Weekly Fixed Income Update

Interest rates, inflation, central bank action—all these and more can impact fixed income. Stay on top of the market with our weekly update.

April 22, 2025

Macro update

Fixed income volatility began to settle down last week, but that relative calm followed yield swings we haven’t seen in many years as the market responded to US tariff policy announcements. The 10-year Treasury yield has moved over 50 basis points (bps) during the past two weeks and closed on Thursday with a yield only slightly higher than its pre-tariff-announcements level (Bloomberg, 4/17/2025).

US banks reported strong first quarter earnings but struck a cautious tone on conference calls, citing macroeconomic uncertainty. The strong first-quarter earnings—driven largely by equity trading—suggest that the banking system entered the recent volatility in solid shape. Credit quality remained firm, and deposit bases were stable (Bloomberg, 4/17/2025).

On the data front, March nominal headline retail sales rose 1.4% month-over-month, as expected, driven by robust auto and building materials. February’s sales data had shown a 0.3% gain. Housing starts declined 11.4% in March, more than twice the 5.4% expected and more than reversing February’s revised 9.8% increase.

The Federal Reserve continues to monitor market liquidity. Fed funds futures are now pricing in at least three rate cuts for this year, with only a 16% chance of a rate reduction at the upcoming Federal Open Markets Committee meeting on May 7 (Bloomberg, 4/17/2025).

April 25, 2025

Fixed income portfolio manager Kevin Lynyak shares his insights into the current bond market. Listen now:

Municipal bond update

Benchmark AAA municipal yields declined materially across the yield curve last week amid less volatility than prior weeks. Two-year maturity yields decreased 21 bps, five- and 10-year yields each dipped 22 bps and the 30-year shed 18 bps. While these are significant moves, they pale in comparison to the prior week’s 40- and 50-bps midweek moves.

Benchmark tax-exempt yields remain solidly higher since the start of the year, with five- and 10-year maturities each up by 28 bps, while 30-year yields are up by a robust 56 bps. Benchmark 10-year yields have backed away from the new decade high of 3.66% and stand at 3.44% (Refinitiv MMD, 4/17/2025).

The Bloomberg Municipal Bond Index gained 1.09% last week, cutting the negative year-to-date (YTD) total return to -1.69% YTD. Treasurys had a somewhat less strong week and added 0.81%, bringing that YTD total to 2.43% (Bloomberg, 4/17/2025).

Muni relative value is also returning to normalcy and ended at 79% by Thursday’s close. This percentage of the 10-year Treasury yield metric remains sharply above the two-year average of 66% (Refinitiv MMD, 4/17/2025).

Five- to 15-year A-rated municipal yields ranged from 3.35% to 4.23%, with related taxable-equivalent yields ranging from 5.66% to 7.15%, assuming a combined federal tax rate of 40.8% (Refinitiv MMD, Parametric, 4/17/2025).

Mutual funds experienced their sixth consecutive week of outflows, with open-end funds losing $1.9 billion, while ETFs enjoyed a moderate $659 million inflow (LSEG Lipper, JP Morgan 4/17/2025).

This week’s municipal new-issue calendar begins with more than $12 billion scheduled but may rise to as much as $15 billion because of postponed deals re-entering the market after the recent downside volatility. Seasonally-heavy supply has been a primary factor behind the March and April muni underperformance, which continues (Ipreo, 4/17/2025).

Corporate bond update

US investment-grade (IG) corporate yields fell across the curve last week. Two-, five- and 10-year yields decreased 17, 22 and 18 bps, respectively. Corporate yields are mixed across the curve YTD. Two- and five- year yields are down 11 and 10 bps, respectively while 10-year yields are unchanged (Bloomberg, 4/17/2025).

The ICE BofA 1–10 Year US Corporate Index returned 1.09% for the week and -0.55% month to date (MTD). The index outperformed like-duration Treasurys by 0.29% during the week and have underperformed by -0.65% MTD (Bloomberg, 4/17/2025).

IG mutual funds and ETFs experienced outflows of $7.1 billion, an increase in flows from the previous week’s outflows of $9.8 billion. Corporate-only funds experienced outflows of $695 million, following the previous week’s outflows of $4.7 billion (JPMorgan, 4/17/2025).

Investing in fixed income securities involves risk. All investments are subject to loss. Learn more.

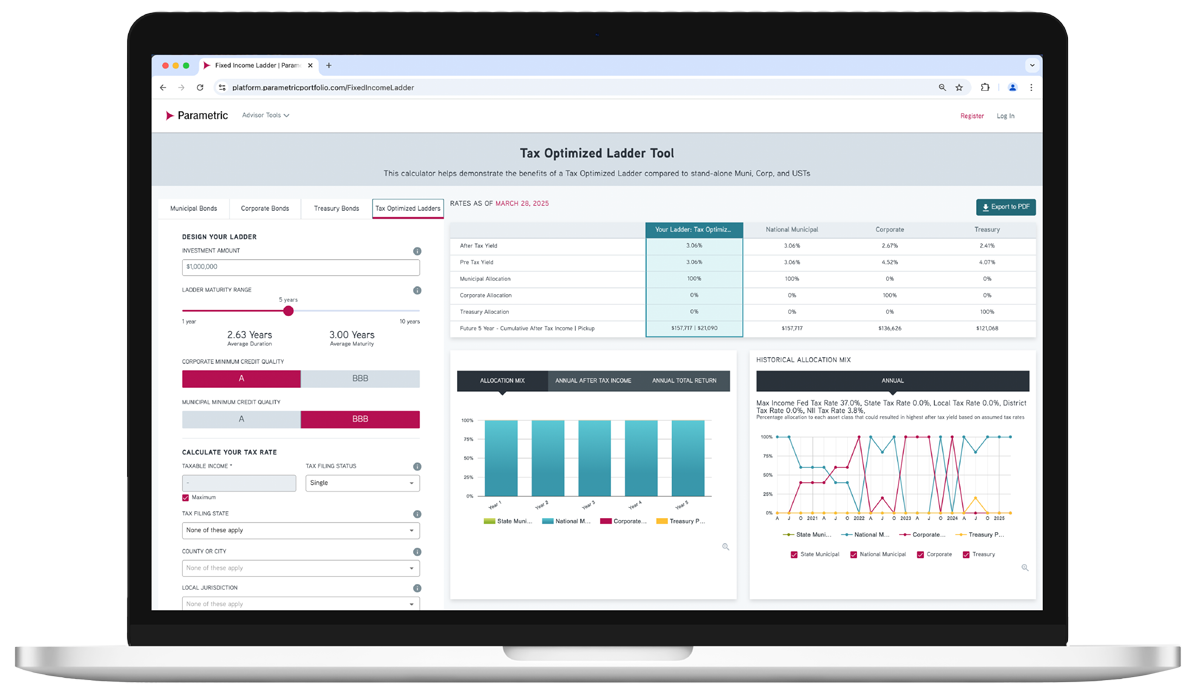

ADVISOR TOOL

Laddered Interest Rate Scenario Tool

Which fixed income asset class is just right for each investor? Explore possible ways to achieve optimal after-tax yield.

Use our online tool to showcase potential benefits of tax-managed and customized laddered bond portfolios.