Presidential election cycles are invariably driven by emotions, often accompanied by unpredictable and even shocking events. The 2024 version is turning out to be a particularly illustrious example of this dynamic. Assessing each party’s policies, on the other hand, requires a reasoned analysis of details, which can run counter to our emotional judgements.

With the 2024 campaign now firmly at the forefront of US consciousness, we must try to set our emotions aside and soberly assess the implications of tax policy proposals from both sides of the aisle.

"There is only one redeeming thing about this whole election, it will be over at sundown."

— Will Rogers, November 7, 1932

More uncertainty about candidates than tax policies

Although the events of recent weeks have cast significant uncertainty over the leadership of the Democratic party, the tax policy proposals are unlikely to materially change—regardless of who is at the top of the ticket. And with the Republican National Convention now concluded, the GOP’s intended tax initiatives appear more certain.

Whatever the election outcome, we view the tax policy challenges for the next administration as multidimensional:

- With provisions of the 2017 Tax Cuts and Jobs Act (TCJA) set to expire, many Americans may be facing significant tax increases.

- At the same time, persistent fiscal budget deficits and the ever-ballooning national debt are issues that must be addressed.

- Additionally, crafting a tax code that offers stability and promotes economic growth is vital for US businesses and individual taxpayers alike.

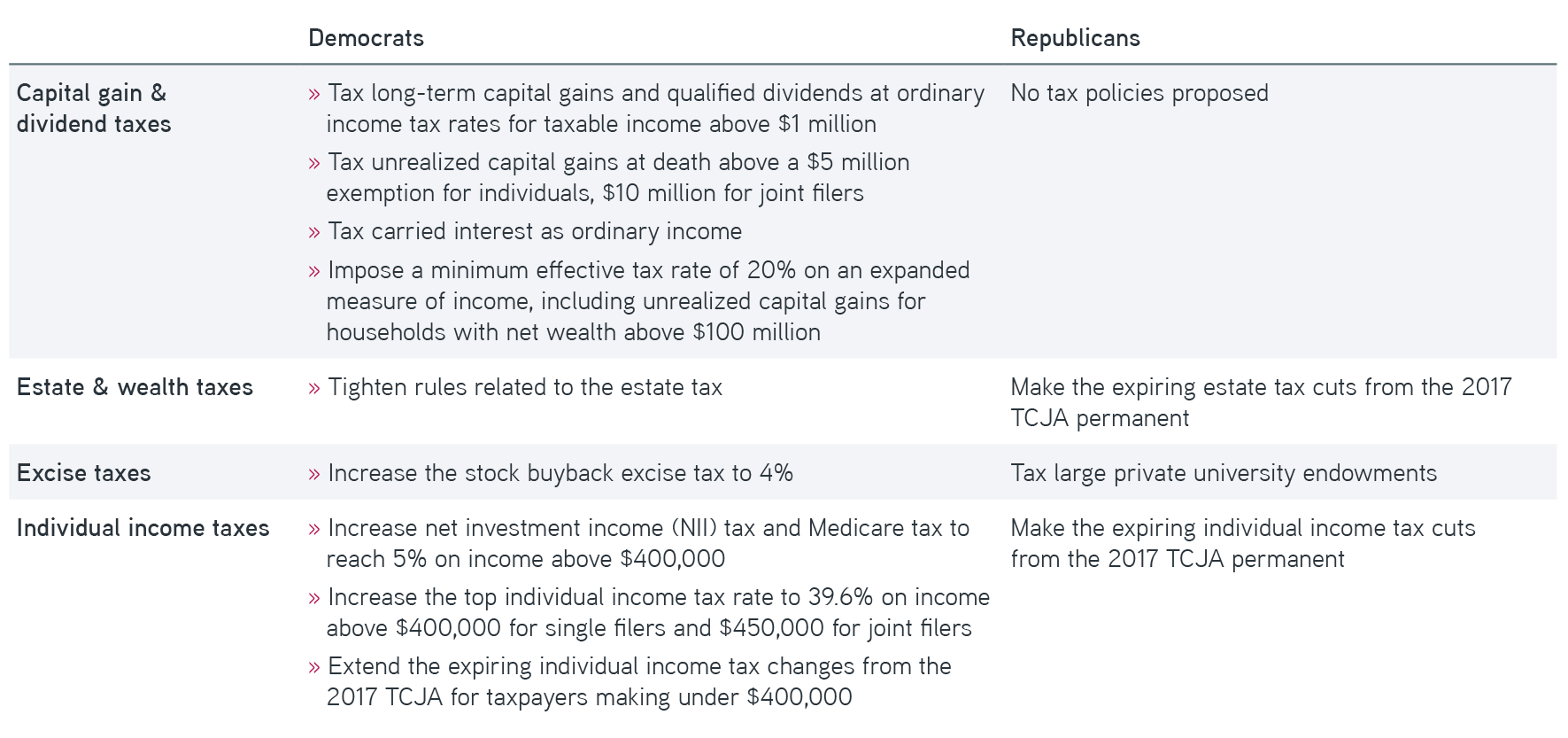

With that in mind, here’s a brief summary of each party’s tax proposals that could be important to investors:

Consider the benefits of active tax management

Viewing tax policy proposals through an investor’s lens

Tax proposals from the Democrats are far more detailed than can be cited here. By contrast, what jumps out immediately is that Republican proposals don’t go much beyond making the 2017 TCJA provisions permanent. This might avoid the tax increase for most Americans. However, ignoring all other issues is fundamentally unserious.

Things could change, given former President Trump’s unpredictable negotiation tactics. For example, Republicans may draw upon the Heritage Foundation’s Project 2025 proposals to dramatically alter the current tax structures.

Democrats also propose extending the 2017 TCJA brackets, but only for those earning less than $400,000. In addition, they introduce a variety of tax increases aimed at raising revenue—specifically from the wealthiest taxpayers. We suspect these proposals could be expressions of political philosophy, intended to reduce perceptions of income inequality. It’s not clear whether any revenue raised would go to deficit reduction or to further social spending.

