What Can Investors Do About Inflation?

In inflationary periods, it can seem like there’s nothing to do but sit and wait for prices to stop rising. But with properly structured portfolios, investors can build some expected protection from inflation long before it settles.

How does inflation affect investors?

Purchasing power

Learn more >>

Interest rates

Learn more >>

Volatility

Learn more >>

As inflation erodes the value of earnings, the market has a more difficult time pricing equities properly. This environment can force companies to pay higher prices for their inputs, cutting further into earnings.

How can investors ease the effects of inflation?

Diversification

Get intelligently designed exposure to the defensive commodity asset class.

Dynamic strategies

Ladder your fixed income allocation to adjust to rising rates and fluctuating returns.

Risk management

Access a distinct volatility risk premium and potentially persistent returns over time.

Total-plan perspective

Build a liability-driven strategy that considers both growth needs and risk constraints.

Get in touch

Whether you’re a wealth manager with clients concerned about inflation or an institution trying to hedge against inflationary risk, we’re here to help. Let us know how to reach you, and one of our representatives will get in touch.

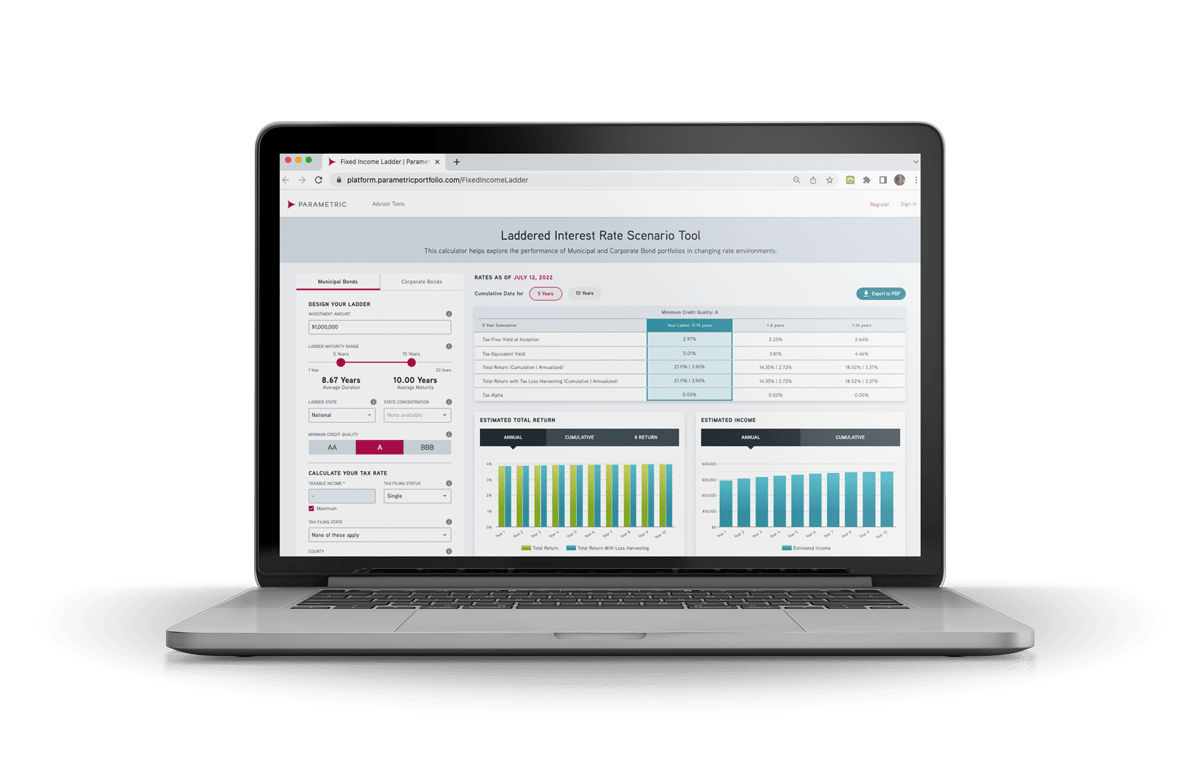

ADVISOR TOOL

Laddered Interest Rate Scenario Tool

Capture the performance of your laddered municipal or corporate bond portfolio in changing rate environments.