Many investors don’t think about including commodities in their portfolio. However, commodities offer security during periods of unexpected inflation—something many portfolios may be unprepared for. We discuss how including them can improve a portfolio’s long-term resilience.

Many investors would say asset allocation is the most important element of investment performance. Yet most just stick with stocks, bonds, and cash in their core portfolio. This completely overlooks an asset class we’d argue deserves more consideration: commodities. Not only do commodities demonstrate a long-term return premium, earning a return higher than the risk-free rate, but they can also provide diversification benefits and inflation defense.

Commodity strategies are increasingly more accessible to investors. However, we’d advise anyone seeking exposure to consider looking past index-based approaches in this asset class. We’ll explain the benefits of including commodities in an investor’s strategic allocation.

How can commodities offer balance during unexpected inflation?

Commodities are often described as an asset class that does well during periods of high inflation. While historical evidence supports this claim, it isn’t high inflation alone that investors need to worry about but inflation that comes in higher than expected. Most portfolios lack exposure to assets that do well during these episodes. This may be when an investor’s portfolio is most vulnerable, however, as higher-than-expected inflation can erode its purchasing power while falling stock and bond prices may also erode its market value. Many investors felt this dynamic firsthand in 2022.

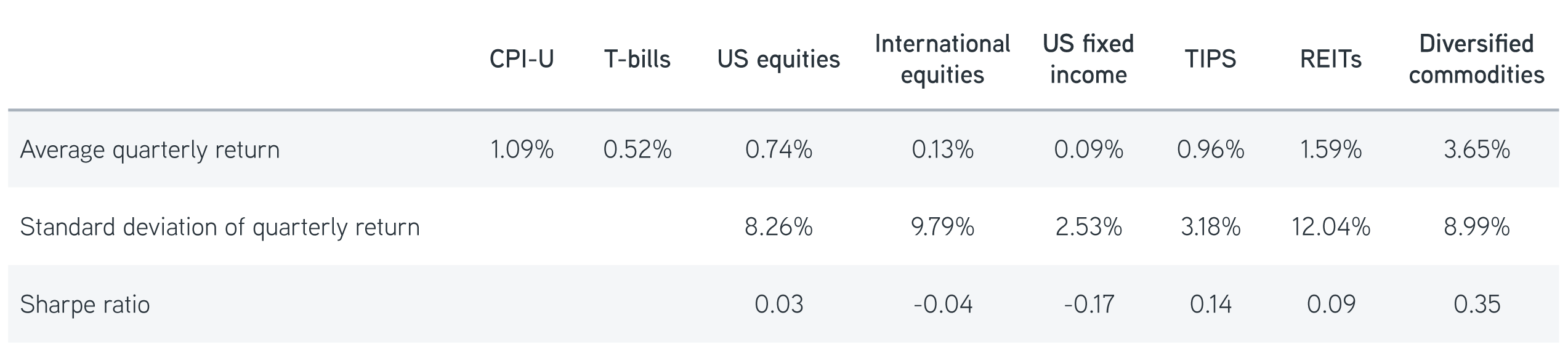

We analyzed how the asset class has performed during periods of unexpectedly high inflation as proof that commodities offer this benefit. We began by sorting historical quarterly observations from most positive to most negative using Citigroup’s Inflation Surprise Index, which measures price surprises relative to market expectations. Positive surprises indicated that inflation was above expectations and negative indicated below. We then focused on the top 75% of positive surprises to filter out periods where inflation came in somewhat close to what the market had expected. This left us with 36 positive surprises between January 1999 and June 2023, which is about one-quarter of the time.

We found that a basket of commodities during these periods, as represented by the S&P Dow Jones Commodity Index Total Return, performed the strongest, with an average quarterly return of 3.65%. This was more than double the next closest asset class, real estate investment trusts (REITs). We found that commodities also performed well when we account for the volatility of the asset class in those quarters. Commodities delivered a return of 0.35% above cash per unit of risk.

Asset class performance in quarters of unexpectedly high inflation, January 1999–June 2023

Sources: Parametric, BLS, ICE BofA, MSCI, FTSE, Bloomberg, 6/30/2023. Not a recommendation to buy or sell any security. CPI-U represented by Consumer Price Index for All Urban Consumers, T-bills represented by ICE BofA US 3-Month Treasury Bill Index, US equities represented by MSCI USA Gross Total Return USD Index, International equities represented by MSCI ACWI ex USA Net Total Return USD Index, US fixed income represented by Bloomberg US Aggregate Index, TIPS represented by Bloomberg US Treasury Inflation-Linked Bond Index, REITs represented by FTSE NAREIT All Equity REITS Total Return Index, Diversified commodities represented by the S&P Dow Jones Commodity Index Total Return. For illustrative purposes only. Past performance is not indicative of future results. All investments are subject to loss. It is not possible to invest directly in an index.

We believe the reason for commodities leadership in a high-inflation environment is twofold:

- Higher-than-expected inflation is often associated with strong underlying growth in the economy, which drives demand for raw materials and puts upward pressure on commodity prices.

- Food and energy consumption are large components of CPI, so rising prices in those categories can reflect in corresponding futures contracts.

REITs also held up well during these periods because higher interest rates—and thus mortgage rates and rents—were passed on to investors. That said, they did exhibit the highest degree of volatility of any asset class considered. US equities trailed well behind the rate of inflation but delivered a positive return on average. Rising rates proved discouraging for US fixed income returns, which experience a price decline when yields increase. TIPS also performed effectively in line with CPI during these periods, which isn’t altogether surprising given their tie to realized inflation. It’s clear that commodities performed the best when inflation was unexpectedly high.

