Robust economic growth and high inflation will likely lead the Fed to raise interest rates this year, and commodities typically outperform other asset classes during the hiking phase of the interest rate cycle.

Last year was a strong one for the commodity asset class. At the headline level, the Bloomberg Commodity Index gained 27.11%, easily making it one of the top-performing parts of the market. You’d have to go back more than two decades, to the start of the last commodity supercycle, to find a similarly strong calendar-year result.

A lot went right for commodities over the year—consumer demand for goods was strong, in part because of numerous rounds of stimulus doled out by Congress—and rising inflation made for a supportive backdrop. In addition, supply-side impediments for many commodities further squeezed the situation, putting upward pressure on prices.

As we attempt to navigate 2022, we’re faced with a very different landscape from a year ago. Commodity performance has remained strong, with some prices reaching record levels as investors the world over brace for further supply disruptions in the wake of Russia's invasion of Ukraine. Economic uncertainty has risen substantially. But if all goes as the market expects, the Federal Reserve will be well on its way to hiking interest rates by year-end and may no longer be carrying a balance sheet nearly two-fifths the size of the US economy.

Inflation, which has been running at a 30-year high, is expected to moderate as the year rolls on, forecasted by a group of economists polled by Bloomberg to fall to 5.8% on a year-over-year basis by midyear, then 3.3% by December. On the surface, many investors might view this backdrop as unsupportive to commodity performance. Commodities, after all, have been proclaimed to hedge inflation, exactly the thing the Fed is now focused on reining in. In reviewing commodity performance during prior interest rate cycles, however, we find evidence that commodities typically outperform other common asset classes during the rate-hiking phase before moderating after. In addition, we point to the high degree of scarcity pricing across most major commodities as further evidence that prices may need to stay high for some time to help bring additional supply into the market.

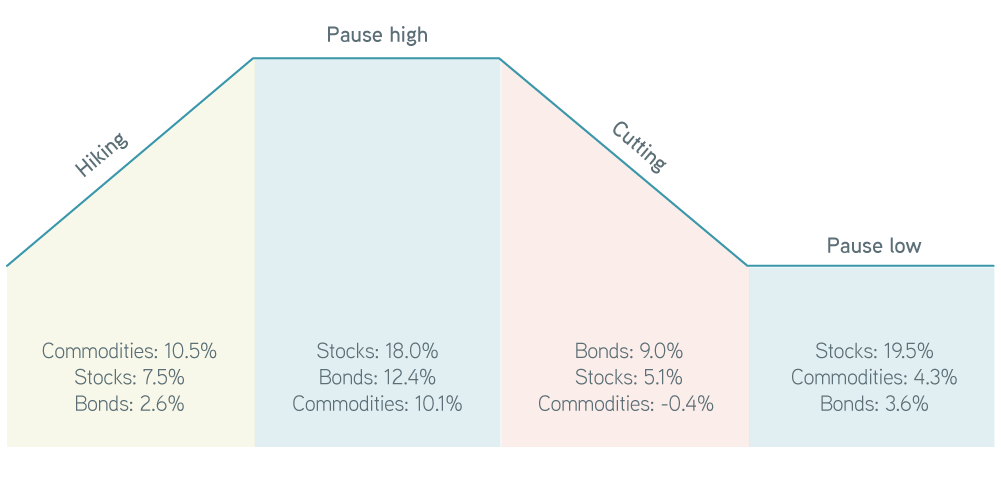

Commodity performance during interest rate cycles

In reviewing the prior 35 years of data for the federal funds target rate (midpoint of range), we find five well-defined interest rate cycles. Each begins with the Fed hiking rates, followed by an extended pause before rates are cut and held low for some time. In our analysis we define these periods as hiking, pause high, cutting, and pause low. The following chart compares the annualized average monthly total returns for commodities, stocks, and bonds over these phases.

Common asset-class performance during different phases of the interest rate cycle, annualized average monthly returns, 1987–2021

Sources: Federal Reserve, Bloomberg, MSCI, and Parametric, 1/27/2022. For illustrative purposes only. Past performance is not indicative of future results. It is not possible to invest directly in an index. “Commodities” represents the Bloomberg Commodity Index Total Return, “stocks” represents the MSCI USA Gross Total Return Index, and “bonds” represents the Bloomberg US Aggregate Total Return Index.

On average we find commodities have performed best during the hiking phase of the interest rate cycle, followed by stocks, then bonds. These results shouldn’t come as a surprise, however. Generally, interest rate hikes follow periods of strong growth in the US economy, which are often accompanied by rising inflation. Often these conditions arise during the later stages of the business cycle, when demand for raw materials is quite high, which puts upward pressure on commodity prices.

