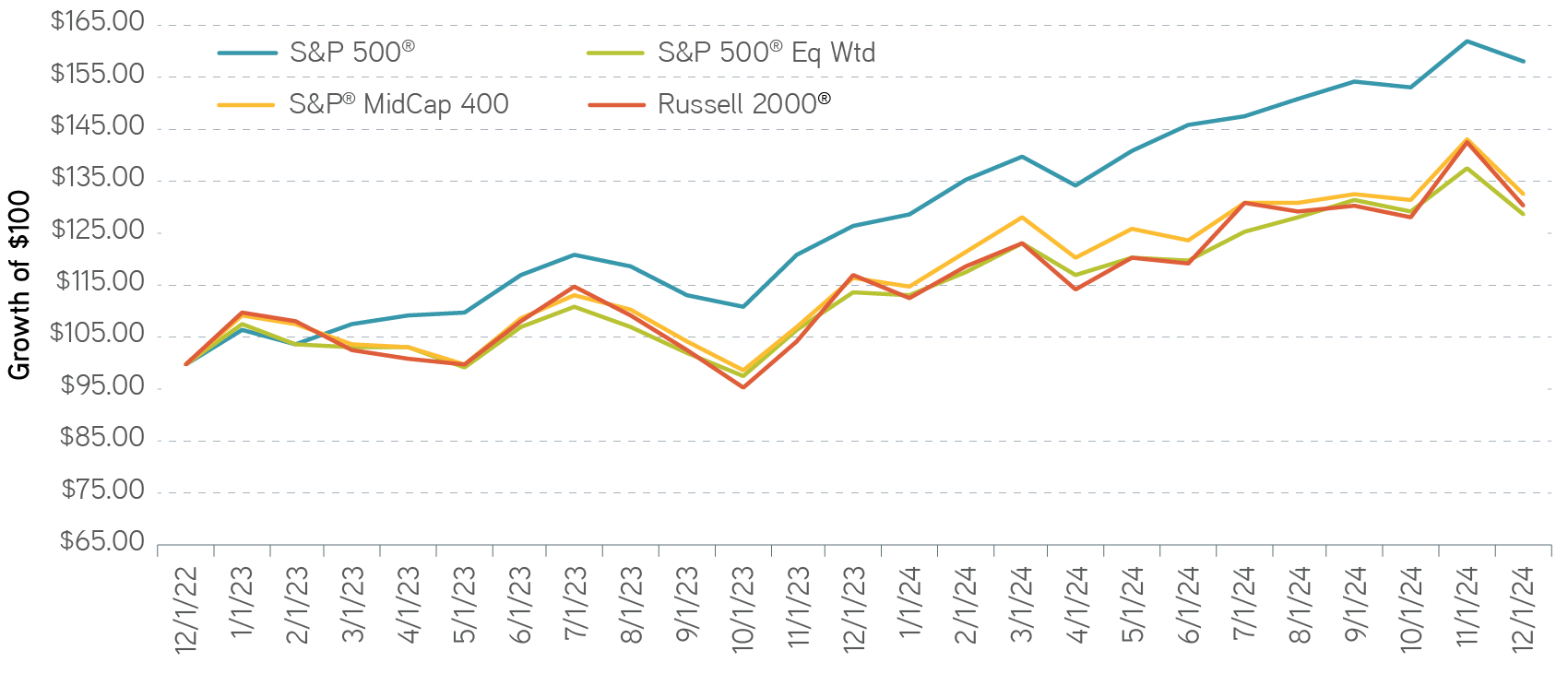

The recent two-year run in US equities has been stunning. Excitement about AI, increased productivity and US exceptionalism have contributed to the positive momentum behind the market. The rally has been narrow, however, driven by only a select few mega cap names. Looking at 2024 returns data, the capitalization weighted S&P 500® Index was up 25%, but the Mag 7 companies—Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla—generated fully 53.7% of that return, while accounting for an average 30.7% of the index capitalization during the year.

The performance of the Mag 7 masked the broader relative weakness of most US stocks. Over the last two years, US stocks as measured by the equal weight S&P 500, S&P Midcap 400® or Russell 2000 produced returns roughly half that of the S&P 500®—in other words, good but not exceptional.

Cap weighted large stocks have dominated equal weighted, mid cap and small cap stocks

Source: LSEG Data & Analytics (formerly Refinitiv), S&P and Russell index data as of January 14, 2025. For illustrative purposes only. Past performance is not an indicator of future results. It is not possible to invest directly in an index. Indexes are unmanaged and do not reflect the deduction of fees or expenses.

Will this momentum in large cap US growth stocks continue? No one can answer that question with any degree of certainty. We only need to look back at the tech-driven bull market of the 1990s to see the hazards of trying to call a reversion for equities. In testimony before Congress after the S&P 500 gained 72.6% from January 1995 through November 1996, then-Federal Reserve Chair Alan Greenspan questioned if the equity market was exhibiting an “irrational exuberance.” Following Greenspan’s comments, the S&P 500 rallied another 107.6% over the next three years.

