The pension industry is an enormous, slow-moving machine, with projected benefits stretching out for decades. Let’s consider why pension plans are in relatively good shape compared to the past, and what trends we expect to continue into the future.

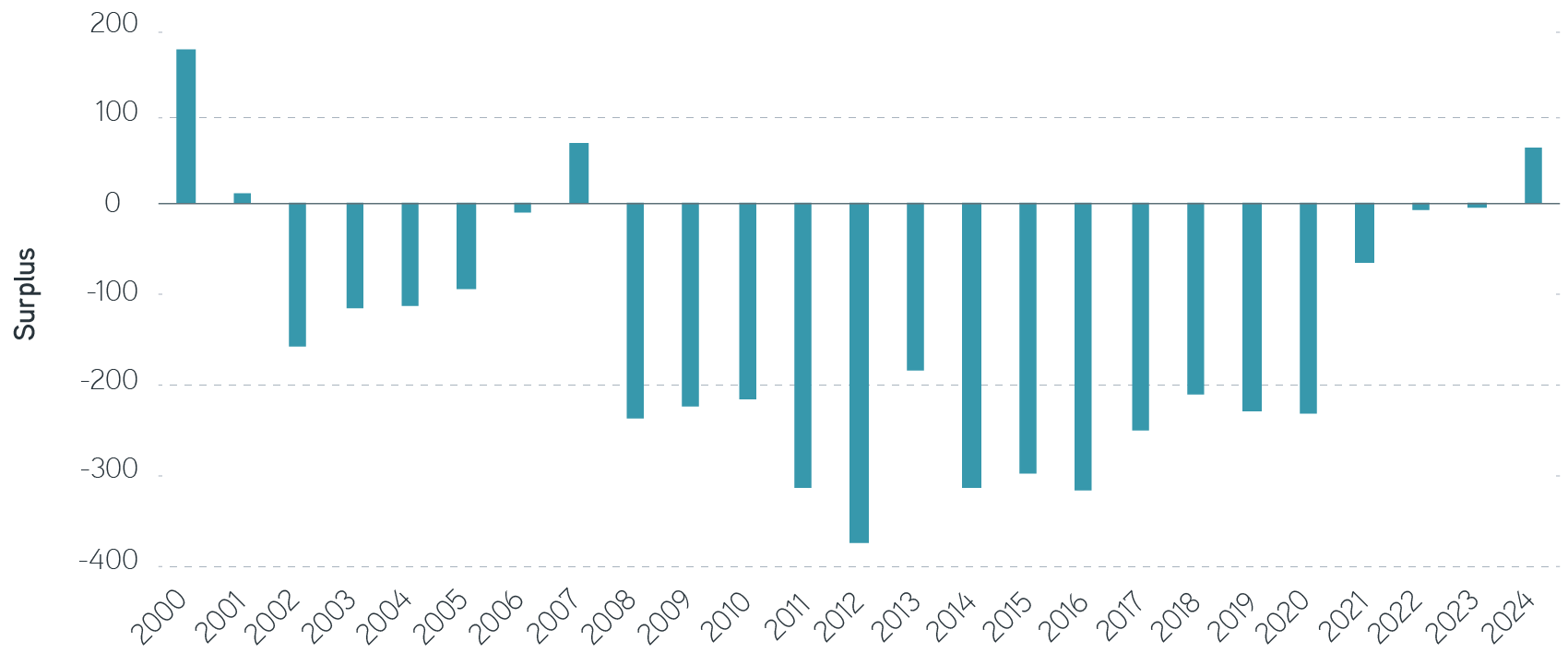

Another year, another good result for pension plan funding—a four-year trend. According to the Milliman 100 Pension Funding Index, corporate pensions funded stand at 105.0% in December 2024, up from 99.5% at the end of 2023.

Milliman 100 Pension Funding Index improved in 2024

Source: Milliman, 12/31/2024. For illustrative purposes only. Past performance is not an indicator of future results. It is not possible to invest directly in an index. Indexes are unmanaged and do not reflect the deduction of fees or expenses.

