Many questions remain about where the world of pensions may be headed in 2022. Between the lingering effects of COVID-19, supply chain issues, and uncertain Fed policy, the guessing game is as hard to play this year as any other.

Parametric has released several blog posts since the beginning of the year that are relevant to liability-driven investing (LDI). Like any other year, guessing what is coming in the year ahead is a difficult task. As outlined in articles by Tom Lee on January 4 and Evan Rourke and Bernie Scozzafava on January 10, COVID-19, government spending, supply lines, and consumer demand are all having a strong influence on markets and the economy. The Fed’s response to resulting inflation will play a significant role in the markets going forward.

What might these factors mean in terms of LDI? To answer that, we need to start by examining where pensions stand in terms of funding, then think about how asset returns on a total plan basis can influence the plan’s situation going forward. Plan sponsor goals are as relevant as ever, and sponsors shouldn’t be distracted, whether they aim to close deficits, hibernate, or even transfer liabilities to an insurance company through a partial or full termination.

Funding ratios higher than they’ve been for a long time

As you’re likely aware, times have changed, and funding ratios are higher than they’ve been for many years. This is largely thanks to significant recent equity returns, combined with negative liability returns in 2021.

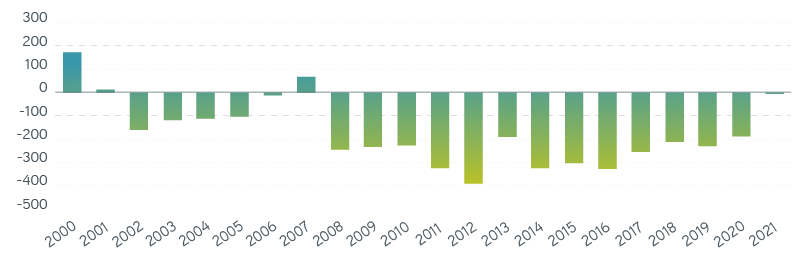

The Milliman 100 Pension Funding Index (PFI), an annual study of the 100 largest benefit pension plans sponsored by US companies, started 2021 with a deficit of $190.143 billion and a funding ratio of 90.3% but finished the year in a much better position, with a relatively small deficit of $7.067 billion and a high funding ratio of 99.6%. In 2021, asset returns for the Milliman 100 PFI were 8.33%, while liabilities returned -1.96% with discount yields increasing by 34 basis points.

Milliman 100 Pension Funding Index pension surplus/deficit

Source: Milliman, http://www.millman.com/pfi, 1/12/2022. For illustrative purposes only. Past performance is not an indicator of future results. It is not possible to invest directly in an index.

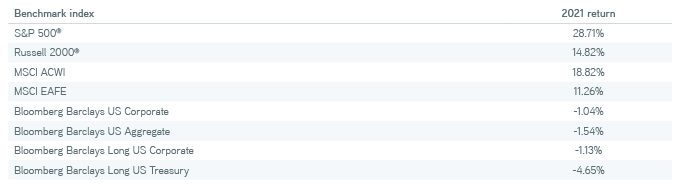

The asset returns were driven largely by equities, as the S&P 500® returned 28.71% in 2021, while the Bloomberg Barclays Long US Corporate returned -1.13%.

Source: Parametric, 1/31/2022 . For illustrative purposes only. Past performance is not an indicator of future results. It is not possible to invest directly in an index.

Balance growth and risk through LDI

What should a plan sponsor think about?

Pension plans are notorious for their asymmetrical risk profiles. A poorly funded plan needs to close its funding gap. The plan sponsor can achieve that through contributions from the organization or through investment returns that exceed liability returns. Commonly, corporations aren’t in the pension plan business and would rather use their resources to grow their company than to fund pensions. It’s typical for plan sponsors to contribute what they must according to the law, then rely on investments to close the gap further over time. Usually, the asset portfolio consists of return-seeking assets in larger proportions and liability-hedging assets in smaller proportions. An asset portfolio built with these parameters likely won’t match the liabilities, meaning there’s a substantial amount of surplus—or funded status—volatility, which is the price of higher expected surplus returns that will presumably close the funding gap. As we noted above, plans with substantial return-seeking allocations did indeed close the funding gap quite nicely in 2021.

Even under these circumstances, plan sponsors usually try to do as much as they can to reduce risk using the liability hedging assets they have. In addition, through LDI derivative overlay programs, most plans can still eliminate as much interest rate risk as they see fit. This is because interest rate risk from the asset-liability mismatch is typically viewed as uncompensated in terms of expected surplus returns. Sometimes, plan sponsors have a strong conviction about the direction of future interest rates and will adjust their interest rate hedging strategy to reflect it. In other words, an underfunded plan whose sponsors think interest rates will shoot up may choose to hedge very little liability interest exposure in hopes that liabilities will fall as a result, while assets remain unaffected. This strategy hasn’t often proved particularly successful over the last 20 to 30 years.

Once a certain funding level is reached, there’s little benefit to the sponsor to increase it further. This is particularly the case for closed and frozen plans, where little or no new liabilities accrue to participants. That leaves little incentive to take unnecessary risks. Downside outcomes hurt the plan’s funding and thus the plan sponsor, while upside outcomes have little impact. For corporate pension plans, overfunded benefits result in trapped capital, because excess funding can’t be returned to the plan sponsor until pensions are paid, with any remaining assets subject to severe excise taxes.

Of course, this is why plans with an asset-allocation glide path typically have lower return-seeking allocations and higher liability-hedging allocations in their portfolios as the plan nears full funding. This is a sound strategy to keep the plan from creating problems for the plan sponsor by maintaining funding levels that are and should remain sufficient.

The bottom line

As noted above, there’s substantial uncertainty about where we’re headed in 2022. Perhaps this is the year pension discount yields finally truly rise. Perhaps return-seeking assets will struggle with potentially hawkish Fed policy. There are plenty of options for a betting man; the question is whether it’s prudent to place those bets.

For years—really since the global financial crisis—pension plans have been trying to close their funding gap. That gap closed quickly for many plans in 2021, to the point where it’s no longer worth taking further risks. Ideally, a well-funded plan should match its assets to its liabilities as well as possible, then welcome a well-executed, stable hibernation.

It’s still early in 2022, but already we’ve seen meaningful increases in interest rates. The time is right for many plans to attempt to mitigate pension risks. If not there yet, a plan sponsor will benefit by putting the pieces in place to quickly and nimbly de-risk through corporate bonds, Treasury bonds (including STRIPS), and derivative overlays as soon as possible.