Weekly Fixed Income Update

Interest rates, inflation, central bank action—all these and more can impact fixed income. Stay on top of the market with our weekly update.

July 2, 2025

Macro update

Following the US bombing of nuclear sites in Iran, oil prices initially spiked, then sold off sharply when Iran’s response was deemed “muted” and President Trump announced a ceasefire between Isreal and Iran. Equities and credit spreads rallied.

Bond yields were quiet on the geopolitical headlines and rallied later in the week as the market started to ponder rate cuts coming sooner rather than later.

The yield curve steepened as the two-year note declined by 20 basis points (bps) week over week and the 10-year note yield eased 10 bps.

The Senate continues to strive to pass their version of the President’s budget bill by July 4. The 90-day reprieve on reciprocal tariffs is due to expire on July 9th, and the market is expecting adjustments lower.

On the data front, real first-quarter GDP was revised lower to -0.5% compared with the -0.2% prior and anticipated. The highlight of this week will be Thursday morning’s June Payroll Situation Report, with the market expecting 110,000 jobs added and an unemployment rate of 4.3%.

June 27, 2025

Fixed income portfolio manager Kevin Lynyak shares his insights into the current bond market. Listen now:

Municipal bond update

Benchmark AAA municipal yields declined mildly last week. Two-year yields dipped by four bps, five- and 10-year yields eased by five and two bps, respectively, and 30-year yields were unchanged (LSEG MMD, 6/27/2025).

Muni relative value compared with the 10-year Treasury was 76% by Friday’s close and remains sharply higher than the two-year average of 66% (LSEG MMD, 6/27/2025).

Five- to 15-year A-rated municipal yields ranged from 2.88% to 4.27%, with related taxable-equivalent yields ranging from 4.86% to 7.21%, assuming a combined federal tax rate of 40.8% (LSEG MMD, Parametric, 6/27/2025).

Mutual funds experienced their ninth consecutive week of net inflows at $77 million. ETFs again carried the week, attracting $467 million, while open-end funds again represented a drag, losing $390 million (LSEG Lipper, JPMorgan 6/25/2025).

The upcoming primary market gets a break during this holiday-shortened week, with just $3 billion scheduled for pricing following last week’s $11 billion slate, which was easily digested. We may need to wait until two weeks after July 4 to determine whether a summer supply-slowdown is developing (Ipreo, JP Morgan 6/27/2025).

Corporate bond update

US investment-grade (IG) corporate yields decreased across the curve last week. Two-, five- and 10-year yields fell 12, 13 and 10 bps, respectively. Corporate yields are lower across the curve year to date (YTD). Two-, five- and 10-year yields have fallen 34, 40 and 22 bps, respectively (Bloomberg, 6/27/2025).

The ICE BofA 1–10 Year US Corporate Index returned 0.61% for the week and 1.07% month to date (MTD). The index outperformed like-duration Treasurys by 0.04% during the week and 0.25% MTD (Bloomberg, 6/27/2025).

IG mutual funds and ETFs experienced inflows of $5.3 billion, an increase from the previous week’s inflows of $2.3 billion. Corporate-only funds experienced inflows of $2.3 billion, following the previous week’s outflows of $1.5 billion (JPMorgan, 6/27/2025).

Corporate one- to 10-year IG bond yields have decreased 40 bps YTD and ended last week at 4.7% (Bloomberg, 6/27/2025).

Investing in fixed income securities involves risk. All investments are subject to loss. Learn more.

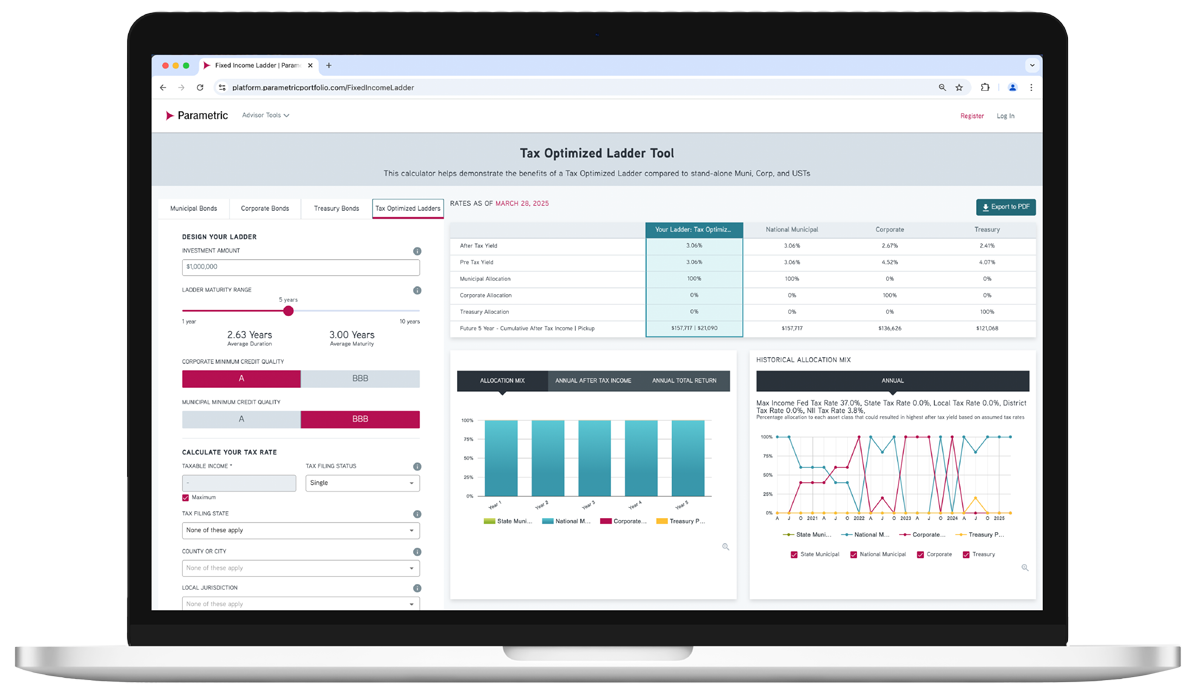

ADVISOR TOOL

Laddered Interest Rate Scenario Tool

Which fixed income asset class is just right for each investor? Explore possible ways to achieve optimal after-tax yield.

Use our online tool to showcase potential benefits of tax-managed and customized laddered bond portfolios.