Risk-management solutions for uncertain markets

What are the diversification benefits of commodities?

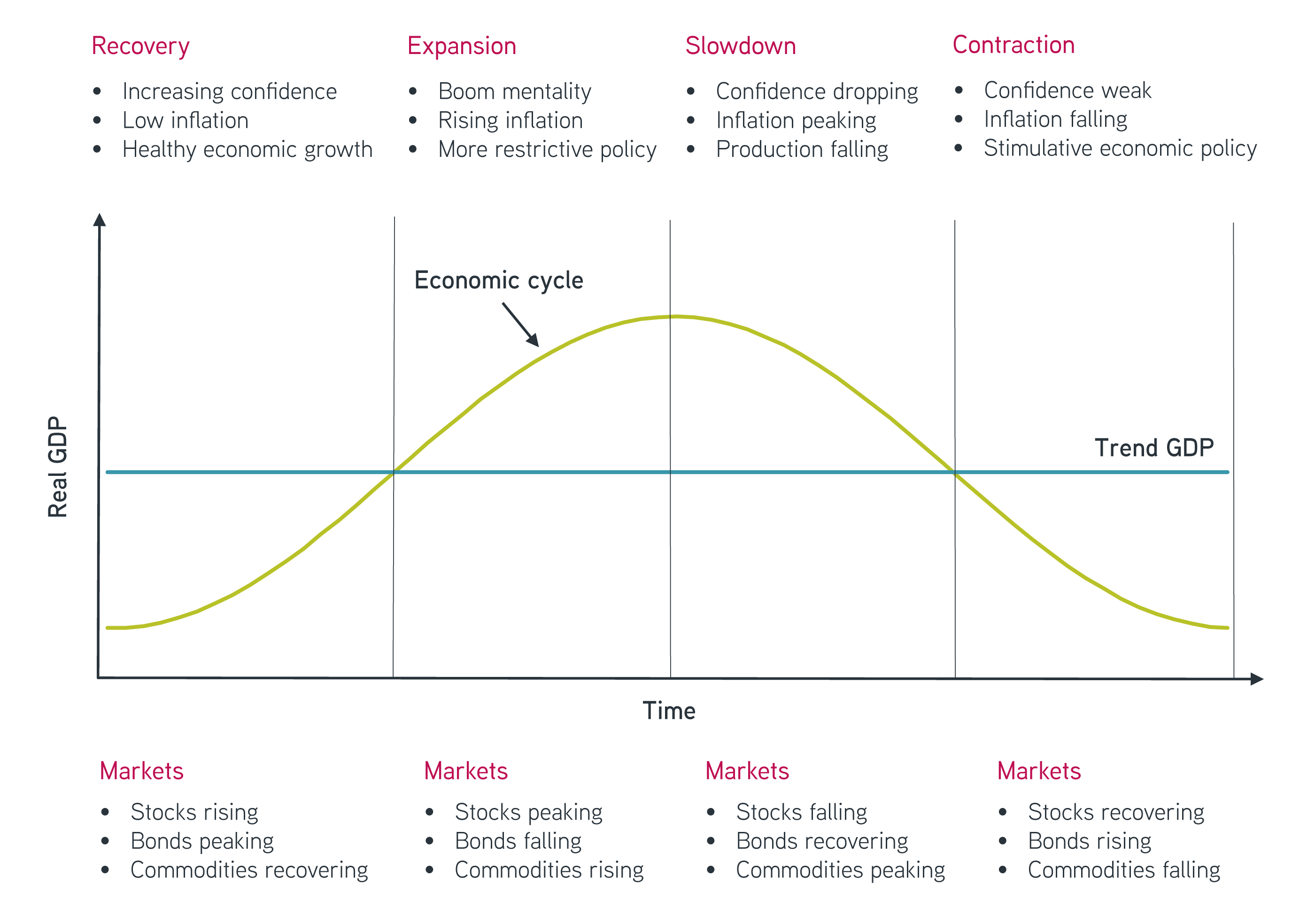

Commodities have historically provided a diversification benefit when held in combination with traditional assets, such as stocks and bonds. That benefit is realized through the relatively high volatility and low correlation that commodities have exhibited with other risky assets. Investors can tap into an asset class that responds differently than stocks and bonds at various stages of the economic cycle.

Idealized behavior of commodities, stocks, and bonds over an economic cycle

Source: Parametric, 8/31/2023. For illustrative purposes only. Not a recommendation to buy or sell any security.

Commodity returns tend to be more directly tied to the economic cycle due to their link to the prices of raw materials. Commodity returns typically peak near the height of economic expansion and bottom near the lows of economic contraction. This outcome is in contrast to both equities and bonds, which can have price movements that are offset from the economic cycle, with extreme valuations happening noticeably before or after economic expansion and contraction. This has meant that over the last half-century, a commodity index such as the S&P GSCI had a 0.05 correlation with the S&P 500® and -0.16 with the Bloomberg US Government/Credit Bond Index. As an asset class that zigs while others zag, commodities can help lower expected volatility compared to a portfolio that doesn’t contain them.

The bottom line

An important question all investors face is how to maximize the long-term growth of their portfolio. The answer comes down to building a core portfolio that can withstand the many different market environments it’s likely to encounter over a lifetime. We think commodities should form a key pillar in this asset allocation process. Not only can they offer balance during periods of unexpectedly high inflation, something most portfolios may be unprepared for if only exposed to traditional assets, but they do so with a return stream that’s offset from both stocks and bonds. This means that even a modest addition can meaningfully improve the long-term resiliency of a portfolio.