Pension investing environment

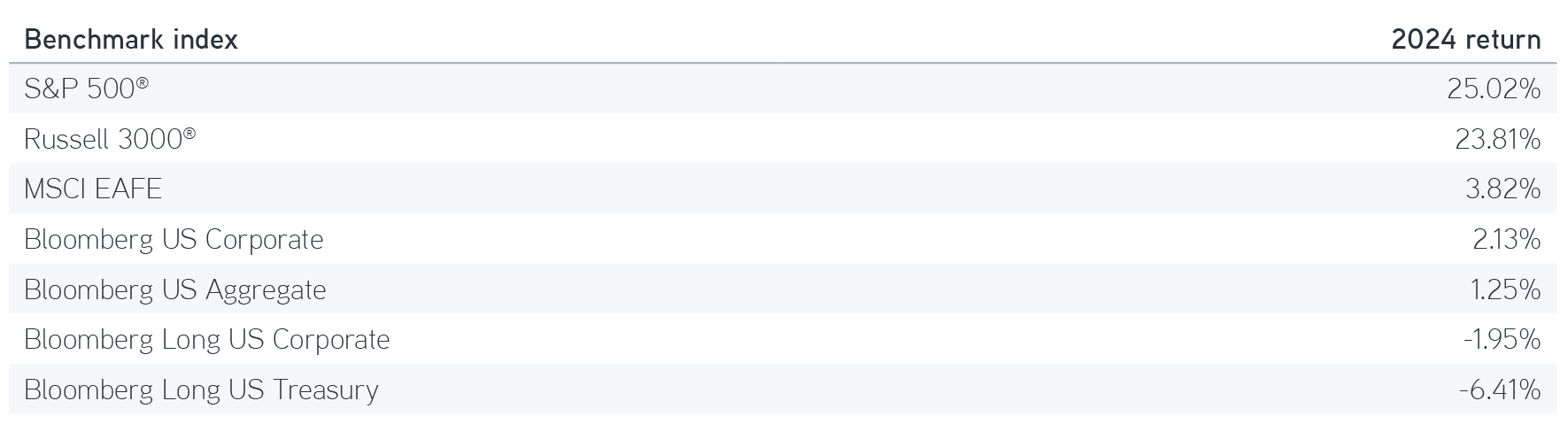

Yield curves steepened a bit in 2024, with short yields falling and long yields rising, which resulted in a decrease in liability. While equity markets again produced strong returns for the year—particularly in the US—fixed income returns were a bit mixed.

By now, with most plans engaging in LDI strategies, the fixed income returns generally offset some or all of the liability changes. In the meantime, plans’ allocation to return-seeking assets has fallen, so funded status increases may seem small compared to equity returns. But a 5.5% improvement in funding ratio is clearly a winning outcome.

Source: S&P, Russell, MSCI, Bloomberg, 12/31/2024. For illustrative purposes only. Past performance is not an indicator of future results. It is not possible to invest directly in an index. Indexes are unmanaged and do not reflect the deduction of fees or expenses.

Refine and enhance liability-driven investing strategies

Let’s review a few areas of interest for the pension and LDI world that we identified in our 2024 outlooks:

Reopening pension plans given better funding situations

Early last year, IBM used surplus pension assets to reopen their pension plan using a cash balance formula. While I view that as a positive step forward, I also recognize that it may take time for others to follow suit—if they do at all. Not too surprisingly, we haven’t seen activity from other plans to reopen.

One indication that workers are again beginning to value retirement pensions came during the Boeing machinists’ strike. Among the union’s demands was reopening the pension plan. Alas, when the strike was settled, the pension demand fell by the wayside as machinists were instead given additional 401(k) considerations.

Will new and reopened plans emerge in the future? That would require a long runway to take off, so I don’t think this question will be definitively answered for years to come.

Litigation related to pension buyouts

Another area of interest has been litigation. Pension risk transfer (PRT) has become a commonplace process over the past dozen years or so. Early in 2024, however, groups of impacted participants in several pensions sued the plan sponsor and its advisor for participating in a buyout of some pension liabilities. To be clear, it’s the plan sponsor who is being sued, not the insurer who has taken over the liabilities. In those cases, the plan sponsor shifted responsibility to pay benefits to an insurance company by transferring assets to the insurer.

In these lawsuits, the participants say the plans failed to select the safest insurer and that they paid more than reasonable compensation, which is a breach of fiduciary duty. The claim is that the decision reduced the value of their benefits. Interestingly, since the middle of the year, several more lawsuits have popped up. Until recently, the same insurer was the annuity provider for the buyouts, but a new lawsuit has been filed involving another insurer. We’ll see if this slow-moving litigation amounts to anything in the end. Meanwhile, it’s another data point for a plan sponsor wanting to offload pension liabilities.