Fed officials have avoided speculating about the valuation or reversal of a trend in the equity market ever since. At Parametric, we won’t speculate either, although we can offer some insights into what market characteristics we may see in the future.

Few firms created long-term wealth

The lack of breadth in the market has created ongoing frustration and concern among investors, who wonder if the Mag 7 or a similar narrow cohort will continue to dominate the equity market. While we think the supremacy of the Mag 7 is unlikely to persist—after all, trees don’t grow to the sky—any future advance in the broader market may be limited to a relatively small group of names.

For those who may be skeptical of this prediction, I recommend the 2023 Financial Analysts Journal article, “Long-Term Shareholder Returns: Evidence from 64,000 Global Stocks,” by Bessembinder et el. The authors found that over the 30 years from 1990 to 2020, 100% of the wealth created in the global equity market—approximately $75 trillion—was generated by 2.4% of firms. The average stock in the US and international markets underperformed one-month Treasury bills.

More volatility expected

Except for a few brief spikes, equity market expected volatility as measured by the VIX Index has remained relatively low over the course of the last two years, reflecting the trend in realized volatility.

Recent equity market volatility has been muted

Source: St. Louis Fed FRED database, Chicago Board Options Exchange (CBOE) Volatility Index, or VIX, as of January 16, 2025. For illustrative purposes only. Past performance is not an indicator of future results. It is not possible to invest directly in an index. Indexes are unmanaged and do not reflect the deduction of fees or expenses.

Rules-based strategies for customized investing solutions to fit any portfolio

We could see both actual and expected volatility increase in 2025 for several reasons:

US political concentration, now that one party controls all three elected branches of government, suggests they can potentially use this power to effect changes in tax policy, border policy, immigration policy, trade policy, energy policy and more. These changes are likely to create uncertainty in Washington and financial markets for at least the first 100 days of the new administration. That uncertainty could be expressed as volatility in the markets.

Interest rate uncertainty, particularly in the back end of the yield curve, would be another contributor to increased market volatility. In recent weeks as the Fed has remained on hold, the yield curve has begun to steepen, with long-term rates drifting higher on concerns of financing increased deficits. The 10-year US Treasury yield has been firmly positioned in the 4.5% to 5% range for the last several months.

At this higher level of rates, stocks appear more sensitive to changes in long-term yields. Good news on inflation, as with the recent CPI data, causes yields to decline and equities to rally. Bad inflation news, by contrast, causes yields to rise and puts pressure on equities. The negative correlation between bond yields and equity markets at these rate levels contributes to the volatility of the overall equity market.

Increasing geopolitical risk is the third vector supporting heightened equity volatility. In a recent report by the World Economic Forum, many survey respondents expressed growing concern about the potential for state-based armed conflict (23%) and extreme weather events (14%) to occur this year.2 Evolution of a bipolar world order and accelerating climate change will make both outcomes more likely. Either event happening on a large scale would again be additive to equity market volatility.

What is an investor to do?

In Parametric’s view, investors need to think of volatility as a friend, not a foe. If we can assume portfolios are diversified, then all investors would have the ability to rebalance asset class exposures when market volatility causes them to drift too far from their targets. Rebalancing helps to prevent portfolios from becoming too concentrated, keeps the overall risk aligned with the target and allows investors to benefit from the natural reversion of asset class returns by selling high and buying low.

For investors who simply cannot afford to see the value of their equity portfolio decline 15% or more, we believe a thoughtfully constructed tail risk hedge may be the best solution. Such a hedge is intended to have a modest running cost—typically less than 1% of notional annually—and seeks to generate gains once equities fall 10% to 15%, with the gains accelerating if losses increase beyond 15%. The potential benefit of a tail risk hedge is that it may provide liquidity in times of stress, preventing the investor from becoming a forced seller.

And for US taxable investors, equity market volatility offers opportunities to capture realized losses in real time. These losses can be used to offset gains in the current period or rolled forward indefinitely at the Federal level to offset future gains.

The bottom line

Investors who held large cap US growth stocks or indexes like the S&P 500® have enjoyed two good years of returns. Now may be the time to start preparing for more challenging markets in the future. Parametric is here to help with several steps that investors can take now to be ready for what may be more volatile times ahead.

1 Chicago Board Options Exchange (CBOE) Volatility Index, or VIX, measures the stock market's expectation of volatility based on S&P 500® Index options.

2World Economic Forum, “Global Risks 2025: A world of growing divisions,” published January 15, 2025.

Parametric and Morgan Stanley do not provide legal, tax, or accounting advice or services. Clients should consult with their own tax or legal advisor prior to entering into any transaction or strategy described herein.

The views expressed in these posts are those of the authors and are current only through the date stated. These views are subject to change at any time based upon market or other conditions, and Parametric and its affiliates disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions for Parametric are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Parametric strategy. The discussion herein is general in nature and is provided for informational purposes only. There is no guarantee as to its accuracy or completeness. Past performance is no guarantee of future results. All investments are subject to the risk of loss. Prospective investors should consult with a tax or legal advisor before making any investment decision. Please refer to the Disclosure page on our website for important information about investments and risks.

01.27.2026 | RO 4184991