Has the demise of pension plans been greatly exaggerated? With the right liability-driven investing (LDI) strategies—and funding—in place, sponsors might manage cost and risk more effectively, providing benefits to both employers and employees. Is it time for pension plans to reopen?

Many of us felt a mixture of disbelief and surprise in 2012 when a major US automaker transferred $25.1 billion in pension liabilities for 110,000 participants to an insurance company. The idea of annuity purchases and plan terminations wasn’t a new thing—it happened all the time. What was shocking was the magnitude. There had been a belief that insurance companies didn’t have the capacity or appetite to engage in that kind of pension risk transfer, which was many times larger than the sum of all pension buyouts over several years.

That automaker’s decision was a major turning point in the pension world, and we’ve seen more companies take the same approach in the years since. But perhaps there’s a better solution.

How are pension plans changing?

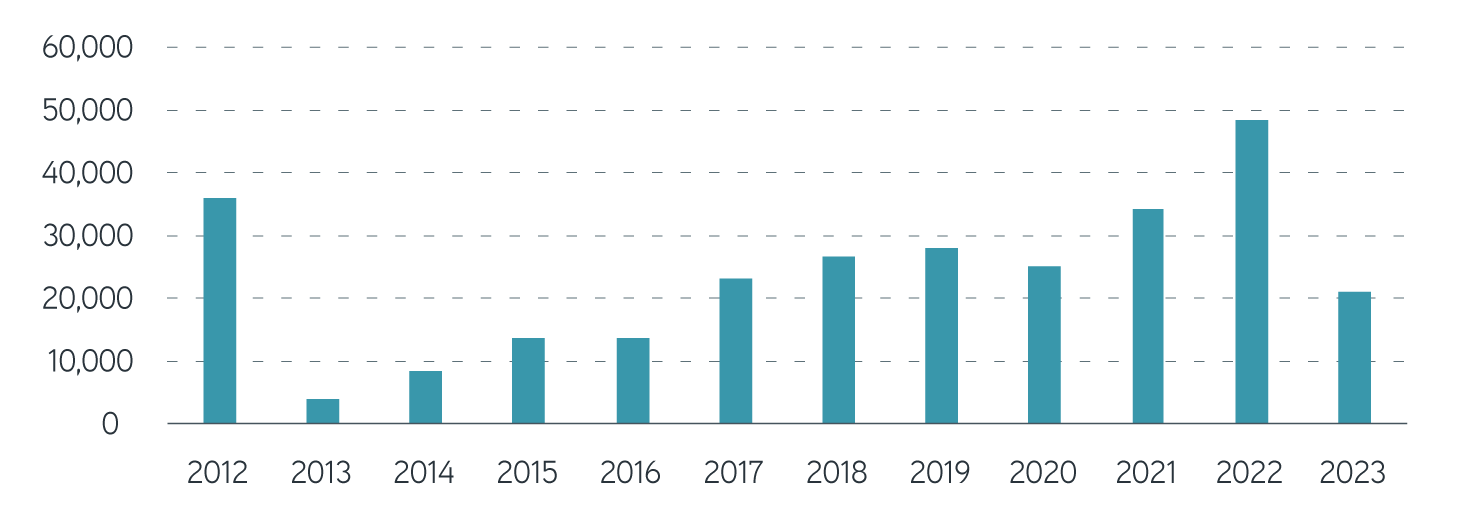

The size of the automaker’s 2012 pension risk transfer (PRT) made quite a splash, and we’re still seeing the ripples in the pension waters. As we can see in the following chart, PRTs have become much more common in recent years, and we expect there’s more to come. However, recently a major tech firm surprised analysts by announcing plans to reopen its defined benefit (DB) plan. Could the DB pension landscape be changing again? In 10 or so years, will we look back on 2023 as another turning of the tides? As we move into 2024, we’re beginning to see some new ripples.

Pension buyout sales through October 2023

*Through October 2023 only

Source: LIMRA, 10/31/2023. For illustrative purposes only. Past performance is not an indicator of future results.

