Laddered Fixed Income

For institutional investors

Our laddered strategies provide a systematic and customizable approach for income-oriented investors.

Fixed income investigated. Our weekly updates will keep you on top of rates, inflation, and much more.

![]()

Parametric’s Laddered Fixed Income strategies give investors the opportunity to adjust to rising interest rates and improve yields. These strategies aim to deliver predictable income and preserve investor capital.

Intended benefits of laddered bond portfolios

Predictable exposure

Learn more >>

Once designed, a portfolio structure will be maintained to balance reinvestment and price risk.

Execution

Learn more >>

Our size and scale allow us to buy and sell bonds at attractive prices with a focus on high efficiency and cost-effective trades.

Risk management

Learn more >>

We seek to minimize downside risk with fundamental credit analysis from our credit research teams.

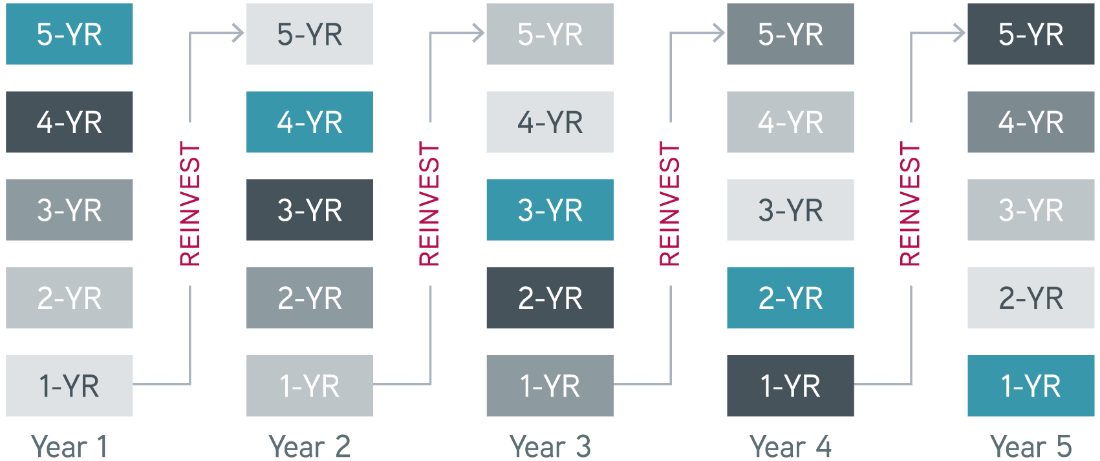

To build a laddered portfolio of corporates or municipals, we equally weight investment-grade bonds by maturities along a defined segment of the yield curve. As bonds mature, their proceeds are reinvested into longer maturities, which typically have higher yields. Through continuous reinvestment in longer-dated bonds, the overall portfolio benefits from higher income during periods of rising rates.

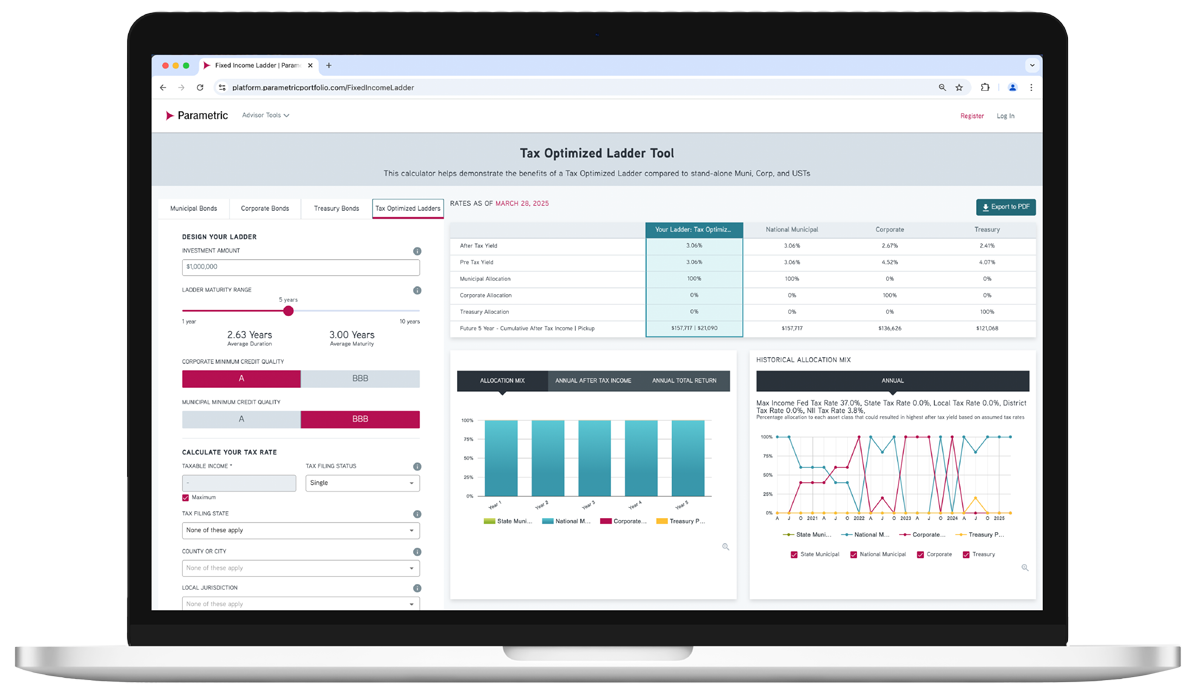

ADVISOR TOOL

Laddered Interest Rate Scenario Tool

Which fixed income asset class is just right for each investor? Explore possible ways to achieve optimal after-tax yield.

Use our online tool to showcase potential benefits of tax-managed and customized laddered bond portfolios.

Explore more fixed income solutions

Why choose Parametric?

Resources

Midyear Fixed Income Outlook: Starting Yields Matter Amid Uncertainty

by Jonathan Rocafort, Managing Director, Head of Fixed Income Solutions

June 30, 2025

Higher starting yields may result in more attractive return profiles for fixed income investments, and elevated income could also provide a cushion to limit downside risk amid continued rate volatility.

Municipal Bond Premiums: Separating Fact from Fiction

by Jonathan Rocafort, Managing Director, Head of Fixed Income Solutions; Evan Rourke, Director, Portfolio Management

June 24, 2025

This paper helps dispel common misconceptions about premium municipal bonds that can lead to poor decision-making. Once investors learn the difference between fact and fiction regarding municipal bond premium prices, they can make decisions that lead to better investment outcomes.

How Corporate Bond Ladders May Help to Hedge Volatility

by John Hemingway, Vice President, Portfolio Manager

April 28, 2025

With corporate bond ladders, maturities reinvested at higher rates have the potential to benefit the portfolio.