During 2024, equity implied financing has remained at levels well above the historical average—presenting an opportunity for investors to potentially enhance returns on cash. Through an equity cash and carry trade, investors may be able to capture a meaningful improvement in yield relative to US Treasurys.

Understanding the cash and carry trade

A cash and carry trade is a type of arbitrage that captures the mispricing between the cash or spot price and the forward price of a security. When the forward price is trading rich—that is, above its theoretical fair value—investors can sell the forward instrument, while simultaneously hedging market risk by purchasing the underlying security in the cash market. In other words, effectively selling high and buying low. What remains is positive carry via a cash-like position that can earn a yield far exceeding the yields on T-Bills with a similar maturity.

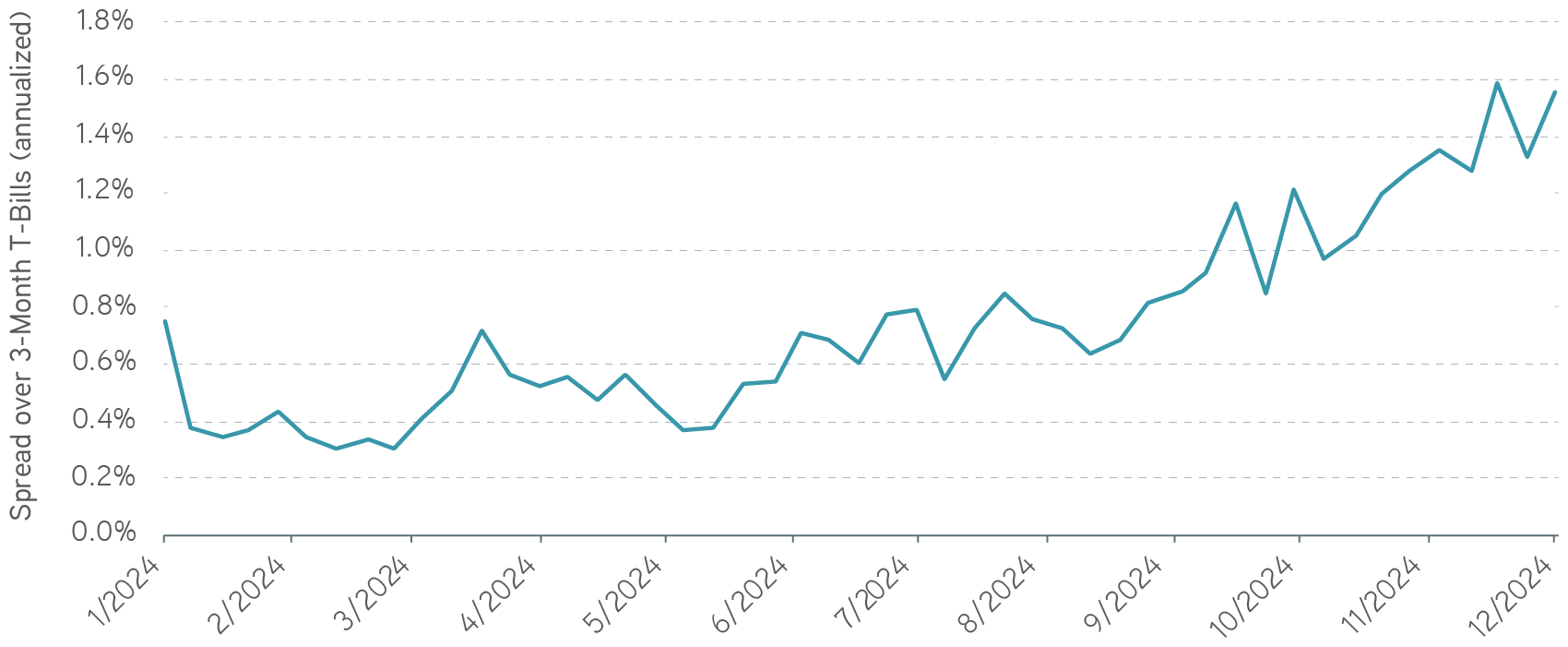

As of December 2, 3-month equity cash and carry returns exceeded US Treasurys by 1.56% annualized.

YTD S&P 500 Cash and Carry Spread to T-Bills

Source: Bloomberg as of 12/2/2024. For illustrative purposes only. Not a recommendation to buy or sell any security. It is not possible to invest directly in an index. Indexes are unmanaged and do not reflect the deduction of fees or expenses. Past performance is not indicative of future results. All investments are subject to risk, including risk of loss.

