What to Do When It Isn’t?

One of the major concerns for an institutional investor is maintaining sufficient liquidity in the portfolio during periods of high volatility and market stress. During the global financial crisis of 2008–2009, for example, many investors were challenged to raise cash for ongoing plan obligations (such as benefit payments and capital calls). At the same time, there was a desire to rebalance the portfolio out of asset classes that were overweight to their policy target (such as fixed income) and into asset classes that were underweight (such as equities).

The problem many investors faced during this period was that the desired source of liquidity was the fixed income market, which at the time was strained from a liquidity perspective—much as it is now during the market downturn triggered by the coronavirus outbreak. Then as now, investors who chose to sell fixed income exposure were often forced to do so in illiquid markets in which assets were sold at steep discounts. During the global financial crisis, this had a negative effect on portfolio returns.

It raises a challenging question: How can investors remain in compliance with policy targets while maintaining sufficient liquidity for plan obligations?

For liquidity and rebalancing, turn to an overlay program

Investors establish a strategic asset allocation with the goal of generating consistent long-term returns for plan beneficiaries. During market corrections or periods of high volatility, the plan can deviate significantly from the allocation, which can trigger mandatory rebalancing if stated in the plan’s investment policy statement. If a physical rebalance is executed during periods of market stress, managers in certain asset classes may be forced to sell at a discount due to decreased liquidity, negatively affecting performance.

In a period when liquidity is needed and portfolio rebalancing is necessary, an overlay program allows an investor to raise cash from the most liquid portion of their portfolio to use both for plan expenses and to rebalance the portfolio back to policy targets.

Potential Parametric solution

How does an overlay program help maintain liquidity?

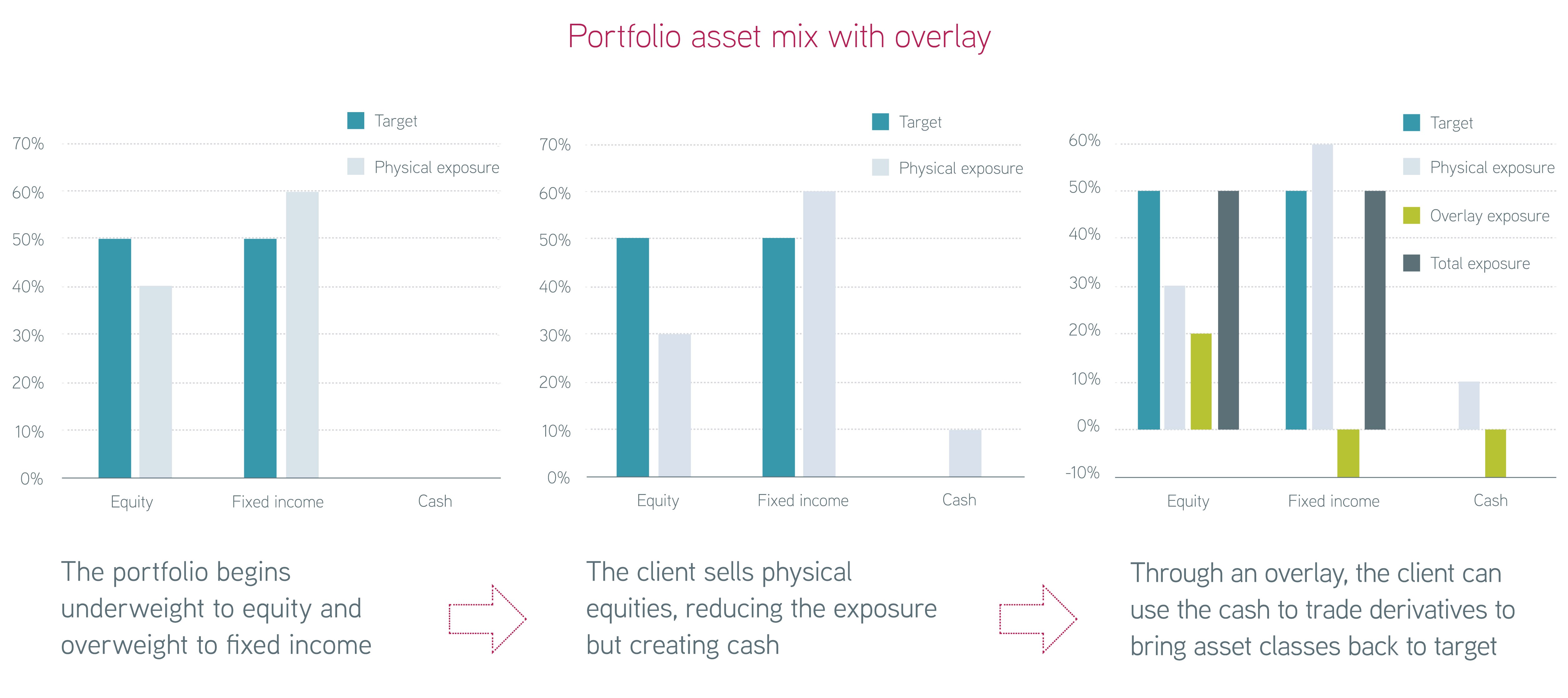

While counterintuitive at first, a unique solution used during the global financial crisis was to sell physical equities to raise liquidity both for ongoing cash needs and to fund a rebalancing overlay. Equities were a good target for liquidity because they remained relatively liquid during this period of market stress. While it may appear that this left investors with a more severe underweight to equities, the overlay program used this cash not only to replace the equity exposure that was sold but to also rebalance the overall portfolio exposures back to target. As a result, plans found themselves in a position to both create sufficient liquidity and maintain the desired asset allocation.

The goal of the rebalance in this example is simple: to reduce fixed income exposure and increase equity exposure. Assuming a portfolio has liquid equity exposure (passive exposure works well for this situation), an overlay program can achieve the goal in a capital-efficient manner while avoiding the discount associated with selling fixed income securities. Physical passive equity exposure can easily be substituted with equity futures without the need to fully fund the position. The illustration below gives you an idea of how this typically works.

Hypothetical. For illustrative purposes only.

In short, by selling passive physical equity exposure, adding synthetic equity exposure, and selling Treasury futures, institutional investors can rebalance in a capital-efficient manner and avoid forced selling of less liquid physical fixed income positions.

The bottom line

During the global financial crisis, institutional investors that made smart use of an overlay program found themselves able to generate liquidity to rebalance their portfolio in a way they may not have been able to independently. By selling out of liquid asset classes, they sidestepped the negative effects of selling assets at a discount and instead remained on target. As the coronavirus outbreak roils markets today, it’s an approach whose time may have come once again.