For investors who work with financial advisors, taxes are an inevitable consequence of good performance. This becomes only more true as their wealth grows and they become subject to higher capital gains tax rates. In an actively managed portfolio, there’s no way to escape capital gains taxes altogether. But understanding the importance of tax efficiency is crucial to long-term success for investors and advisors.

For a flexible way to unlock potential after-tax value, advisors can turn to direct indexing. Active year-round tax management is central to this Parametric-pioneered approach to investing. Let’s look at how it can help your clients.

How does tax-loss harvesting work?

Just about every investor will see some of their holdings lose value now and then. It may be tempting to hang on to those holdings and wait for them to gain again, to protect the investor’s overall allocation. Other investors may sell and buy back the same securities within a short time, hoping to reset the portfolio’s cost basis and deduct the loss from their taxes. However, they may end up running afoul of IRS rules against wash sales, in which the investor sells and repurchases identical securities within 30 days. If a transaction violates this rule, the IRS can disallow the loss deduction and add the loss to the cost basis of the repurchased security, which can effectively wipe out the benefit of the trade.

Luckily, neither of these is necessary with systematic tax-loss harvesting. In a direct indexing portfolio, when one security loses a specified percentage of its value, the manager sells it at a loss, which serves to offset current or future gains elsewhere. The manager then purchases one or more other replacement securities that match the risk-return profile of the original security. This keeps the investor in the market, with their desired exposures intact.

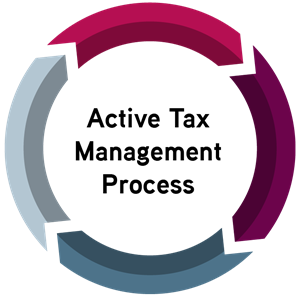

Systematic tax-loss harvesting

1. Build portfolios for specified exposure

We seek to outperform the model portfolio on an after-tax basis through active tax management.

2. Identify securities held at a loss

Sell shares of company A to replace company B. The portfolio weight to the industry stays close to the model portfolio.

3. Select replacement securities

Buy shares of company A to replace company B. The portfolio weight to the industry stays close to the benchmark.

4. Manage sector, industry and security biases

Continue to seek performance in line with the target exposure.

For illustrative purposes only.

It’s worth noting that this process doesn’t completely eliminate the possibility of wash-sale violations. There are rare occasions where a wash-sale violation may be beneficial. For example, when a client makes a large contribution shortly after trading a portfolio for loss harvesting, it may make sense to purchase a security to maintain desired risk characteristics, even if that means delaying the realization of the loss due to wash-sale rules. In cases like this, the client may benefit from the portfolio manager’s experience balancing the risks and tax benefits of loss harvesting.

Take control of your passive investments

How often should you harvest tax losses?

The short answer: whenever it makes sense. The long answer is that the frequency of loss-harvesting activity doesn’t matter as much as the value that activity adds to the portfolio. We’ve seen some recent entrants into the direct indexing space claim to harvest a certain number of losses every year, month or day. But that number can’t tell us how successfully those providers track the investor’s benchmark, limit portfolio risk or avoid wash-sale violations. All these considerations, to say nothing of the upfront transaction costs, represent ways that inattention to taxes can cut into the investor’s returns.

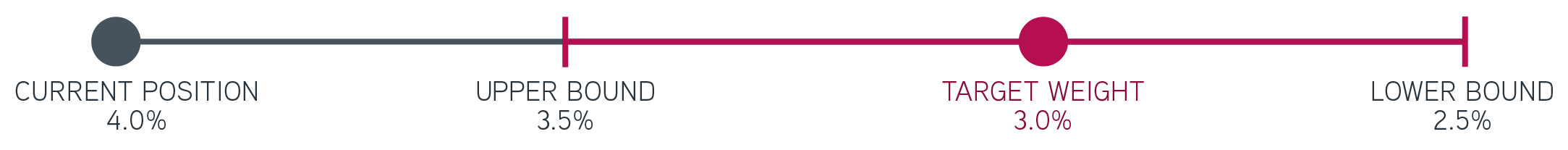

This is one example of the worth of a rules-based approach to tax management. Providers should measure target weights for direct indexing portfolios at the security, sector, country and risk-factor levels, with bounds above and below those targets that keep tax-management activity to the most significant gains and losses. Actual weights can change for several reasons: index or model updates, cash flow changes, individual company action and so on. If a position drifts out of bounds in either direction, the provider knows to sell and replace the position, either at the upper bound for a gain or the lower bound for a loss.

Rules-based tax management

For illustrative purposes only.

Each type of sale aims to create a tax benefit for the investor by delaying the realization of a gain or speeding up the realization of a loss. This can also have the effect of reducing the investor’s risks while maintaining their targets. If a provider fails to balance these goals with the push to harvest losses, they may fall short of the investor’s desired outcomes, which are rarely as simple as a total of trades.

What are some other ways to manage taxes in direct indexing?

The goal of investors is for their portfolio value to keep rising over time. Chances to harvest losses can fade as holdings appreciate, which can make the portfolio feel “locked up.” While this may change during periods of market volatility, many major benchmarks tend to gain over the long term. But loss harvesting isn’t the only way to unlock potential after-tax excess return. Four other tax-management techniques present themselves in the later stages of a direct indexing portfolio’s lifespan:

Add cash

Adding cash resets the portfolio’s cost basis, creating new lots that may be ideal candidates for loss harvesting during market fluctuations. Portfolio managers can use the investor’s most tax-efficient lots for further loss-harvesting trades, then use cash contributions to fill in any resulting underweights.

Make charitable security donations

Donating securities to charity offers the same tax deductions as donating cash, with the added advantage of reducing the investor’s tax liability. Portfolio managers can help with lot-level management, which allows the investor to donate only the lots that can have a risk-reducing effect on the overall portfolio.

Realize long-term gains

As portfolios continue to increase in value, short-term realized gains get taxed at higher rates. It’s at this point when investors can begin realizing the long-term gains they’ve deferred. This can refresh the portfolio’s basis at the lower long-term tax rate, which in turn can make more room for short-term losses to harvest.

Continue balancing gains and losses

Some investors may not be keen to add cash or realize long-term gains. For this group, managers should focus on doing the most with the tax losses available to them, seeking to offset some gains and defer others. Managers should match their clients’ patience and be ready to recommend the above tax-management techniques when investors are more comfortable.

The bottom line

Ongoing tax management in direct indexing isn’t easy. It takes a repeatable and methodical process, a consistent lookout for opportunities and a commitment to quality over quantity. At first it can seem overwhelming for advisors who are just starting to get their clients into direct indexing. That’s why it’s vital to partner with an experienced provider that can handle day-to-day tax-management tasks. With this extension of your team, you can focus on what matters most: delivering investor value.

The views expressed in these posts are those of the authors and are current only through the date stated. These views are subject to change at any time based upon market or other conditions, and Parametric and its affiliates disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions for Parametric are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Parametric strategy. The discussion herein is general in nature and is provided for informational purposes only. There is no guarantee as to its accuracy or completeness. Past performance is no guarantee of future results. All investments are subject to the risk of loss. Prospective investors should consult with a tax or legal advisor before making any investment decision. Please refer to the Disclosure page on our website for important information about investments and risks.

12.16.2025 | RO 4007431