Dynamic Put Selling

For institutional investors

Parametric’s Dynamic Put Selling program aims to capture the volatility risk premium (VRP) by selling fully collateralized put options on the S&P 500® Index.

![]()

![]()

Dynamic Put Selling may make sense for investors who seek to increase returns on underlying fixed income portfolios or cash. The strategy seeks to earn the VRP by selling put options on the S&P 500® Index.

Investing in an options strategy involves risk. All investments are subject to loss. Learn more.

Explore more VRP solutions

A strategy that

adapts to the market

DPS employs a rules-based, systematic approach that avoids forecasts and market timing but remains responsive to changing market conditions through the use of dynamic strike prices. Strike prices are determined by targeting a likelihood of worthless expiration. Implied volatility drives the determination of strike price, and strike prices move further out of the money in higher-volatility environments. Frequent expirations mitigate risk and allow for the capture of mean reversion in volatility.

Due to economic, behavioral, and structural factors, options buyers are willing to pay a premium to sellers to hedge against the risk of drawdowns and volatility. DPS capitalizes on this tendency for index put options to trade at higher implied volatilities than realized volatility.

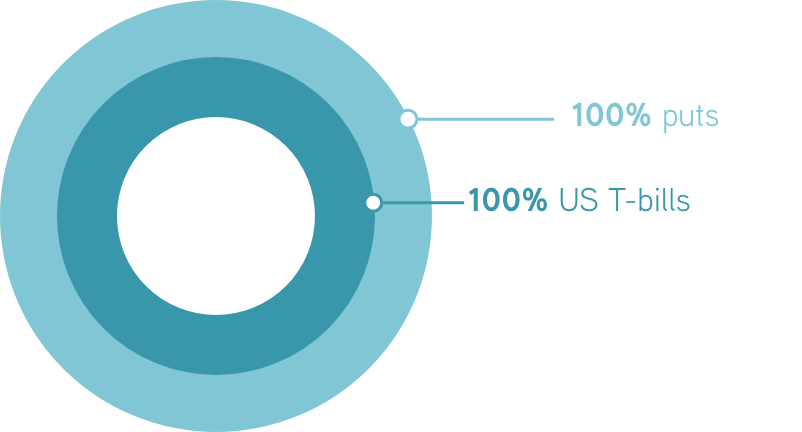

Potential portfolio allocation

Model beta: 0.1

Intended benefits of Dynamic Put Selling

Enhanced return

Learn more >>

The strategy seeks to generate consistent positive returns by selling fully collateralized equity index put options against underlying collateral.

Diversifying risk premium

Learn more >>

The strategy seeks to enhance returns of the underlying bond portfolio or cash without taking additional duration or credit risk.

Diversified exposures

Learn more >>

The strategy executes multiple option tranches with short expiration dates, improving diversification and reducing path dependency.

How Dynamic Put Selling works

Why choose Parametric?

More to explore

Midyear Outlook: Exceptional Uncertainty, Unexpected Market Resiliency

by Thomas Lee, Co-President and Chief Investment Officer

July 17, 2025

Welcome to the 2025 Midyear Outlooks from Parametric. Where does the time go?

Midyear Liability-Driven Investing Outlook: What’s Next for Corporate Pensions?

by David Phillips, Director, Liability-Driven Investment Strategies

July 14, 2025

From funding ratios and plan allocations to buyouts and surplus assets, here’s our midyear review of LDI trends.