Such proposals may also be economically deflationary. Whatever one might think of tax code fairness, the impact on consumer spending could be significant. Consider, for example, the two proposals to increase the top income tax rate from 37% to 39.6% and the Medicare tax from 3.8% to 5% on income above $400,000. Taken together, that would result in a 3.8% reduction in take-home pay right off the top. Similarly, increasing the NII to 5% would represent another 1.2% decrease in spending power. In essence, these proposals could limit the pro-growth impact of extending the 2017 TCJA.

As for taxing unrealized capital gains, we anticipate multiple problems that would be murky in nature. Market valuations of capital assets—whether securities, hard assets or collectibles—are notoriously unstable, often resulting from speculation and perceptions that are removed from reality. The prospect of having to pay tax on an unrealized gain—especially for an asset at the top of a bubble—might force investors out of the capital markets. That could lead to illiquidity and potentially disincentivize long-term investment.

The bottom line

With just over 100 days to go before the election, who could be the next president and how future tax policy would be shaped are still largely uncertain. We believe US voters deserve an open and honest discussion of the nation’s financial condition, not a hodgepodge of wishful thinking emanating from both sides. A responsible tax structure that provides for the necessary functions of government and promotes long-term investment is essential for sustaining a competitive edge in the global marketplace. Regrettably, the 2024 election cycle has so far offered no such thing.

Parametric and Morgan Stanley Investment Management do not provide legal, tax or accounting advice or services. Investors should consult with their own tax or legal advisors prior to entering into any transaction or strategy.

The views expressed in these posts are those of the authors and are current only through the date stated. These views are subject to change at any time based upon market or other conditions, and Morgan Stanley Investment Management and its affiliates disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions are based on many factors, may not be relied upon as an indication of trading intent on behalf of any strategy. The discussion herein is general in nature and is provided for informational purposes only. There is no guarantee as to its accuracy or completeness. All investments are subject to the risk of loss. Please refer to the Disclosure page on our website for important information about investments and risks.