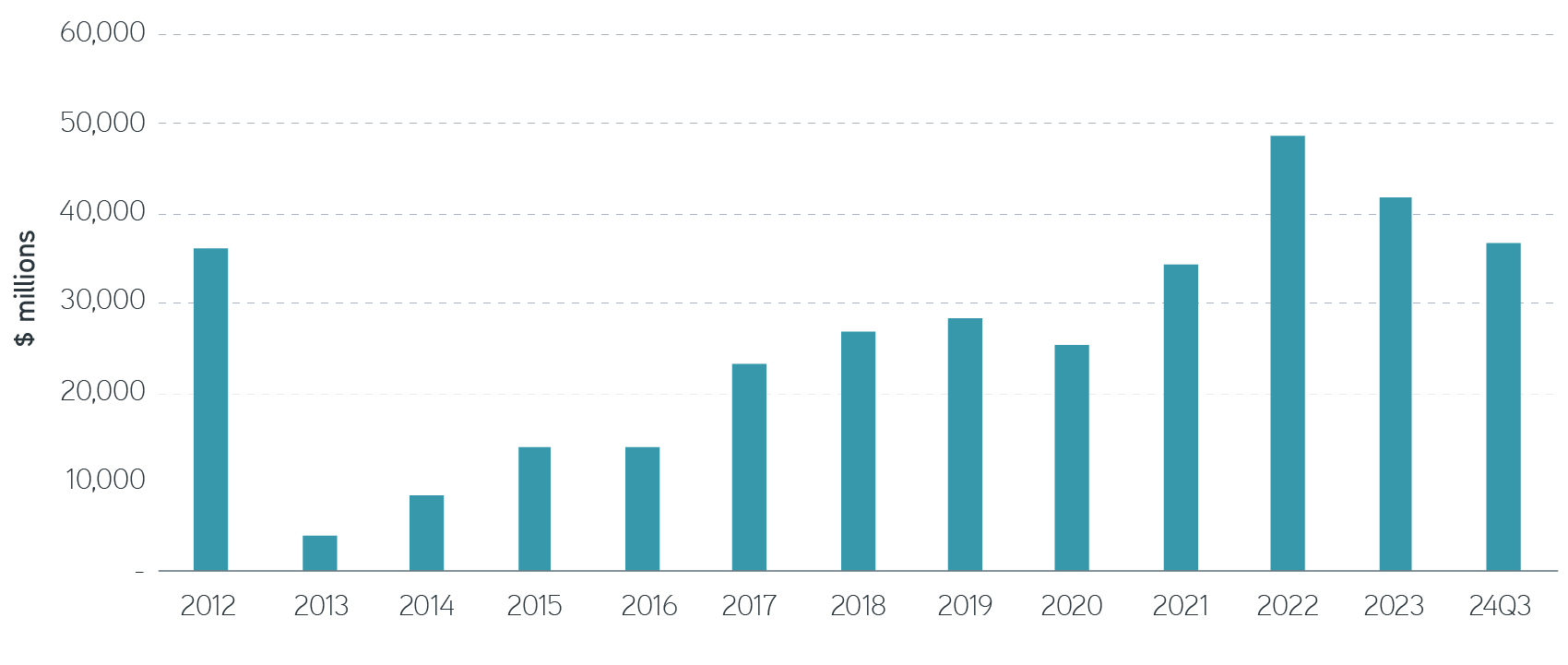

Continuation of pension risk transfers

Speaking of PRTs, let’s take a look at how substantial that market remains in 2024. The largest transaction was around $6 billion by IBM, who also reopened their plan earlier in the year (see above)—illustrating how these trends aren’t mutually exclusive. Higher yields and better funded status have continued to drive the high volume of pension buyouts.

In the first three quarters of 2024, LIMRA shows more than $36 billion in pension buyouts, compared to around $42 billion for all of 2023. We don’t find that particularly surprising, given the long-term trend. However, we think it’s wise to do the homework before starting the PRT process. If a plan doesn’t transfer the entire plan, the remaining liabilities can leave the sponsor with more risk than they realize and a difficult liability stream to manage.

LIMRA pension buyout sales continuing long-term trend through Q3 2024

Source: LIMRA data as of 9/30/2024. For illustrative purposes only. Past performance is not an indicator of future results. It is not possible to invest directly in an index. Indexes are unmanaged and do not reflect the deduction of fees or expenses.

The bottom line

LDI risk mitigation strategies have advanced over the last couple of decades, and surplus risk for a funded plan can be well controlled. If a plan is well-enough funded and subject to substantial risk, then by all means, liability should be hedged using LDI strategies—particularly given a 2025 Fixed Income Outlook where we expect volatility in yields and potentially favorable fixed income returns relative to equity.

Risk transfers remain high as corporations want to offload plans from their balance sheets. While we see no reason to expect that will change in the future, we wouldn’t say it’s all over for pension plans. As the population ages, more workers are likely to see the value of receiving a monthly retirement payment from an employer pension plan. As corporations find that managing the risk may not be so difficult if they understand the funding costs, we wouldn’t rule out a resurgence in defined benefit plans down the road. All these things will take time.

The views expressed in these posts are those of the authors and are current only through the date stated. These views are subject to change at any time based upon market or other conditions, and Parametric and its affiliates disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions for Parametric are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Parametric strategy. The discussion herein is general in nature and is provided for informational purposes only. There is no guarantee as to its accuracy or completeness. Past performance is no guarantee of future results. All investments are subject to the risk of loss. Prospective investors should consult with a tax or legal advisor before making any investment decision. Please refer to the Disclosure page on our website for important information about investments and risks.

01.21.2026 | RO 4161358