Tax Management

Active tax management helps advisors set themselves apart

and provide added value to their clients.

![]()

Most investment managers are active in their portfolio construction and stock selection but passive on taxes. Parametric takes the opposite approach: We focus on outperforming on an after-tax basis by using active tax-management techniques. As any investor knows, it’s not what you make but what you keep.

Explore more Custom Core solutions

Tax expertise

No matter how you build your portfolio, you can make the most out of it with Parametric’s tax-management expertise as your guide.

Whether you want to sell off your concentrated equity position or reinvest your laddered bonds at higher yields as rates rise, we can help you steer clear of big tax pitfalls and achieve bigger after-tax returns.

![]()

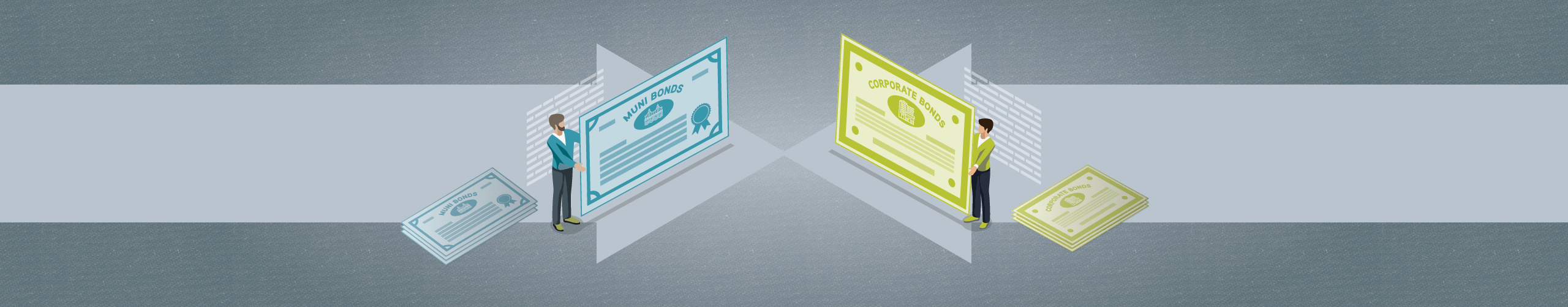

Staying active on taxes

We take a systematic and risk-controlled approach, using multiple strategies throughout the portfolio

process to ensure we can capitalize on tax-saving opportunities.

INVESTOR SPOTLIGHT

Custom Core Equity

Show your clients how they can make passive investing personal. Build a portfolio according to their values, preferences, and needs with Parametric Custom Core.

Get in touch

Want to know more about our Tax Management solutions? Complete our contact form, and a representative will respond shortly.

More to explore

Fixed Income Tax Loss Harvesting: Realizing Losses No Matter When They Occur

by Nisha Patel, Managing Director; Nicholas Stahelski, Vice President, Portfolio Manager

April 10, 2025

Learn how an “all weather” approach to fixed income tax loss harvesting helps to add value in any market climate.

Harvesting Tax Losses in Volatile Equity Markets

by Jeremy Milleson, Director, Investment Strategy

April 9, 2025

When nobody knows where the market is headed next, Parametric seeks to help investors weather the volatility storm.

As Tariffs Cloud Outlook, Municipal Bonds May Offer Opportunity

by Jonathan Rocafort, Managing Director, Head of Fixed Income Solutions

April 8, 2025

With growth concerns emerging following tariff announcements, here’s why we see potential opportunity in stepping out of cash, adding some duration and locking in yields near a decade high.