As the year winds down, many investors focus on year-end charitable giving and tax planning. Finding a charity and donating money is the easy part. Taking slightly different approaches to gifting can yield dramatically different results from a tax perspective.

At Parametric, we think it’s worth the effort to evaluate ways to maximize donations while reducing the burden of taxes.

How much charitable giving is tax deductible?

Charitable donations are deductible only for those taxpayers who itemize deductions. The IRS limits deductions to 60% of adjusted gross income (AGI) for cash donations and 30% of AGI for stock.

Which method of charitable giving is best?

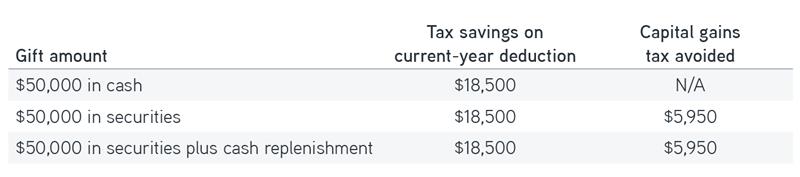

Let’s look at the comparable after-tax benefits of three methods:

Gifting cash

Cash is a convenient gift—donors simply write checks for charities to deposit—that’s also tax deductible in the current tax year. For example, let’s consider a charitable gift of $50,000 in cash, which would reduce the taxpayer’s AGI by $50,000. If the donor is taxed at highest marginal rate of 37%, the gift would result in a tax bill that’s $18,500 lower ($50,000 x 37% = $18,500).

Gifting securities

The S&P 500® Index total return (with dividends reinvested) is 20.97% for the year through October 31, with an annualized total return of 13.00% over the past 10 years. Many investors are likely to see appreciation in their portfolios.

That’s a clear positive until investors are ready to sell some of their stock holdings. Given a federal long-term capital gains tax rate of 23.8%, which factors in the 3.8% Medicare surtax applying to high earners, selling highly appreciated positions may have a negative tax impact.

Donating the stock to charity—instead of selling to raise cash—is one way to completely avoid the tax liability. This enables investors to make their desired donation, deduct its value from their AGI and sidestep the capital gains tax applied to stock sales. Note that the IRS allows investors to take deductions from donated securities only if the securities were held for at least one year and the dollar amount gifted is less than 30% of the investor’s AGI.

To analyze the tax benefits of gifting securities, let’s consider the same $50,000, given not in cash but as securities that have appreciated by 100% from their initial cost or basis of $25,000. The embedded gain of $25,000 would represent a tax liability of $5,950 at the highest capital gains tax rate of 23.8%.

By gifting highly appreciated securities to charity, rather than cash, the investor avoids the capital gains tax liability embedded in the investment, while also getting a tax deduction of $50,000 to reduce their AGI. And the charity is free to sell the security tax free, making the gift as good as cash.

Gifting securities with cash replenishments

Investors with a tax-managed direct indexing portfolio could be able to realize additional benefits if they replenish their investment portfolio with cash equal to the value of the gifted stocks. This manner of reinvesting would result in a cost-basis increase that may enhance the potential for tax-loss harvesting, which could help reduce future tax payments.

Let’s examine a direct indexing portfolio of $1 million, with $50,000 in securities to gift after appreciating 100%. In this case, the investor replenishes the portfolio with $50,000 cash. Given the size of the portfolio and the gift, the cash contribution could potentially raise the expected tax alpha—the net after-tax excess return minus the gross pretax excess return. This measure indicates how much better the portfolio may perform on an after-tax basis relative to the benchmark.

The portfolio manager may be able to reduce tracking error risk by targeting overweight stocks for gifting and reinvesting the cash in other stocks at closer to benchmark weights. Cash replenishment after gifting securities in a tax-managed direct indexing portfolio can thus obtain all the benefits of gifting highly appreciated securities instead of cash, while also lowering the portfolio’s overall tracking error relative to the investor’s benchmark.

Charitable gifting methods by the numbers

Source: Parametric, 10/31/2024. For illustrative purposes only. Does not reflect the experience of any investor and should not be relied on for investment decisions. Parametric and Morgan Stanley do not provide legal, tax, or accounting advice or services. Clients should consult with their own tax or legal advisor prior to entering into any transaction.

Consider the benefits of active tax management

When considering which gifting method might best suit their needs, many investors ask how donations might affect their tax burden. For some, bunching donations may make sense to maximize both gifting and tax benefits. In donation bunching, an investor designates what could be multiple years of planned donations to take advantage of the tax deductions.

Investors often use donor-advised funds as vehicles for these donations. With a donor-advised fund, the investor receives an income tax deduction (up to 30% of AGI) for the fair market value of the securities at the time of the donation. Unlike donating securities directly, the investor maintains control of the assets until contributed to a public charity through a grant recommendation.

The bottom line

Charitable giving can have a large impact on the philanthropic landscape and should be an important part of a wealth management strategy. Determining the amount and the specific financial instruments can be challenging for many investors. Selecting a path that helps to maximize potential gifting and provide the highest tax benefit, while still aligning the portfolio with the investor’s selected benchmark, can be difficult. But choosing the right asset manager—with the expertise, tools and reporting capabilities to help make the important decisions for your clients’ portfolio needs—can make all the difference.

Parametric and Morgan Stanley do not provide legal, tax, or accounting advice or services. Clients should consult with their own tax or legal advisor prior to entering into any transaction or strategy described herein.

The views expressed in these posts are those of the authors and are current only through the date stated. These views are subject to change at any time based upon market or other conditions, and Parametric and its affiliates disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions for Parametric are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Parametric strategy. The discussion herein is general in nature and is provided for informational purposes only. There is no guarantee as to its accuracy or completeness. Past performance is no guarantee of future results. All investments are subject to the risk of loss. Prospective investors should consult with a tax or legal advisor before making any investment decision. Please refer to the Disclosure page on our website for important information about investments and risks.

11.11.2025 | RO 4000031