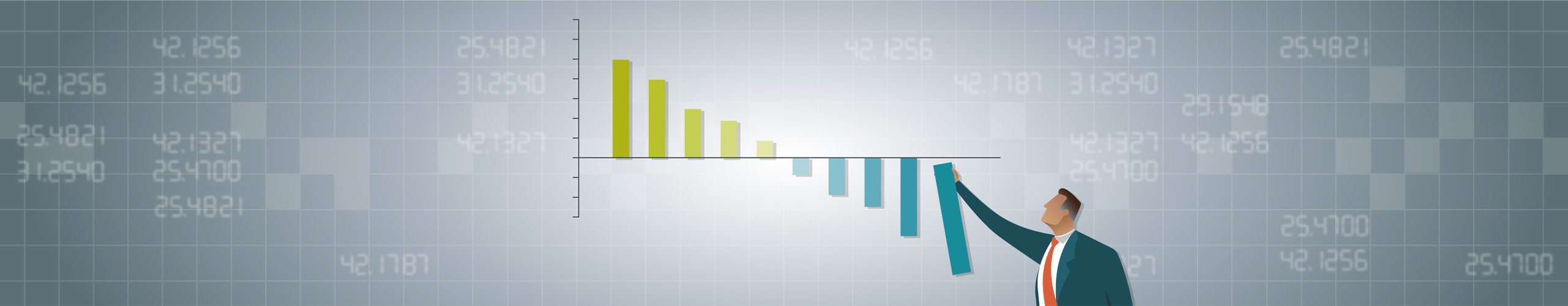

After another year of 20%-plus returns in the broad equity market, let’s look at our analysis of potential tax benefit1 to see how Parametric has used periods of volatility to harvest losses.

US equity markets rallied just enough to round out 2024 with all four quarters posting positive returns. The S&P 500® Index finished the fourth quarter up 2.41%, bringing the year’s total return to 25.02%. That makes two years in a row with returns over 20%, which we haven’t seen since the dot-com days of the late 1990s.

Reviewing the ups and downs of the fourth quarter

In November, investors were optimistic after the US elections raised the prospects of deregulation and corporate tax cuts. The party ended abruptly on December 18, however, when the Fed reduced its forecasts for more interest rate cuts in 2025 amid concerns about inflationary pressures from proposed tariffs and an uncertain policy outlook. As the dust settled, seven of 11 sectors lost ground for the quarter, with strong returns in Consumer Discretionary and Information Technology driving the positive returns in the index.

The silver lining of this volatility was an uptick in tax loss harvesting opportunities during the quarter, especially after the Fed’s guidance in December drove down the markets to end the year. For the quarter, 297 stocks in the S&P 500® finished in the red.

As a result, we harvested over $1.4 billion in losses across 171,000 trades during the fourth quarter, delivering a potential tax benefit of almost $520 million2 to Custom Core investors.

Even with better prospects for loss harvesting in the quarter, opportunities may have been limited for many accounts with higher levels of appreciation. Over the last five years, the annualized return of the S&P 500® is over 14.5%—a great environment for appreciation but potentially challenging for loss harvesting.

Consider the benefits of active tax management

The bottom line

At Parametric, we believe it’s crucial to monitor direct indexing accounts on a regular basis for loss harvesting opportunities. That helps us take advantage of those brief periods of volatility when losses present themselves—all while constantly balancing the potential benefits of loss harvesting opportunities with the risk of the portfolio.

1 The potential tax benefit is calculated by applying the maximum federal rates for short-term and long-term capital gains, which are currently 40.8% and 23.8%, respectively.

2 Source: Parametric, 12/31/2024. The information is provided for illustrative purposes only. Values are aggregated across all equity direct indexing strategies. Only client positions with unverified cost basis were excluded from calculations. Loss calculation is based on the amortized book price minus the sell price, represents historical information and should not be construed as future results. Loss information illustrates the effect to a portfolio and is not representative of, and should not be construed as, performance. There is no assurance that tax loss harvesting will continue in the future. There is no guarantee that any specific account may engage in tax loss harvesting.

Parametric and Morgan Stanley do not provide legal, tax, or accounting advice or services. Clients should consult with their own tax or legal advisor prior to entering into any transaction or strategy described herein.

The views expressed in these posts are those of the authors and are current only through the date stated. These views are subject to change at any time based upon market or other conditions, and Parametric and its affiliates disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions for Parametric are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Parametric strategy. The discussion herein is general in nature and is provided for informational purposes only. There is no guarantee as to its accuracy or completeness. Past performance is no guarantee of future results. All investments are subject to the risk of loss. Prospective investors should consult with a tax or legal advisor before making any investment decision. Please refer to the Disclosure page on our website for important information about investments and risks.

01.22.2026 | RO 4177683