Managed Fixed Income

Parametric’s Managed Fixed Income strategies actively manage municipal, corporate and preferred securities to turn inefficiency into opportunity.

![]()

Parametric offers an actively managed SMA solution for every investor. Our fixed income investment team has designed active strategies that cover the municipal, corporate and preferred asset classes. Our experienced portfolio management team uses advanced technology and expert credit analysis to gain an edge for fixed income investors. In each strategy, our team tactically exploits relative trading opportunities, adjusts yield-curve positioning and embeds ongoing tax management for select strategies.

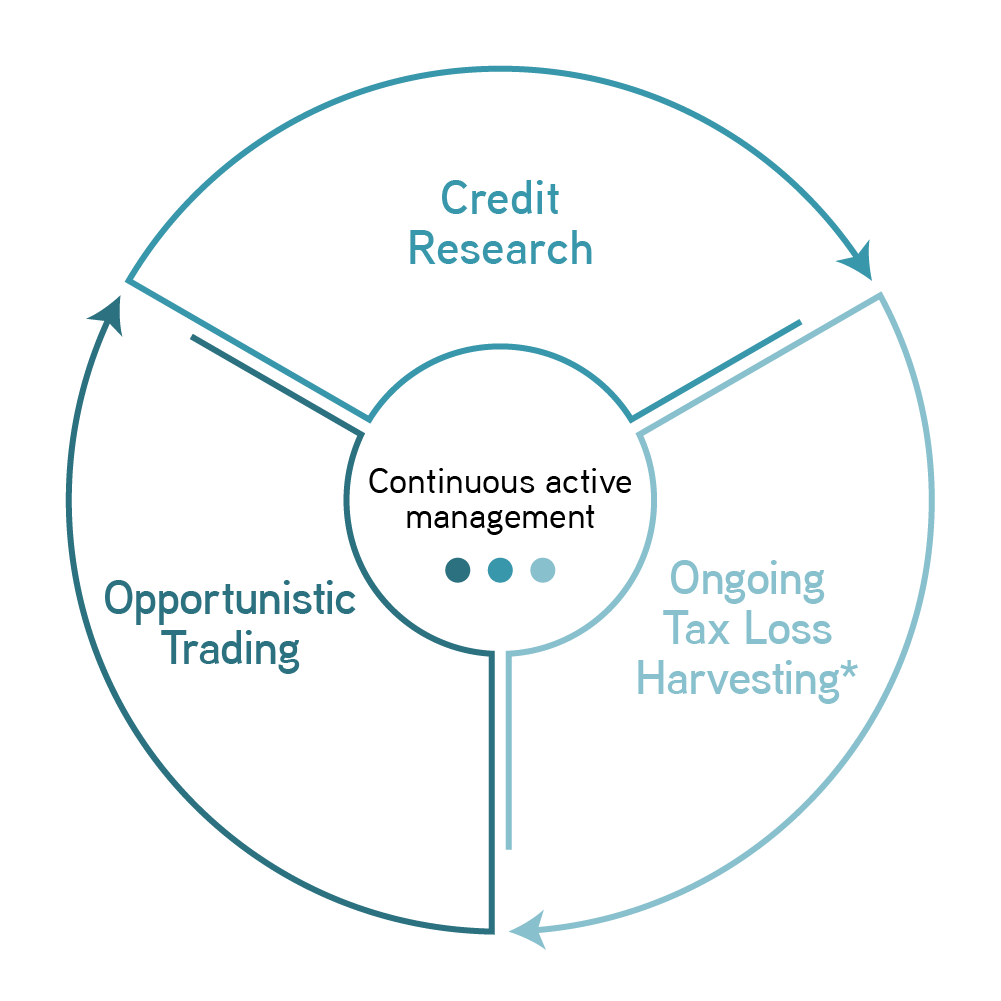

How it works

Our actively managed strategies are designed to capitalize on pricing inefficiencies across the fixed income market, with a focus on maximizing after-tax returns. Leveraging proprietary technology, we tap into both newly issued and secondary markets to uncover undervalued bonds. Ongoing relative value trading and tactical yield curve positioning result in a dynamic approach to management. In addition, we implement tax-loss harvesting year-round*, not just at year-end. Unlock the full potential of your fixed income portfolio with our proactive and innovative approach.

*Offered on most strategies

Intended benefits of active fixed income management

Access

Learn more >>

Our large network of fixed income broker dealers helps us offer our clients a wide variety of municipal, corporate, Treasury and preferred securities.

Oversight

Learn more >>

Our in-house analysts and strategists perform extensive research to select securities and monitor for credit risks.

Tax efficiency

Learn more >>

Investors can embrace year-round tax-loss harvesting, allowing us to aim for enhanced after-tax returns.

Relative value trading

Learn more >>

By actively trading the portfolio into retail demand, we attempt to add excess return by selling securities above their current valuations.

Tax efficiency through advanced technology

Even sophisticated fixed income investors can miss opportunities to boost tax efficiency. Learn how Parametric's advanced technology can help investors navigate complex rate environments and enhance potential after-tax returns.

Explore more fixed income solutions

Why choose Parametric?

Get in touch

Want to know more about our Managed Fixed Income solutions? Complete our contact form, and a representative will respond shortly.

More to explore