This resembles the current environment quite strikingly. Real GDP growth has rebounded strongly following the COVID-19 dip, and economic output sits nearly on par with the prepandemic trend. Concurrently, inflation has clearly eclipsed what the Fed is comfortable with, hence the acute focus on the institution’s next move from most market participants.

Invest broadly in commodities and avoid overconcentrations

One reason for high inflation is rising goods prices. Consumers’ buying habits have shifted dramatically over the prior couple of years in response to lockdowns and social distancing measures, and it’s resulted in Americans buying a lot more stuff than before the pandemic. This shift in demand has created a growing scarcity in physical raw materials and driven large deficits across many major commodities. Spot prices have shot up in reaction.

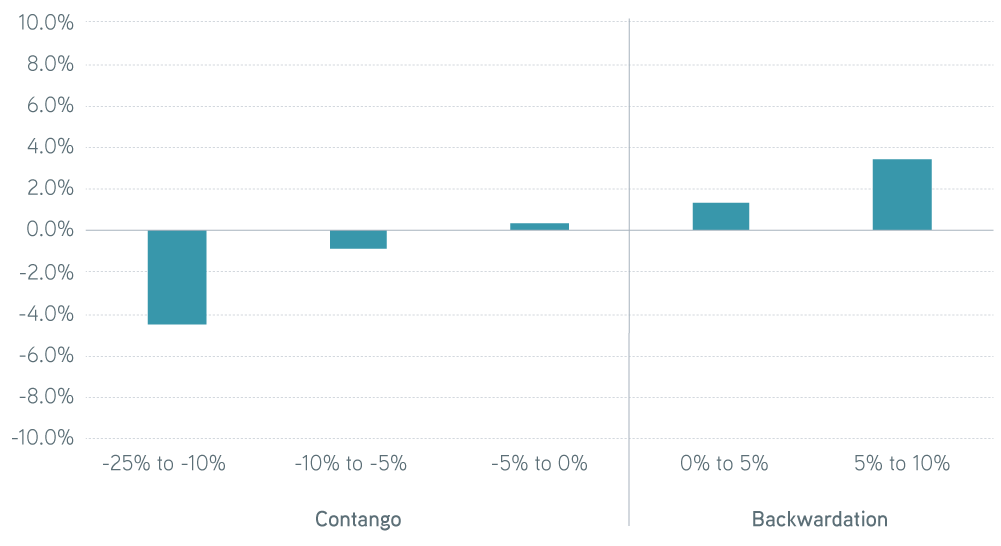

Futures prices for deferred delivery haven’t gone up as much and now trade at a discount. For example, the price to buy oil for delivery today is significantly higher than the price to buy it for delivery in six months or a year from now. This is frequently referred to as backwardation, while the opposite state—spot prices trading below futures prices—is called contango.

It’s common to measure the degree of backwardation or contango by calculating the percentage difference between the nearest-to-mature futures contract and one maturing in a year. Using this method, we calculate the average level of backwardation across the commodity universe to be roughly 6% as of January 31. This is unusually large from a historical perspective, placing it in the top 5% of daily observations going back to 1995, the earliest we could find data.

Generally, periods of extreme backwardation have been associated with better commodity performance on average, which may indicate a higher risk premium during periods of physical market scarcity, such as we’re in today. The following chart shows average monthly results for the Bloomberg Commodity Index during different levels of contango and backwardation.

Average monthly commodity performance during various levels of contango and backwardation, January 1995–January 2022

Sources: Bloomberg, CME Group, and Parametric, 1/27/2022. For illustrative purposes only.

It’s often said that the cure for high prices is high prices, because they induce producers to increase supply while dampening demand. Of course, these changes don’t come about overnight. The prior decade of weak commodity returns has left the industry with insufficient spare capacity to fill the current demand spike. It will likely take a prolonged period of high prices to prompt additional supply to come online, which could mean an extended period of gains for the asset class.

The bottom line

The tailwinds that greeted commodities in 2021 have shifted, but we don’t believe they’re gone. Faced with strong economic growth and high inflation, the market expects the Fed to run down its balance sheet and begin hiking interest rates this year. Commodities have historically outperformed other common asset classes during this phase of the interest rate cycle, since they generally align with strong underlying demand for raw materials. In addition, a shift in consumer habits has left most commodity markets priced for a deficit, which may require an extended period of high prices to alleviate and could lead to continued strength from the asset class.