Weekly Fixed Income Update

Interest rates, inflation, central bank action—all these and more can impact fixed income. Stay on top of the market with our weekly update.

April 15, 2025

Macro update

Fixed income volatility continued as a response to US tariff polices. 10-year treasury yields traded below 4% as the equity market sold off on Monday, but then yields moved higher throughout the week to close above 4.5%. Only four other times in the past 30 years have we seen US bond yields spike along with a sell-off in the dollar (Bloomberg, 4/11/2025).

The presidential administration decided to institute a 90-day reprieve on “reciprocal” tariffs, but a 10% tariff rate remains with trading partners.

Economists continue to raise their targets for inflation while taking down GDP estimates. Fiscal concerns also could be pushing rates higher. The US House passed a budget that contains many of the administration’s tax cut proposals.

The Federal Reserve continues to monitor market liquidity. Fed funds rate futures are now pricing in three rate cuts for this year, with only a 30% chance of a rate cut at the upcoming Federal Open Markets Committee meeting on May 7 (Bloomberg 4/11/2025).

March 20, 2025

Fixed income portfolio manager Kevin Lynyak shares his insights into the current bond market. Listen now:

Municipal bond update

Benchmark AAA municipal yields soared last week amid historic volatility, in sympathy with Treasurys, and underperformed to close the week. Two-year maturity yields increased 69 basis points (bps), the five-year rose 74 bps, the 10-year spiked 80 bps and the 30-year added 71 bps. It’s worth noting that there were swings of between 40 and 50 bps mid-week. Given the magnitude of these yields increases, benchmark tax-exempt yields are now solidly higher since the start of the year, with five- and 10-year maturities up by 50 and 60 bps, respectively, while 30-year yields are up by an impressive 74 bps. Benchmark 10-year yields have now set a new decade high at 3.66% (Refinitiv MMD, 4/11/2025).

The Bloomberg Municipal Bond Index plummeted last week and lost 4.04%, bringing the year-to-date (YTD) total return to -2.78% YTD. Treasurys had a somewhat less jarring week and lost 2.46%, bringing that YTD total to 1.62% (Bloomberg, 4/11/2025).

Muni relative value was choppy throughout the week but ended at 83% by Friday’s close, remaining at the YTD high and its highest ratio since 2022. This percentage of the 10-year Treasury yield metric remains sharply above the two-year average of 66% (Refinitiv MMD, 4/11/2025).

Five- to 15-year A-rated municipal yields ranged from 3.57% to 4.43%, with related taxable-equivalent yields ranging from 6.03% to 7.48%, assuming a combined federal tax rate of 40.8% (Refinitiv MMD, Parametric, 4/11/2025).

Mutual funds experienced massive outflows last week. Open-end funds lost $1.9 billion, while ETFs experienced a record $1.4 billion outflow. This powerful negative combination brought the net exit for the asset class to $3.3 billion, the largest outflow since June of 2022 (LSEG Lipper, JP Morgan 4/10/2025).

Despite the outsized volatility and more than half of last week’s issuance being postponed, the municipal new-issue calendar returns with a $9 billion week scheduled to enter the market, which may grow if any postponed deals re-enter. Seasonally heavy supply has been a primary factor behind the March and April muni underperformance, which has continued (Ipreo, 4/11/2025).

Corporate bond update

US investment-grade (IG) corporate yields rose across the curve last week. Two-, five- and 10-year yields increased 35, 47 and 45 bps, respectively. Corporate yields are higher across the curve YTD. Two-, five- and 10-year yields are up six, 13 and 19 bps, respectively (Bloomberg, 4/11/2025).

The ICE BofA 1–10 Year US Corporate Index returned -1.74% for the week and -1.62% month to date (MTD). The index underperformed like-duration Treasurys by -0.15% during the week and have underperformed by -0.93% MTD (Bloomberg, 4/11/2025).

IG mutual funds and ETFs experienced outflows of $9.8 billion, a decrease in flows from the previous week’s inflows of $5 billion. Corporate-only funds experienced outflows of $4.7 billion, following the previous week’s inflows of $1.4 billion (JPMorgan, 4/11/2025).

Corporate one- to 10-year IG bond yields have increased 18 bps YTD and ended last week at 5.3% (Bloomberg, 4/11/2025).

Investing in fixed income securities involves risk. All investments are subject to loss. Learn more.

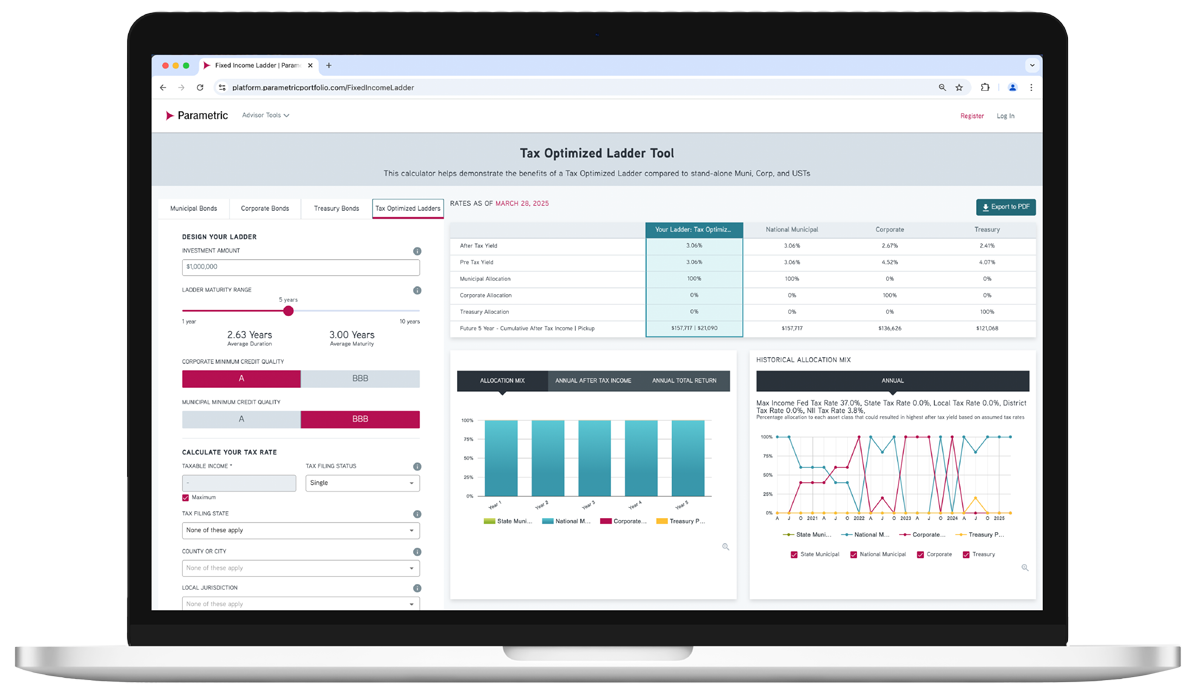

ADVISOR TOOL

Laddered Interest Rate Scenario Tool

Which fixed income asset class is just right for each investor? Explore possible ways to achieve optimal after-tax yield.

Use our online tool to showcase potential benefits of tax-managed and customized laddered bond portfolios.