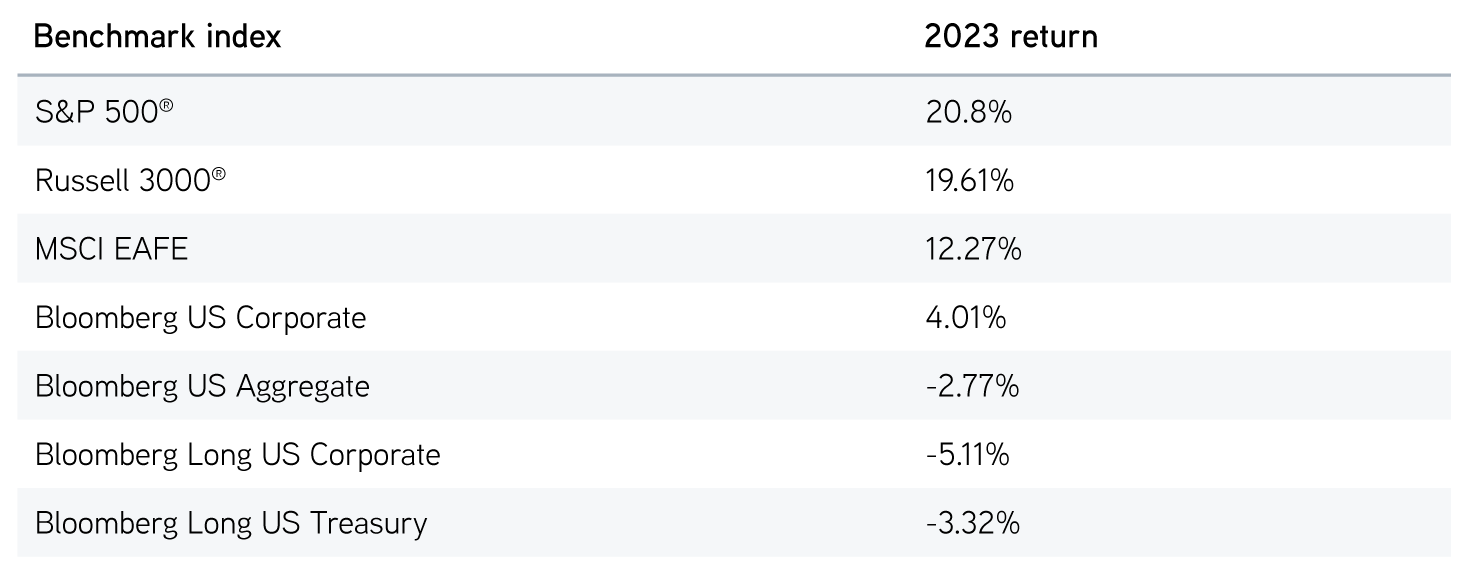

Much of that PRT activity has come when pensions haven’t been fully funded and couldn’t be fully terminated. But a lot has changed in the last two years, at least when it comes to funding ratios. Our 2023 outlook pointed out that what most would consider a terrible year in the markets during 2022 worked out quite well for pensions. Plans more than overcame asset losses by reducing liabilities coming from elevating yields. Outside the S&P 500®, investors have experienced mixed asset returns, but it’s been another decent year for pensions, with yields still higher than at the beginning of the year. The following table shows some typical benchmarks and liabilities, and as these numbers indicate, pension funding is at its highest level in more than 20 years.

Index total returns as of 11/30/2023

Source: Parametric, 11/30/2023. For illustrative purposes only. Past performance is not an indicator of future results. It is not possible to invest directly in an index. Indexes are unmanaged and do not reflect the deduction of fees or expenses.