Using cash and carry for cash enhancement

For investors with significant and stable cash balances, an equity cash and carry trade could be appealing, potentially offering a higher yielding complement to a portfolio invested in a short-term investment fund (STIF) or Treasurys.

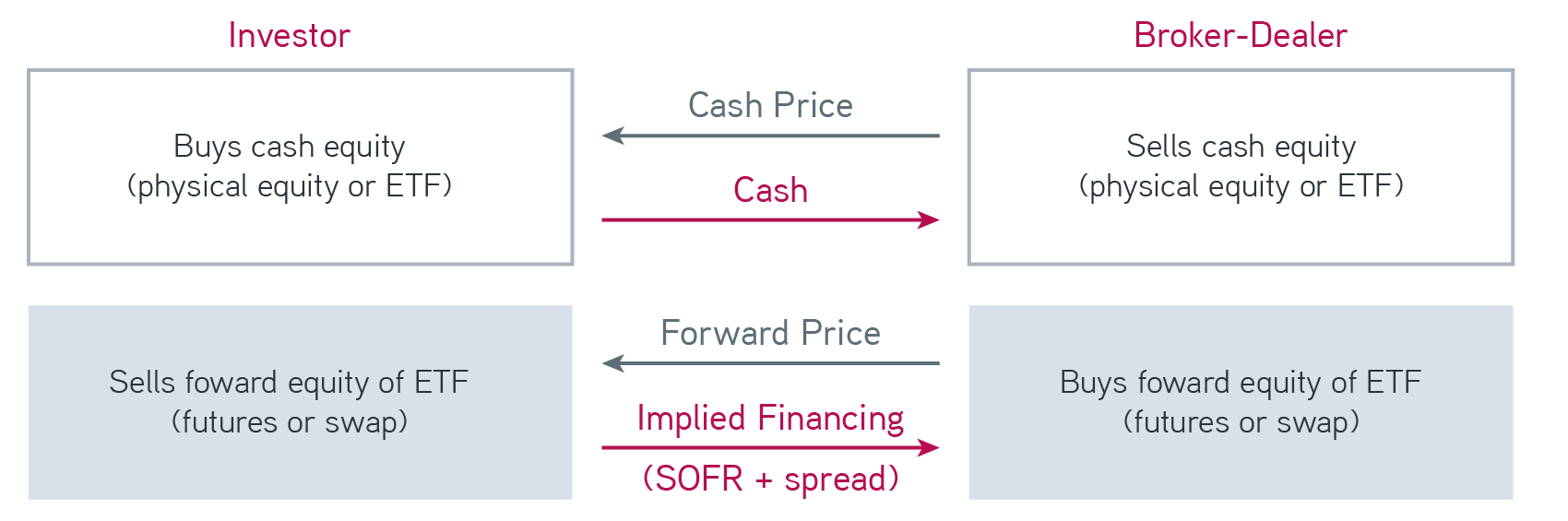

The mechanics of implementation typically involves purchasing a low-cost equity instrument, such as an index ETF, and selling a forward instrument (swaps or futures) on the same underlying instrument—then systematically rolling it at the expiry of the swap or futures contract each month into a new position to maintain constant exposure over time.

• Swaps may offer greater precision than futures, which may help to mitigate slippage and tailor maturities to match investor preferences.

• Futures can be a more easily accessible instrument, however, especially for investors without the documentation to trade swaps.

In either case, with both legs of the trade being extremely liquid, these trades can be unwound early with relatively low risk should the benchmark rate (SOFR) decline or if cash liquidity is needed prior to maturity.

Risk management solutions for uncertain markets

The bottom line

Implementing the cash and carry trade at this time of year can be particularly attractive given the year-end funding squeeze, when banks and broker-dealers tend to pare lending activity and shore up their balance sheets for regulatory reporting. Yet the implied financing richness has persisted for some time, in our view making the equity cash and carry trade a potential opportunity to enhance returns on cash.

The views expressed in these posts are those of the authors and are current only through the date stated. These views are subject to change at any time based upon market or other conditions, and Parametric and its affiliates disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions for Parametric are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Parametric strategy. The discussion herein is general in nature and is provided for informational purposes only. There is no guarantee as to its accuracy or completeness. Past performance is no guarantee of future results. All investments are subject to the risk of loss. Prospective investors should consult with a tax or legal advisor before making any investment decision. Please refer to the Disclosure page on our website for important information about investments and risks.

12.04.2025 | RO 4041894