Volatility Risk Premium

For wealth managers

The volatility risk premium (VRP) is the compensation earned by investors for providing protection against unexpected market volatility. Parametric’s VRP solutions are a suite of strategies that seek to capture this unique and diversifying risk premium through the systematic sale of call and put options.

![]()

The VRP can be a persistent source of return over time that may allow investors to access attractive risk-adjusted returns and increase overall portfolio diversification.

Investing in an options strategy involves risk. All investments are subject to loss. Learn more.

Explore more VRP solutions

Capturing the VRP systematically without leverage

Equity index options may be thought of as financial insurance contracts, and investors pay a premium for insurance-like protection against unfavorable outcomes. The size of the VRP is driven by a range of behavioral, structural, and economic factors that may lead to an imbalance between buyers and sellers of index options.

A defensively structured portfolio can capture the VRP by selling fully collateralized options without introducing leverage. Our rules-based solutions favor diversification, accessibility, and transparency.

Why choose Parametric?

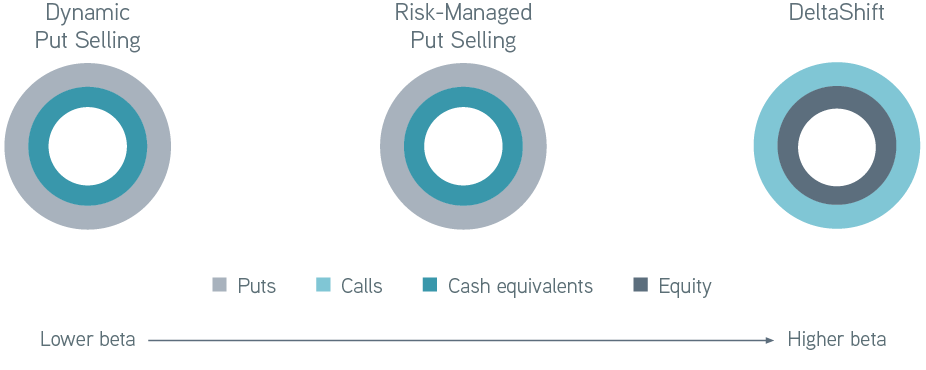

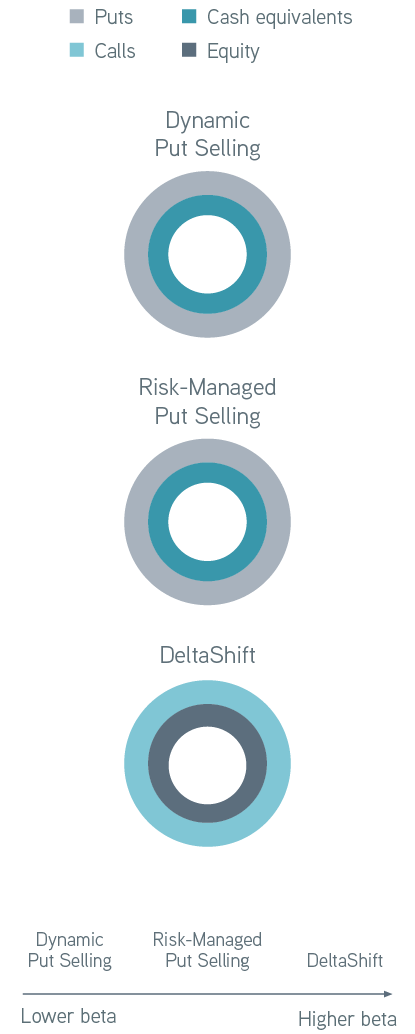

Which VRP solution is right for your client?

Parametric offers a range of VRP solutions using different combinations of collateralized equity index put and call options, which can be customized to meet your clients’ portfolio objectives.

![]()

Frequently asked questions

Get in touch

Want to know more about our Volatility Risk Premium solutions? Complete our contact form, and a representative will respond shortly.

More to explore

Pyrrhic Victory: Sacrificing Pretax Returns at the Altar of Realized Losses

by Jeff Wagner, Senior Investment Strategist; Jeremy Milleson, Director, Investment Strategy

May 5, 2025

Like an army who wins a battle that inflicts a devastating toll on its own troops, pursuing losses without regard for risk would be a pyrrhic victory.

How Corporate Bond Ladders May Help to Hedge Volatility

by John Hemingway, Vice President, Portfolio Manager

April 28, 2025

With corporate bond ladders, maturities reinvested at higher rates have the potential to benefit the portfolio.

Fixed Income Tax Loss Harvesting: Realizing Losses No Matter When They Occur

by Nisha Patel, Managing Director; Nicholas Stahelski, Vice President, Portfolio Manager

April 10, 2025

Learn how an “all weather” approach to fixed income tax loss harvesting helps to add value in any market climate.