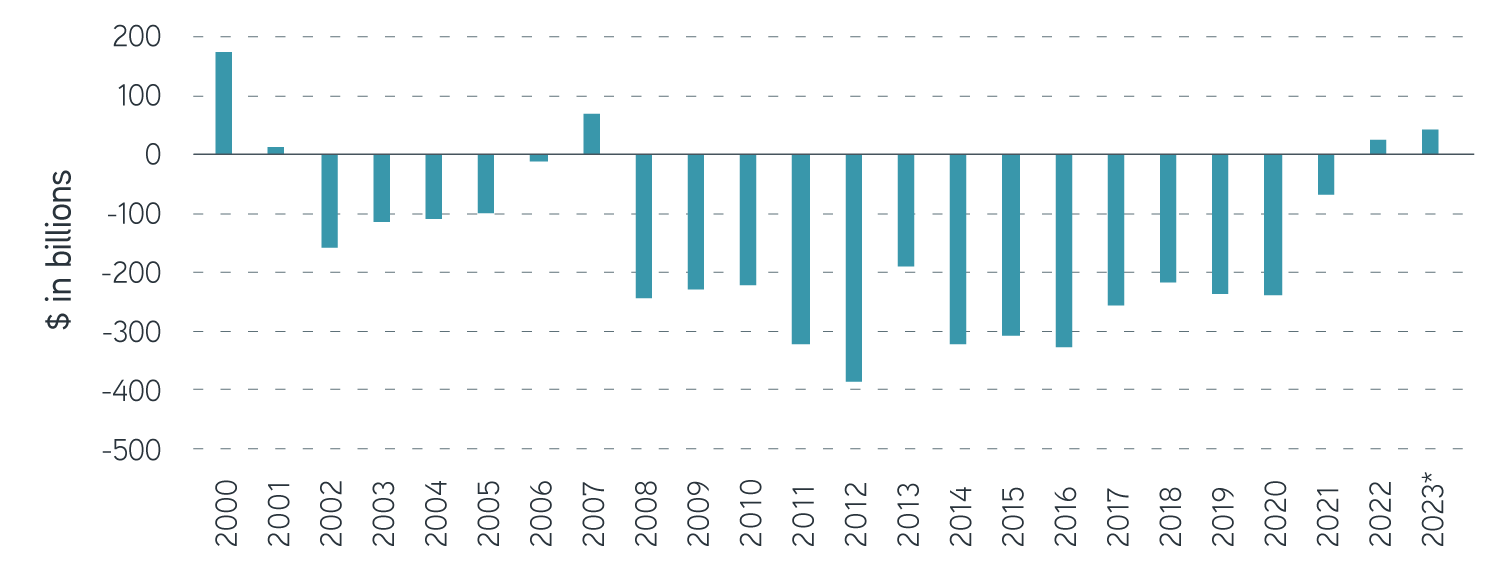

Milliman 100 Pension Funding Index plan funding ratios, 2000–2023*

*Through November 2023 only

Source: Milliman, 11/30/2023. For illustrative purposes only. Past performance is not an indicator of future results. It is not possible to invest directly in an index. Indexes are unmanaged and do not reflect the deduction of fees or expenses.

Refine and enhance liability-driven investing strategies

What should plan sponsors do with a funding surplus?

For more than 20 years, most LDI outlooks have been questioning how to close a funding gap. Now we’re in the happy position of how to make use of a funding surplus, a very interesting question indeed. Depending on who answers that question, a few choices come immediately to mind. Among other options, a plan sponsor could do one of the following:

Pursue a partial or total PRT with an insurance company.

Allocate assets into a hibernation strategy where the plan sponsor maintains the plan but minimizes the risk that comes with it.

Reopen a well- or overfunded plan.

We’ve typically seen sensible behavior from pensions in the last year or two. Most plans have moved forward in their glide paths and implemented new investment strategies. Plans are now oriented more toward managing surplus risk by allocating more assets to fixed income and reducing interest rate exposure by targeting higher interest rate hedge ratios. (Note: Cash balance plans require more detailed analysis to get to an appropriate target, given their more complicated curve exposure.) Because hedging portfolios increase in size, the impact of riskier growth assets is reduced, also reducing overall surplus risk for the plan. This leaves sponsors in a good position going forward, since markets will have less impact on outcomes than in the past.

Should sponsors consider terminating or hibernating pension plans?

