Global Defensive Equity

Parametric’s Global Defensive Equity (GDE) seeks to provide equity-like returns with reduced volatility over a full market cycle. Investors access exposure to the volatility risk premium (VRP) through collateralized put underwriting and covered call overwriting.

![]()

![]()

For institutions particularly sensitive to volatility, reducing equity market risk in favor of pursuing the VRP smooths out returns over the long term, providing an alternative to hedge-fund strategies at a lower cost and with greater liquidity and transparency.

Investing in an options strategy involves risk. All investments are subject to loss. Learn more.

Explore more VRP solutions

A smoother ride

GDE’s model-driven approach is designed to remove emotions and guesswork from the investment decision-making process.

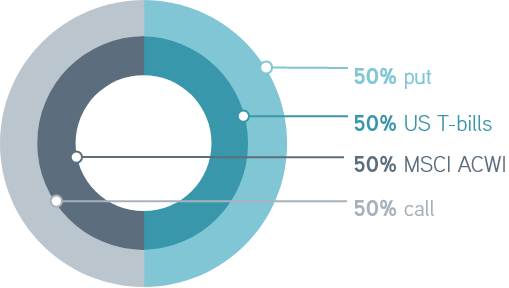

We construct a lower-volatility portfolio by reducing equity market beta and systematically selling fully collateralized equity index options to enhance returns. Compared with a fully invested equity portfolio, GDE’s combination of reduced equity exposure and the VRP is expected to realize a lower magnitude in drawdowns and a quicker recovery from stress events. The strategy is expected to deliver the best relative performance in moderately down and sideways markets while trailing in strong rallies. GDE is best suited for investors with a heightened sensitivity to equity risk seeking an alternative source of yield.

Portfolio construction

Model beta: 0.5

How Global Defensive Equity works

Intended benefits of Global Defensive Equity

Systematic process

Learn more >>

GDE offers a disciplined and rulesbased investment process designed to deliver more predictable, repeatable results without the use of market forecasts or behavioral biases.

Faster recovery

Learn more >>

The defensively structured base portfolio is designed to reduce drawdowns during stress events. Consistent exposure to the VRP aims to deliver faster recovery to prior peak valuation compared with a long-only equity portfolio.

Portfolio diversification

Learn more >>

GDE gives investors an alternative return source while potentially delivering favorable risk-adjusted returns without sacrificing liquidity. It may be used as a complement or replacement for hedge funds or low-volatility equity allocations.

Why choose Parametric?

Want to know more about Parametric Global Defensive Equity? Download our strategy overview.

DOWNLOAD »

More to explore

As Tariffs Cloud Outlook, Municipal Bonds May Offer Opportunity

by Jonathan Rocafort, Managing Director, Head of Fixed Income Solutions

April 8, 2025

With growth concerns emerging following tariff announcements, here’s why we see potential opportunity in stepping out of cash, adding some duration and locking in yields near a decade high.

2025 Equity and Volatility Outlook: Is the US Equity Investor at a Crossroad?

by Thomas Lee, Co-President and Chief Investment Officer

January 27, 2025

Now may be the time to start preparing for more challenging markets in the future. Parametric is here to help.