Tax Harvest Core

Track market exposure. Apply active tax management.

Parametric Tax Harvest Core helps you do both while delivering consistent performance and diversification.

![]()

Take an active approach to passive strategies

Parametric Tax Harvest Core seeks to closely match the pretax return of an investor’s chosen exposure while outperforming on an after-tax basis. We construct portfolios with low-cost, highly liquid, sector-based exchange-traded funds (ETFs) and systematically harvest tax losses throughout the year.

Objectives

Client exposure

Learn more >>

Benchmark a portfolio to the S&P 500® or the Russell 3000®.

Active tax management

Learn more >>

Harvest losses throughout the year and defer the realization of capital gains.

Customization

Learn more >>

Restrict sectors, fund portfolios in kind or in cash, and make tax-efficient charitable donations.

How it works

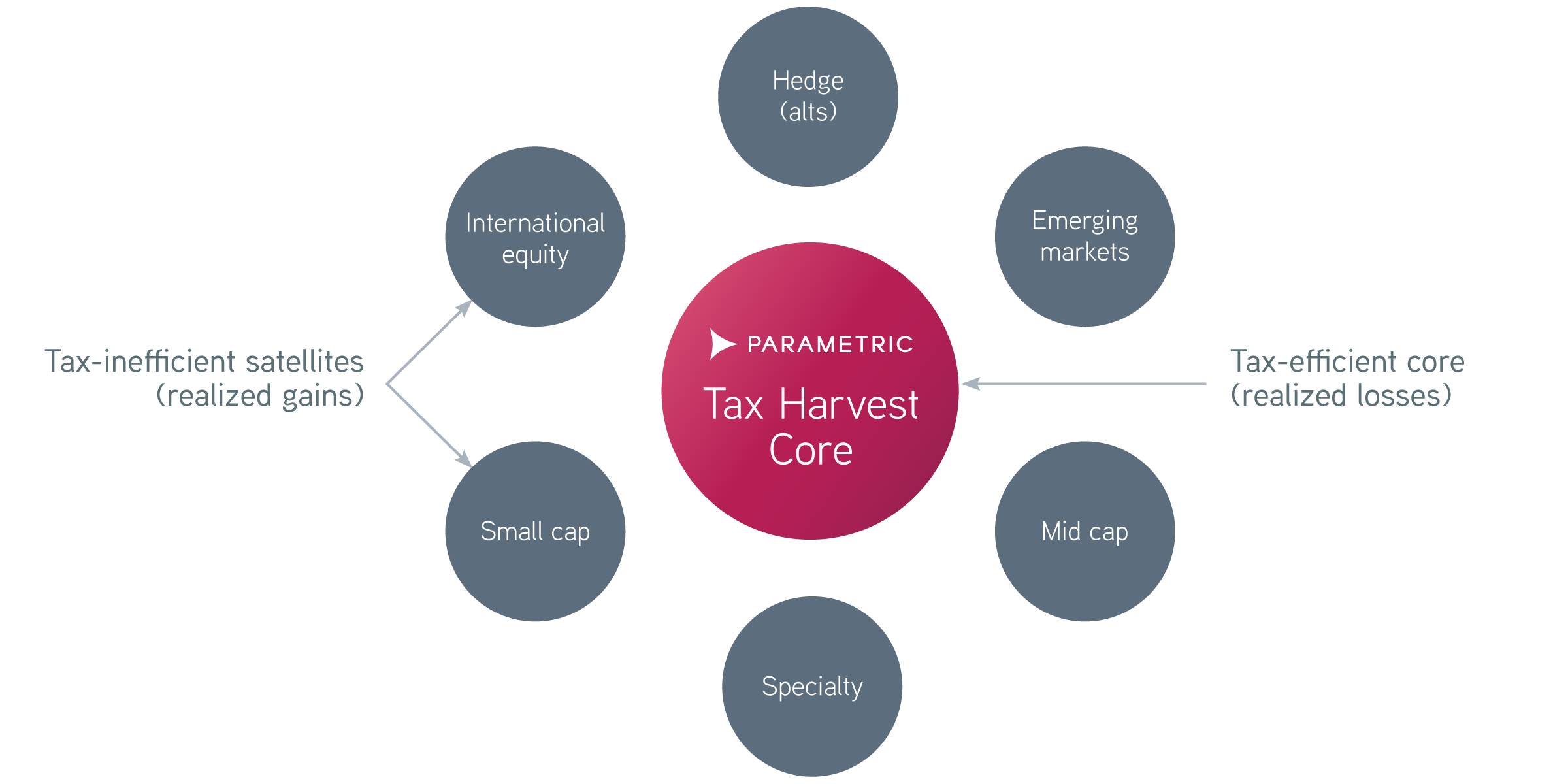

Where Tax Harvest Core fits in a complete investment strategy

Actively managed portfolios aren’t always tax sensitive, and higher turnover could result in significant gain realization. A tax-managed passive mandate as a core holding consistently strives to produce net-realized losses and can help offset gains. This can result in better overall after-tax returns and help your clients keep more of their money invested.