Many plan sponsors have closed, frozen, or terminated their plans over the past 25 years for a reason: They’ve seen well-funded plans become poorly funded, leaving it to them to make up the difference. They limited their own exposure by trimming future benefits promised to participants. They still had plans with funding gaps that needed to be closed, so they couldn’t simply eliminate those plans.

In that context, it might make sense to terminate a plan with sufficient funds to cover the costs of termination without needing additional contributions to buy annuities for all participants. But that sounds simpler than it really is. For one thing, it takes a lot of time and effort to fully terminate a pension plan, often 12 to 18 months. This can be for many reasons: finding lost participants, notifying participants of upcoming changes, and performing due diligence to secure bids from insurance companies for annuities, to name a few. Furthermore, it’s unclear what the true cost might be until it’s over. Actuaries charge significant fees to run the whole process and calculate benefits for each participant. And when the termination process begins, sponsors might not be sure how much it will cost to purchase annuities. Still, if the money exists and a plan sponsor really wants to be clear of a particular plan, termination might make sense.

If the plan sponsor can’t get rid of the entire plan, eliminating part of the plan is more questionable. The sponsor must perform significant analysis before deciding whether even partial elimination is sensible. If a plan has terminated vested participants with small values, it might make sense to offer them lump sums to reduce Pension Benefit Guaranty Corporation premiums. But partial termination comes with many of the same difficulties as eliminating an entire plan, while leaving the plan sponsor with a pension plan that’s harder to manage. Eliminating part of the assets might result in higher required future rates of return to close funding gaps. The sponsor may then have a harder time managing the overall plan risk, because only benefits related to the most difficult and complicated participant demographics are likely to remain. It’s best for sponsors to do their homework to determine whether partial termination is the right path.

Placing the plan in hibernation might be a better option. The idea here is to invest in assets that minimize surplus risk in the plan while benefits pay out over future years, until sponsors reach a point where total plan termination is clearly advantageous. As participants age and future benefit payments become more stable, annuity premiums decrease. If the plan is well funded, sponsors can manage investments against liabilities. The last time funding ratios were as high as they are now, very few sponsors even considered a hibernation approach and, unfortunately, those who didn't maintained significant surplus risk. We’ve learned many lessons over the past 25 years, and LDI strategies that minimize surplus risk are now much more common.

Should sponsors consider reopening closed or frozen pension plans?

One other intriguing idea is to reopen well-funded plans that are frozen or closed. This idea resurfaces from time to time but has recently been more commonly advocated. Like many ideas that come and go only to return again, there had been a general feeling it was unlikely to ever go anywhere—that is, until that tech giant recently reopened its pension plan.

Reopening may indeed be a viable solution. If sponsors can manage risk—and they can with the right LDI strategies—and reliably forecast costs, there could be benefits to reopening (or even opening a completely new plan).

To begin with, reopening an overfunded plan allows a corporation to use assets that would otherwise be trapped in the plan. Employees and employers both could begin to see more value in DB plans as employees age. The increased value of pension plans would improve a company’s ability to attract and retain employees. And running a corporate DB plan can reduce costs compared with a defined contribution (DC) plan. DC plans typically come with significant administration costs (regardless of who pays them), risk of legal action resulting from performance of available investment options, and higher investment fees, as well as the complications of managing and maintaining the appropriate investment managers.

The bottom line

Funding ratios are higher than we’ve seen in more than 20 years, leaving plan sponsors with more flexibility in deciding how to proceed. The wide spectrum ranges from simply getting rid of the plan completely, by terminating and buying annuities, to jumping fully into pensions. At first glance, it’s easy to see why the former is attractive to a company that’s struggled with its plan for a long time. But digging deeper, pension management and investing is much more sophisticated than it was 20 years ago. For a sufficiently funded plan, the right LDI strategy can provide companies and employees with stable benefits at a stable cost.

Perhaps the demise of corporate DB plans has been greatly exaggerated and they are poised to return. In fact, plan sponsors might find good reasons to consider this approach. LDI strategies have advanced and been proved effective over time at providing stability to companies offering pensions, regardless of the future direction of markets. Maybe we’ve simply reached another pension turning point.