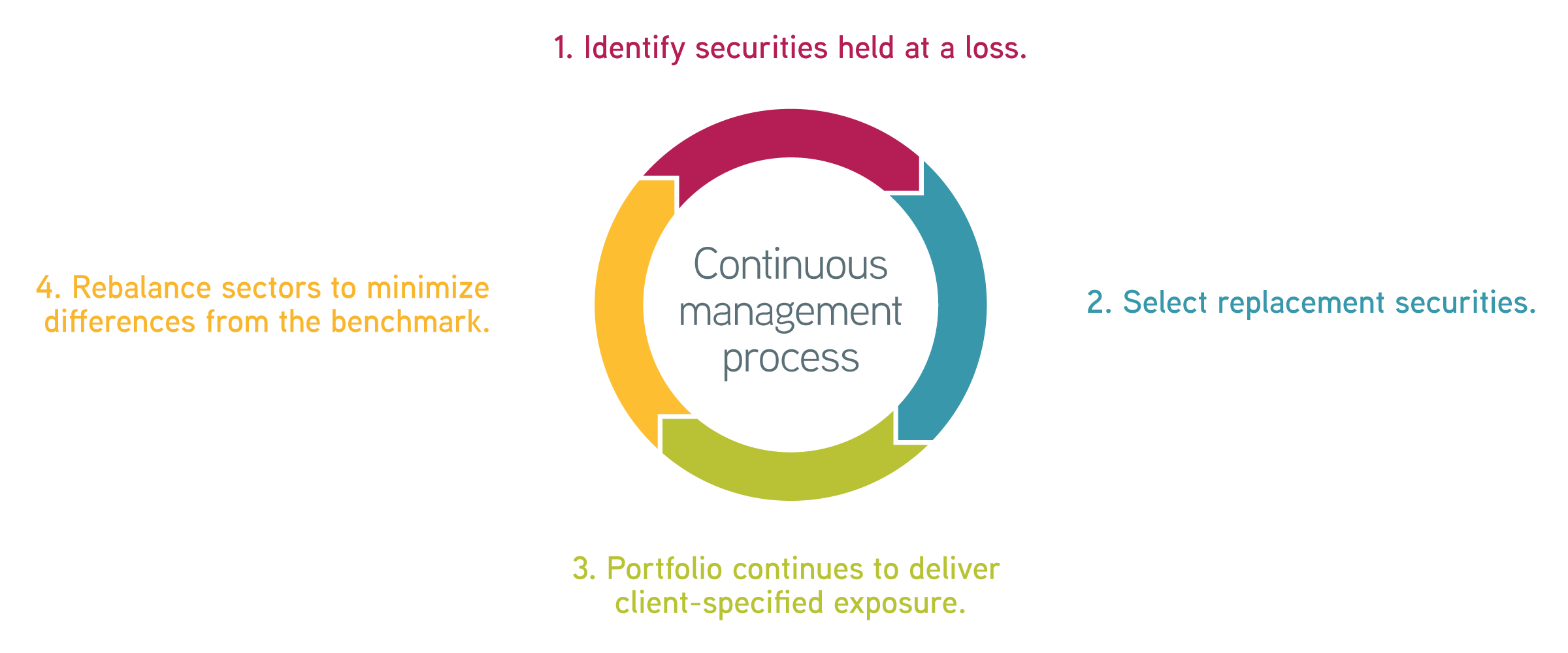

Continuous and active investment management

Our systematic approach to tax-loss harvesting seeks to maximize opportunities for after-tax returns while tracking closely to your client's chosen benchmark. We assess losses at the lot level for each sector ETF, and we harvest losses when value falls 5% below cost basis, purchasing replacement sector ETFs to keep the portfolio in line with its benchmark.

Once we’ve designed and customized the portfolio, our proprietary optimization process continuously manages for both risk and tax-management opportunities.

See more tax-managed solutions

Key benefits

Tax Harvest Core offers many of the customization options that set Parametric’s tax-managed strategies apart. You get the freedom to restrict sectors, fund portfolios in kind or in cash, and raise cash and make charitable gifts with enhanced tax efficiency.

More to explore